Banks and Climate

A global crisis

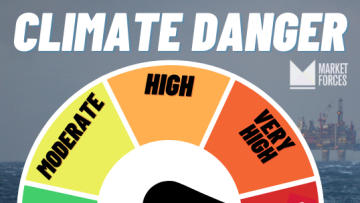

The world is facing an acute and rapidly accelerating climate crisis. With each passing year, the number and severity of heatwaves, hurricanes, floods, forest fires and other climate-related disasters is increasing, already disrupting the lives of millions of people. Despite the goal of the Paris Climate Agreement to limit global warming to 1.5°C, 2023-2024 for the first time saw 12 months above this level of warming. Despite this ominous warning, fossil fuel companies’ expansion plans keep threatening to kill more than millions before the end of the century.

For the world to still have a two-thirds chance to limit temperature rise to 1.5°C, global greenhouse gas emissions must be brought to net zero by 2050 latest, with over half of that reduction achieved by 2030. We are nowhere near. The latest IPCC and International Energy Agency reports are both crystal clear that this requires an immediate end to all new fossil fuel exploration and development, and a rapid phase-out of all remaining fossil fuel use, in line with a just transition to renewable energy use, leaving false solutions behind.

Linked to other crises

The climate crisis poses a huge threat to nature, with ever more forests being destroyed by wildfires or turning into savannah, tundras and alpine permafrost areas thawing, coral reefs bleaching and oceans getting both warmer and more acidic. These ecosystems are thus becoming uninhabitable for many species while also releasing even more greenhouse gases into the atmosphere.

A warming planet is also expected to face more pandemics. Changing weather patterns, forest fires and other climate-related habitat destruction will set animals on the move, from bats to rodents to mosquitoes, leading to contact between animals and with humans that normally don’t interact, physically bringing together pathogens and potential new hosts.

Above all, the climate crisis poses massive risks to people and communities globally, especially poor, marginalised and/or Indigenous communities who bear very little responsibility for causing the crisis. The consequences of global warming, including desertification and extreme weather, will lead to water and food scarcity, forcing many people from their homes, lands and livelihoods. Areas already affected by conflict will be disproportionately impacted.

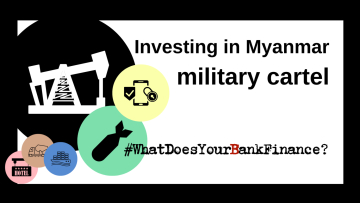

Meanwhile, the fossil fuel industry that is at the heart of the climate crisis also impacts directly on human rights, as it penetrates Indigenous and communal lands for exploration and pollutes water and agricultural land. Even in the global North, its heavily polluting industries disproportionately impact poor, marginalised communities and especially communities of colour. Similarly, low-income and working-class communities disproportionately suffer the consequences of current spiking energy prices, and have less access to energy-saving measures. The welfare of fossil fuel industry workers worldwide must also be at the heart of any just transition towards a green economy.

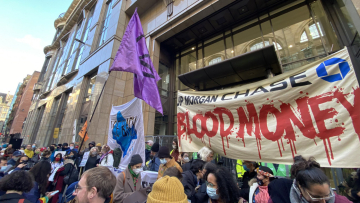

Role of banks

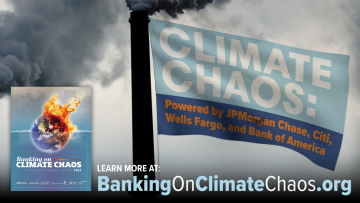

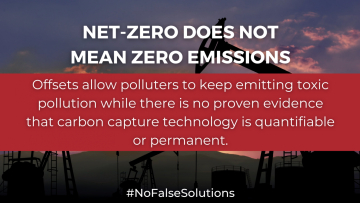

Banks must play a key role in tackling the climate emergency. Despite all the rhetoric coming from fossil banks committing to become net zero by 2050, trillions of dollars in fossil bank finance still keeps the fossil industry afloat, and even helps expand it. No climate commitment of any bank is complete without a pledge to urgently and decisively phase out fossil finance and commit to financing a just transition, leaving false solutions behind.

Banks also act as financiers of other high-emitting business sectors, such as steel, cement, petrochemicals, manufacturing, aviation, construction, etc. They must use their leverage over clients to rapidly steer these industries to go fossil free, including by providing the finance for this transition.

What banks must do

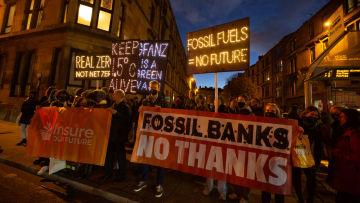

The overall aim of the Banks and Climate campaign is to challenge commercial banks globally to end finance for fossil fuels and fast track finance for a just energy transition.

To achieve this, banks must:

-

Exclude all new finance for projects & companies expanding fossil fuel production and false solutions

-

Endorse the Fossil Fuel Non-Proliferation Treaty

- Phase out all existing fossil fuel finance in line with a just transition within a 1.5ºC-warming scenario

What BankTrack does

Our Banks and Climate campaign works toward achieving 3 long-term goals:

- Stop bank finance for coal (+ info at Banks and Coal)

- Stop bank finance for oil & gas (+ info at Banks and Oil & Gas)

- Fast track bank finance for a just energy transition (+ info at Banks and a Just Energy Transition)

To achieve these goals we use the following tactics:

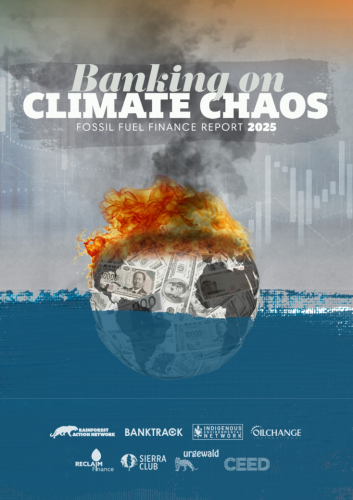

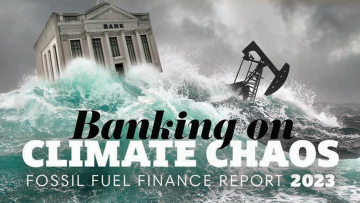

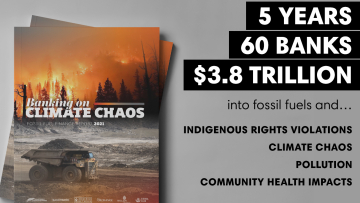

- Mapping finance flows: we are part of the coalition behind the yearly state-of-the-art Banking on Climate Chaos report, publish multiple publications on the latest fossil bank developments on coal, oil & gas, and fossil steel, and do our own research to inform Dodgy Deal campaigning

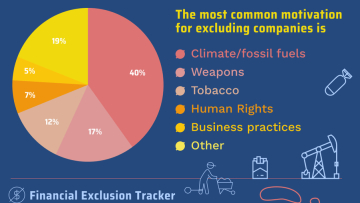

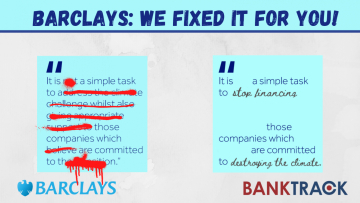

- Strengthen bank policies: our fossil exclusion tables provide an accessible tool for activists and other audiences. We also provide an up-to-date overview of Net Zero commitments and membership of industry initiatives including the Net Zero Banking Alliance. In combination with tools developed by partners like the Coal Policy Tool and Oil and Gas Policy Tracker, the exclusion tables and climate commitment monitoring are a key resource for pushing banks to strengthen their policies on fossil fuels and climate.

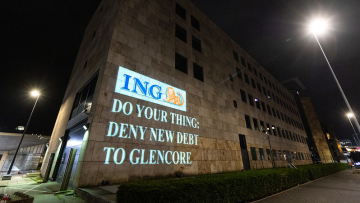

- Target Dodgy Deals: we campaign in collaboration with affected communities and other partners for banks to address the negative impacts of fossil projects and companies, either by engaging to ensure the negative impacts are stopped, or by ruling out bank finance altogether.

- Engage with banks: we directly engage with banks to raise standards, either in banks’ own policies or as part of financial sector initiatives. Together with partners, BankTrack has pushed initiatives like the Net Zero Banking Alliance, the Equator Principles and the Principles for Responsible Banking to strengthen their commitments on climate action. We also attend multiple Annual General Meetings (AGMs), regularly bringing frontline defenders along to make the case for fossil free banking.

- File complaints: we have filed a complaint over Standard Chartered’s coal financing, in a move to increase our to leverage through existing useful grievance mechanisms like the OECD’s National Contact Points for Responsible Business Conduct

- Strengthen movements: with research, training, tools and collaboration. BankTrack’s website provides an extensive database of bank policies, finance data and Dodgy Deal information for civil society to use. Our Fossil Banks No Thanks Platform provides an entrypoint for campaigners to get informed, trained, connected and coordinated with other groups and organisations targeting banks. We are part of campaign coalitions including Fossil Free Finance Campaign, Toxic Bonds Initiative, Beyond Fossil Fuels, Beyond Gas, and the European Responsible Investment Network (ERIN).

Reclaim Finance tracks the coal, oil and gas policies of financial institutions, including banks, in their Coal Policy Tool and Oil and Gas Policy Tool. The below shows the assessments for commercial banks. The table can be filtered by Country and for NZBA membership (more on that see here). For more information about the tool and methodology, see www.oilgaspolicytracker.org

Oil and Gas Policy Tool

Coal Policy Tool

Feedback welcome

Our policy assessments are always a work in progress and we very much welcome any feedback, especially from banks included in them. You can of course also contact us for more information on specific scores and the latest policy changes. Please get in touch at climate@banktrack.org.

Current Dodgy Deal targets

LNG threats to Verde Island Passage

Firewalk

Fracking is Hell: Allen and the YPF Trap

YPF drilled more than 200 wells in the Allen area and since then there have been explosions, spills and various accidents.

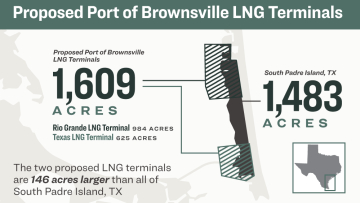

The dark side of US LNG

The Dark Side of US LNG is the result of a field mission to the United States to uncover the strong and growing ties between Italy, and in particular Italy's largest banking group, Intesa Sanpaolo, and the American liquefied natural gas (LNG) sector. Interviews by ReCommon. Filming, editing and music: Carlo Dojmi di Delupis. www.recommon.org

Rio+20 : from sustainable development to green economy, what is at stake ? which alternatives ?

Fireparty: launch campaign against banks and climate change

Subprime Carbon? Michelle Chan talks about carbon trading

explanation about carbon trading

.jpg&cropratio=16:9&width=360)