Financial institutions in the EU are driving harm to the environment and human rights

Financial institutions in the EU have been involved in driving environmental and human rights-related harm, but the upcoming Corporate Sustainability Due Diligence Directive could minimise such impacts, highlights a new WWF report.

Supported by 13 organisations from across the EU, the report’s findings underscore that while the financial institutions in the EU have nearly four times more financial assets than non-financial companies, many policymakers are pushing hard to exclude due diligence requirements for financial activities in the negotiations on the upcoming law.

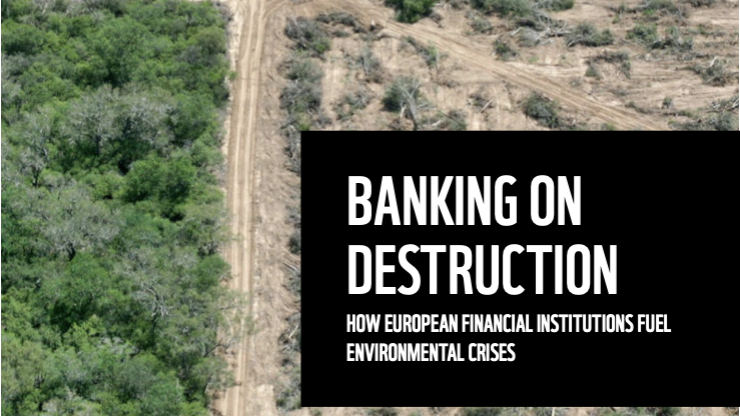

The report zooms in to three cases of harmful finance, which exemplify the adverse impacts that the EU laws have so far allowed financial institutions to overlook or neglect: (1) Paraguay’s deforestation crisis; (2) environmental pollution and public health crisis in Colombia; (3) harm to coastal ecosystems and communities in the Philippines.

Uku Lilleväli, Sustainable Finance Policy Officer at the WWF European Policy Office said: “Deforestation, pollution, harm to coastal areas and human rights violations are just a few stark examples of what’s at stake, and the financial sector is instrumental in minimising such harms. It is inconceivable that some policymakers want laws that would allow financiers to seek investment returns with no safeguards for the environment and human rights. Robust due diligence requirements for financial activities are a necessity to ensure sustainable financial practices and effective risk management.”

All the cases illustrate how the Directive could minimise harmful impacts and why it should ensure that all financial activities, including lending, insuring and investing, are required to identify, prevent and mitigate human rights violations and environmental harm. The report stresses the importance of financial sector due diligence to encourage more sustainable financial practices and more informed risk management.

WWF calls on the EU co-legislators for the full and meaningful inclusion of the financial sector in the Corporate Sustainability Due Diligence Directive during the next phase of the trilogue negotiations

See the original press release on the WFF website here.