A year and a half after Russia's invasion of Ukraine, Raiffeisen, UniCredit, and Citi profited the most among foreign banks in Russia

In a year and a half after the Russian invasion of Ukraine, only 13 foreign banking institutions completely withdrew from the Russian market, while 61 foreign banks are continuing to operate in the country fully or partially, according to KSE Institute.

Big players such as Société Générale, Home Credit, and PPF have left the market, and a number of banks are suspending their business: Deutsche Bank, BNP Paribas, Commerzbank, Citigroup, Pekao SA, and Morgan Stanley.

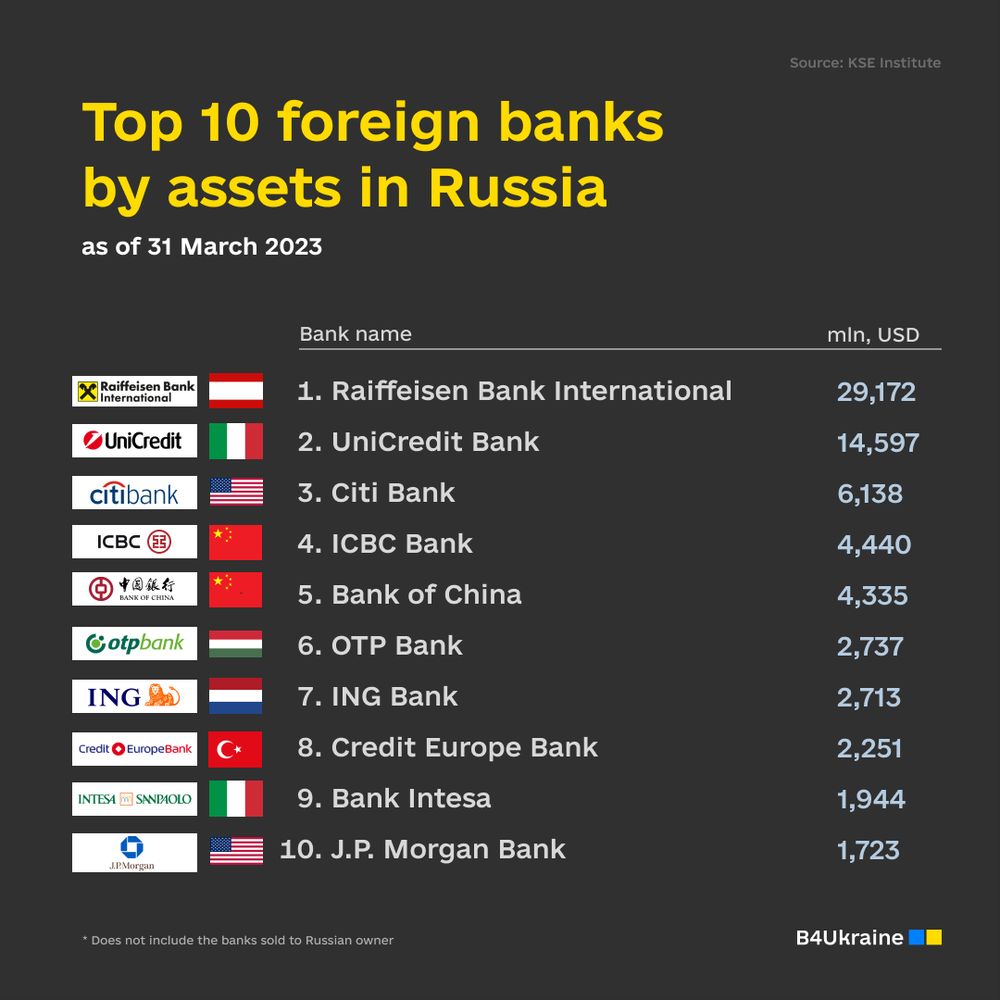

The list of remainers includes European banks Raiffeisen Bank International, UniCredit Group, OTP Bank, Credit Europe Bank, Crédit Agricole, as well as a number of Chinese, Japanese and South Korean institutions such as the Bank of China, China Construction Bank, ICBC Bank, Agricultural Bank of China, Mizuho Bank and KEB HNB Bank.

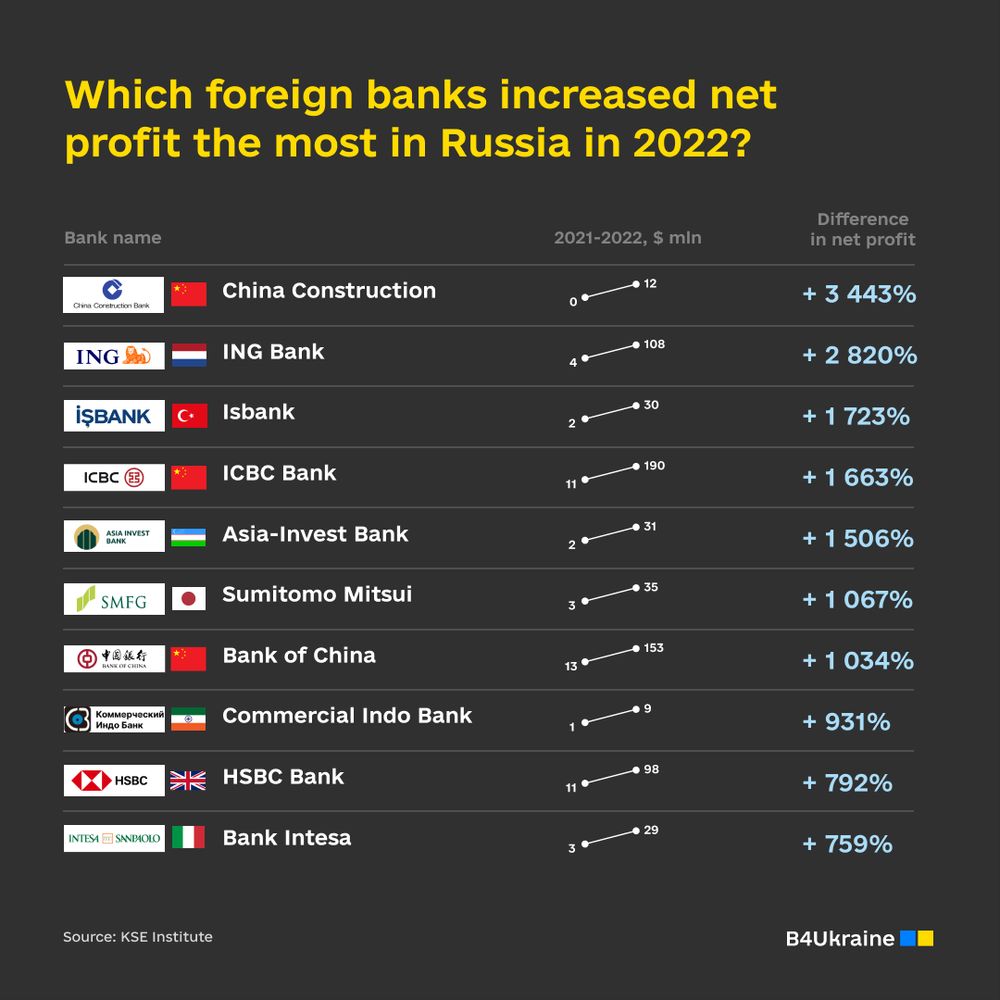

In 2022, the most significant increase in Russian assets was demonstrated by Commercial Indo Bank (+679,9%), Bank of China (+408,8%), and another Chinese bank ICBC (+339,6%).

Still, Austria’s Raiffeisen Bank, Italy’s UniCredit Bank, and the U.S. Citi Bank hold the largest amounts of assets among foreign banks, according to the KSE data.

Such banks as China Construction, Dutch ING Bank, and Turkish Isbank managed to increase their 2022 net profits most dramatically.

It is important to note that since the start of the war against Ukraine and the increasing isolation of the Russian financial system by the West, Chinese bank branches in Russia sharply increased lending to Russian banks. Their share in the Russian market increased almost fivefold, supplying the Russia market with yuan. As an example, from February 1, 2022 to June 1, 2023, the Bank of China increased the volume of loans granted to other banks in Russia by 107 billion rubles.

However, in terms of net profit volume the top-3 financial institutions were western banks, namely Raiffeisen Bank ($2,014 mln), UniCredit Bank ($807 mln), and Citibank ($329 mln).

The total profit of foreign-controlled credit institutions exceeded RUB 211 billion ($2.3 billion) in 2022. Amid a shrinking loan portfolio, foreign banks increased the funds raised, primarily from corporate clients. They also made a decent income on both interest and fees.

Raiffeisen exiting Russia?

Austria’s Raiffeisen Bank International this week posted a 9.6% rise in profit at its operations there during the first half of the year, while the broader group’s profit fell 24%.

Profit generated in Russia in the first six months reached €867 million ($753.23 million), up from €630 million a year earlier.

Raiffeisen also managed to expand the number of both staff and customers in Russia during the first half of the year. The bank simply increased pay for its Russia-based employees by 200 mln euros in the first six months of the year, an equivalent of 22K euro payout per employee.

“We continue to work at full speed on two options for our business in Russia: a sale and a spin-off. While we are working on these complex options, we are consequently continuing to reduce the business in Russia,” said CEO Johann Strobl.

The bank confirmed its plans to pay up to €100 million in additional tax to the Kremlin in accordance with new legislation that calls on a one-off windfall tax on big business. In order to help finance its widening, war-driven budget deficit, the Kremlin aims to raise 300 billion rubles ($3.30 billion) with this new regulation.

These most recent facts provide no indication of the bank management’s intention to exit the Russian market by the end of the year, as was originally communicated. Raiffeisen’s actions also fall way short and are tone-deaf to B4Ukraine’s calls for a moral exit from Russia — without transferring valuable assets to the aggressor state and without further supporting the Kremlin’s finances in the process.

In the case of Russia’s ongoing war against Ukraine with over 100,000 reported war crimes, the financial sector players such as Raiffeisen are oiling Russia’s bloody war machine by providing funding that enables to terrorize, loot, rape and kill. And in light of further tightening of Russia’s partial mobilization law, B4Ukraine urges all other foreign banks and other financial institutions to take into consideration the inevitable risk of complicity in Russia’s war crimes and atrocities committed in Ukraine.

All foreign companies, including financial institutions, must exit Russia responsibly and stay out until the territorial integrity and sovereignty of Ukraine are restored. This is the only way to deprive the Kremlin’s war machine of financial resources and avoid the enormous financial and reputational repercussions of being dragged into Russia’s unjust and brutal war.

This news article was originally posted by B4Ukraine