LNG Ship Bunkering: A High-Risk Bet in a Declining Market

Joanie Steinhaus, Ocean Program Director, Turtle Island Restoration Network

Joanie Steinhaus, Ocean Program Director, Turtle Island Restoration Network

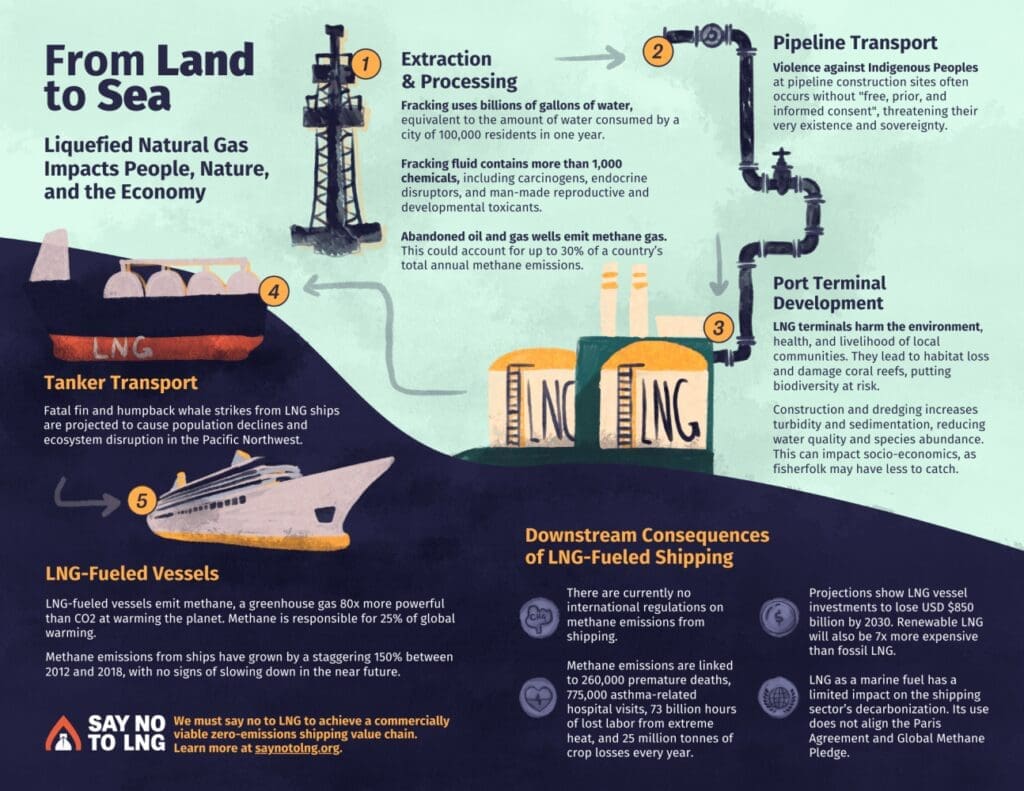

From my vantage point here on the Texas coast, I can see the unchecked encroachment of Liquefied Natural Gas (LNG) from the maritime shipping sector threatening the very ecosystems and communities we at Turtle Island Restoration Network (TIRN) work to protect.

Despite growing public scrutiny and geopolitical concerns, the LNG industry pushes forward. Entrenched vested interests are demanding new infrastructure and financing, compelling investors to continually buy into its expansion.

We’re seeing it firsthand, and we can’t afford to look away.

My home city currently faces the Galveston LNG Bunker Port (GLBP) project, a proposed facility that would initially produce 380,000 gallons of LNG per day, eventually doubling to 760,000 gallons (equivalent to 1.2 Olympic-sized swimming pools), targeting vessels operating in the Houston-Galveston corridor.

Last year, our organization Turtle Island Restoration Network (TIRN), with over 100 U.S. residents and organizations, opposed the GLBP with a formal letter due to its detrimental impact on public health, the environment, and local livelihoods. Yet the project had its permits approved earlier this year.

There’s still a chance to stop the GLBP: it has not reached Final Investment Decision, meaning it has not secured the necessary funding or formal agreement that it is even a viable project.

In response, last month we joined over 40 civil society organizations in sending a letter to banks with an urgent call to publicly commit against financing the GLBP project. This article underscores why there is so much community opposition and a swell of solidarity from groups like Say No to LNG – Global Shipping Campaign, Stand.earth and Pacific Environment.

Who is behind the GBLP Project?

The GLBP is a joint venture between Seapath and Pilot LNG. Both are early-stage ventures with limited staff, no disclosed capital raises, and no experience in large-scale projects. Pilot LNG, in particular, has no reported revenue or operating assets, and one of its directors also serves on a pro-LNG lobbying group’s board, raising conflict-of-interest concerns.

This lack of financial and technical capacity is a major red flag for investors and the project’s viability.

The LNG bunkering market is weakening due to forthcoming international regulations.

From 2028, LNG-powered vessels will begin paying charges under International Maritime Organization regulations.

Further International Maritime Organization decisions on methane-based fuels (like bio- and e-LNG) will also undermine LNG’s long-term viability, signalling a structural decline and significant stranded asset risk for investments.

Currently, over 55% of new ship orders globally are LNG-powered. But only a quarter of these vessels are designed to be retrofitted to operate on future zero-emission fuels, with high conversion costs up to 10% of the ship’s original value.

The LNG shipping market is already showing overcapacity, cancelled orders, and idled vessels.

For those of us living on the Gulf Coast, this isn’t just about economic forecasts or shipping trends; it’s about our homes, our health, and our very lives.

LNG’s primary component, methane, is a highly potent greenhouse gas that is 82.5 times more potent than carbon dioxide in the short-term. Not only does the GLBP pose a climate threat, it also severely impacts our health. Methane emissions contribute to tropospheric ozone, which is linked to over a million respiratory-related deaths annually among adults over 30.

The GLBP would deepen existing environmental injustices, further compromising the health of real people and families.

Communities near Shoal Point in Texas City already suffer from some of the lowest life expectancy rates in the U.S. and high levels of ground-level ozone, a pollutant exacerbated by methane emissions from LNG facilities.

Good news: French bank BNP Paribas has confirmed they will not finance the GLBP project, citing its policy excluding LNG export terminals. Importantly, BNP also confirmed they would not finance LNG carriers for the controversial Mozambique LNG project.

Leading banks are extending their fossil fuel exclusion policies to include maritime shipping assets and high-risk gas projects.

This trend is a clear signal: investors weighing involvement in GLBP and other LNG bunkering projects must scrutinize not only their financial underpinnings but also the broader shifts underway in global shipping markets and policy. Tangible examples of increasing pressure for decarbonization already exist, such as the Panama Canal’s NetZero Slot, which financially incentivizes ship companies to move beyond LNG fuel.

There is no credible future for maritime finance that includes LNG.

In an era of capital discipline and the growing importance of climate-aligned investing, the Galveston LNG Bunker Port (GLBP) project represents a financial risk, community opposition, and climate liability. Banks must urgently commit to stopping all financial services—including project finance, corporate lending, and advisory services—for new LNG bunkering infrastructure.

This is a demand from communities and advocates who understand the true cost of these fossil fuel projects.

We must collectively apply public pressure on these banks, including Citi, Wells Fargo, Bank of America, RBC, CIBC, HSBC, ING, Santander, BBVA. The time to divest is now, and to invest in genuine zero-emission solutions that align with a just and equitable future.

This blog was originally published on Stand-earth's website here.