Banks and Russian Aggression in Ukraine

Max Hammer, Banks and Human Rights Campaigner

Max Hammer, Banks and Human Rights Campaigner

On 24th February 2022, Russia began its full-scale illegal invasion of Ukraine, causing death and destruction on a massive scale and forcing millions of residents to flee their homes in search of safety. Thankfully, the abhorrent actions of the Russian state have been met with an unprecedented global response, with countries and companies alike exerting maximum pressure on Russia to end the war.

It is crucial that commercial banks join this global action and contribute to pressure on Russia by:

-

publicly condemning the Russian aggression,

-

ending any remaining support for the Russian coal, oil and gas industry,

-

and making a complete exit from Russia (and its vassal state Belarus).

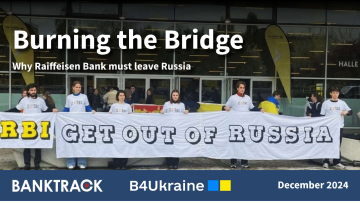

Two and a half years into the war, many international banks have heeded this call, but some banks still refuse to leave Russia to this day - most notably, Italy’s UniCredit, Hungary’s OTP, and especially Austria’s Raiffeisen Bank International. Efforts are underway globally to target those banks still remaining in Russia and enabling Putin’s war.

A war enabled by commercial banks

A number of international commercial banks are providing billions of euros of financing to help the Russian regime sustain and legitimate its war on Ukraine, even though boycotts and EU/US sanctions have restricted their opportunities to do business with some of the Russian companies fuelling this war, including in the oil and gas sectors.

As with other international businesses, commercial banks still operating in Russia provide tax revenues to the Russian government that enable it to keep bombing Ukrainian cities and killing Ukrainian civilians. In 2023, Western banks lined the Kremlin’s pockets with €800m in tax revenue – of which an estimated 41% has gone directly to the Russian war effort. Of these funds, more than three quarters were provided by just three Western banks – Raiffeisen Bank International, UniCredit, and OTP. The Kremlin is now getting more money from global banks than it was at any time before the invasion - not just because Putin introduced a new windfall tax on profitable companies in 2024 to raise money for the war on Ukraine, but also because some of these banks have increased their Russian profits since early 2022. And since Russian courts keep seizing hundreds of millions of euros from foreign banks at will and awarding this money to Russian energy giants such as Gazprom, international banks that still operate in Russia put themselves at further risk of providing huge lump sums to the war effort whenever a Russian court decides. At a time when many global organisations and companies are coordinating to deprive the Russian war machine of its cash flow, these banks are helping Russia’s regime financially sustain itself and its war.

In addition to tax money, commercial banks also put employees at risk of becoming involuntary soldiers for the Russian war effort. In late 2022, Putin dragged all international companies in Russia into the war by signing a law forcing them to make sure eligible employees are conscripted as soldiers. Shortly after this policy was enacted, a Raiffeisen employee who had been mobilised was killed in the war. By failing to pull out of Russia, banks don’t just risk prolonging the war effort – they also put themselves at risk of being forced into complicity in Russia’s war crimes in Ukraine.

As well as for money and soldiers, Russia depends on international banks in order to keep a sense of normality alive in Russia. Banks that refuse to pull out and continue providing financial services enable companies and retail customers to proceed with their business and normal life, thereby ignoring the global pressure and outrage that otherwise could help bring the war to an end.

Because banks are such key players in sustaining Russia’s war on Ukraine, applying pressure on these banks can also play a crucial role in stopping the political legitimacy and financial fuel that the war depends on. The Kremlin has repeatedly tried to block banks from pulling out of Russia: Putin has imposed “exit taxes” on companies that try to leave, and all companies that try to sell their Russian subsidiaries can only do so with his approval. Several of the banks that have stayed in until now have had their shares frozen by Russian courts. The Russian government is taking drastic steps to stop banks from leaving Russia because it is vulnerable to the risk of losing access to the international financial system. But it cannot stop commercial banks from winding down their operations, stopping their servicing of retail clients, and thus ending their complicity with the Russian invasion. The longer international banks stay in Russia, the harder it is to withdraw – now is the time to act.

A fossil fuel driven war

Putin would not have been able to invade Ukraine without years of revenues from Russia's coal, oil and gas exports to Europe and the rest of the world paying for his army. Revenues from state-owned companies and oil and gas-related taxes and export tariffs accounted for 45% of Russia’s federal budget in early 2022. In 2023, Russia was still exporting 4.6m barrels of oil a day, or 9% of global trade - barely marking a decrease from its exports in 2022. Although efforts to reduce Russia’s gas revenues have been more successful, Russia is still the world’s second largest gas producer, after the United States, producing 638 billion cubic metres (bcm) in 2021, or 18% of the world’s gas output. Since the start of the war, Russian gas exports have reduced by 47%, driven largely by a marked decrease in gas supplied to the EU. But the export value of Russian piped gas still amounts to €61 million per day, and the EU is still paying hundreds of millions each month for unsanctioned Russian liquified natural gas (LNG) imports. Finally, Russia still exports around 200 million tons of coal each year, with China, Korea and Europe being the biggest export markets. CREA continues to regularly update its tracker of Russian energy exports, which can be found here.

Alongside 75 NGOs, BankTrack has been calling for a global boycott of Russian fossil fuels since the outset of the war, when it became clear that major banks and investors were continuing to finance Russian coal, oil and gas companies. Since then, most commercial banks have walked back from previous financial ties to the Russian fossil fuel industry, in part because of US sanctions placing limits on financial institutions’ ability to provide financing to already-sanctioned Russian entities.

BankTrack will continue to call upon banks, insurers and investors - including those not directly affected by existing sanctions - to go even further in their commitments, by excluding all Russian coal, oil and gas companies from all financial services. In particular, we call on them to commit to no longer provide new financing, investment, insurance coverage and other financial services to these companies, and divest from existing assets. Reclaim Finance has a list here of such commitments.

A global call on banks to act

It is a moral imperative for banks to make a complete exit from Russia for as long as the war rages on and justice and reparations have not been delivered.

Many commercial banks have responded to the global call to leave Russia – including Société Générale, which exited Russia in April 2022 by selling its stake in Rosbank at a loss; and Citi, which has steadily scaled down its activities in Russia since the invasion and is ending its Russian retail banking services by November 2024.

Unfortunately, more than two and a half years after the invasion, several commercial banks, including Italy’s UniCredit, Hungary’s OTP, and especially Austria’s Raiffeisen Bank International, continue to operate in Russia, providing cover and legitimacy to a Russian regime which has killed tens of thousands of people and destroyed whole cities in the course of its war on Ukraine.

In the early phase of the war, BankTrack and other civil society organisations called upon banks globally to move further. The 2022 open letter by 30+ organisations calls on banks to:

-

Suspend all corporate and investment banking activities in Russia: This should include new loans and underwriting services and the exclusion of Russian shares and bonds from bank indices. Such a suspension of activities must take place with due respect for human rights and following established principles of responsible disengagement.

-

Report publicly on business activities in Russia, with as much detail and transparency as legally permitted: This includes overall exposure via lending and investment services, investments in Russian government and corporate bonds, and investment funds (e.g. ETFs) and mutual funds offered to retail customers. Banks should also report on losses resulting from their own policy response to the crisis.

-

Engage with clients and investee companies with ongoing operations in Russia to heed the call of the Ukrainian government to cease their operations in Russia. Banks should consider suspending their finance for companies that opt to continue their operations in Russia.

-

Cease any and all provision of financial services to Russian and non-Russian companies operating in the Russian coal, oil and gas sectors. This includes all services to Russian coal, oil and gas companies as well as to non-Russian fossil fuel companies that have not yet decided to cease their operations in Russia.

-

Take a clear public stance against the Russian invasion of Ukraine: Banks should not just deplore the situation, but publicly condemn the Russian aggression against Ukraine as unacceptable.

With the Russian invasion of Ukraine showing no sign of waning, it is more urgent than ever before that banks comply with these demands.

Tracking policy responses of banks

BankTrack is keeping track of how banks globally respond to the Russian invasion in Ukraine, and so do others. The KSE Institute of the Kyiv School of Economics maintains the leave-russia.org website listing companies still operating in Russia, including banks and other financial industries. The tracker tool below derives information partly from this website and other sources, including the Yale List of companies leaving and staying in Russia. Most financial data is derived from Western banks' Russian subsidiaries' filings with the Central Bank of Russia.

The tracker was most recently updated in November 2025. Browse it below to see our latest research on the status of the commercial banks that were most exposed to Russia at the start of its invasion of Ukraine in 2022, including the progress of their Russia exits and the tax revenues they paid to the Russian regime in the last three years.

We are continuously looking for ways to improve our research overview of banks' exposure to Russian aggression in Ukraine. If there is any important information you feel is missing from this tracker, or if you would like more information on how the assessments above are sourced and calculated, please get in touch at max@banktrack.org.