Banks and Human Rights

A global crisis

Human rights are under increasing attack around the world. Democracy has been in decline for almost two decades, displaced by the march of authoritarianism. In armed conflicts in Ukraine, Sudan and Gaza, the rules of war are completely sidelined. Minorities and migrants are scapegoated, while a backlash against the gains won for the rights of women, people of colour and LGBTQI communities is growing. Online, information is weaponised, censored, and distorted. The ideals that led to the Universal Declaration of Human Rights in 1948 are under concerted attack, and yet people around the world are fighting back, and standing up in solidarity.

Within this fractured and uncertain landscape, businesses and the finance sector hold tremendous power. Businesses have a clear responsibility to respect human rights, as authoritatively established by the UN Guiding Principles on Business and Human Rights (UNGPs) in 2011. Yet in practice, businesses violate human rights often and with impunity. In some cases, businesses support attacks on democracy – for example when media and tech companies fail to hold authoritarians to account, or actively facilitate disinformation. In other cases, businesses seek to profit from conflict, facilitating grave human rights violations in the process. Efforts to establish mandatory human rights responsibilities for business are vitally important to counter this and to ensure the right of affected people to secure remedy can be realised. Major advances in accountability and transparency are needed if corporate power is to be checked and human rights are to be upheld and respected.

Linked to other crises

The human rights emergency is deeply intertwined with the other global emergencies we face. Climate breakdown poses a direct threat to the right to life and is already affecting human security on a massive scale. The repression and criminalisation of environmental activists is becoming a global trend. The destruction of nature also destroys people’s rights and abilities to enjoy a healthy environment. This affects all of us, but it disproportionately affects Indigenous Peoples, women and girls, children and the poor. Indigenous Peoples are stewards of some 25% of the world's land surface and 40% of protected areas, underlining the importance of their particular rights in conservation.

On the positive side, human rights are also a crucial tool in the fight-back against climate change, as their use in the growing field of climate litigation shows. Communities are also succeeding in many of their battles to stop harmful developments proceeding. The October 2021 recognition of the human right to a clean, healthy and sustainable environment by the UN Human Rights Council should further strengthen the ability of communities to ensure these rights are respected, and a human rights-based approach was embedded in the 2022 Kunming-Montreal Global Biodiversity Framework.

To meet the challenge of the climate crisis, the world must build a new economy driven by renewable energy. Human rights must be at the forefront of this transition if we are to avoid replicating the mistakes of the past. In particular, massive amounts of metals and minerals will be needed for this transition, for which systemic changes in the mining industry will be needed to ensure the rights of affected communities are respected.

Role of banks

Banks, like all businesses, have a responsibility to respect human rights, and have the potential to impact upon all these rights, both positively and negatively, and in a number of ways. The UNGPs set out that businesses can cause, contribute or be directly linked to human rights abuses.

-

Banks can cause human rights violations themselves, for example through racist practices like ‘redlining’ in mortgage provision.

-

They can also contribute to human rights violations, for example where they facilitate harm caused by a client. In such cases, they will also be responsible for cooperating in remediating the impact.

-

Or banks can be directly linked to human rights violations, through lending or other financial support for companies responsible for violating human rights.

Advice from the UN Office of the High Commissioner for Human Rights sets out the factors that can influence the nature of the relationship to the impact. Banks are likely to have contributed to human rights violations through actions including financing oil pipelines that have violated Indigenous Peoples’ rights, providing huge secret loans to highly-indebted countries, and financing construction or infrastructure projects which establish or expand illegal settlements.

Since the advent of the UNGPs, several banking sector and multi-stakeholder initiatives have aimed to clarify banks’ responsibilities to respect human rights. These include the Thun Group, Dutch Banking Sector Initiative on Human Rights, which concluded in 2020, and the OECD Project for Responsible Business Conduct in the Financial Sector.

What banks must do

The Banks and Human Rights campaign aims to challenge commercial banks globally to end financing human rights violations and respect human rights. To achieve this, banks must:

- Publicly commit to respect human rights;

- Implement human rights due diligence to assess actual and potential impacts, act upon the findings and track responses;

- Avoid financing companies that cause human rights violations that are systematic or that they refuse to address;

- Report on how they have managed and remedied specific adverse impacts, with a focus on the most severe impacts identified by the bank;

- Develop effective channels to address grievances from anyone impacted by their activities;

- Commit to transparency, for example so that affected communities can access information on who is financing projects that affect them.

What BankTrack does

BankTrack’s Banks and Human Rights project works towards achieving three long-term goals:

-

Banks act to prevent and address specific human rights abuses linked to their finance

-

Banks fully implement the UN Guiding Principles on Business and Human Rights

-

Banks avoid contributing to human rights violations arising from global conflict.

To achieve these goals we use the following tactics:

- Mapping finance flows: We conduct research on bank finance for specific projects and companies violating human rights, as the basis for our Dodgy Deal campaigning.

- Strengthen bank policies: BankTrack's Human Rights Benchmark project assesses large international banks on the extent to which they are fully implementing the UN Guiding Principles. We published our most recent Global Benchmark in November 2024, and have also published Regional Benchmarks for Africa (2021), Asia (2022) and Latin America (2024).

- Target Dodgy Deals: We target banks involved in financing specific projects and companies violating human rights and legitimate interests of communities, seeking banks to either cut or refrain from financing or exert their influence on clients to end human rights violations. This includes continued bank involvement in conflicts, including the Russian invasion of Ukraine and the Israeli-Palestinian conflict.

- Engage with banks: We engage with banks as part of our Human Rights Benchmark project, and also advise banks, and bank initiatives such as the Equator Principles, on how to strengthen policies and processes, including through the establishment of effective grievance mechanisms.

- Engage with bank stakeholders: We engage with a range of bank stakeholders, including affected communities, shareholder groups, and transnational standard-setters including the UN Office of the High Commissioner for Human Rights and the OECD.

- File complaints: Where appropriate we may file complaints on bank financed activities with relevant recourse mechanisms, such as those of development banks and the National Contact Points of the OECD.

- Strengthen movements: We provide training to fellow campaigners on the human rights responsibilities of banks and the state of their human rights policies. We also assist stakeholders directly affected by bank financed projects and companies in their engagement with banks.

BankTrack Global Human Rights Benchmark 2024

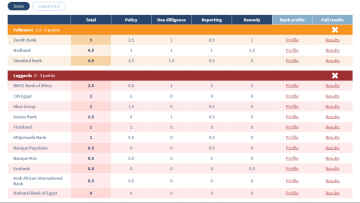

BankTrack’s 2024 Global Human Rights Benchmark again assessed 50 of the largest commercial banks globally. While once again no commercial banks are fully meeting the UN Guiding Principles, two banks were ranked as 'leaders' and there has been some progress in the development of remedy mechanisms.

This year’s Benchmark also assesses for the first time banks’ policies on Indigenous Peoples’ right to Free, Prior and Informed Consent; the protection of human rights defenders; and the human right to a healthy environment.

For further benchmark results, including regional benchmarks, see the Human Rights Benchmarking Project page.

Video Volunteers.png&cropratio=16:9&width=190)