Active

This profile is actively maintained

Active

This profile is actively maintained| Website | http://www.icbc-ltd.com/ICBCLtd/en/ |

| Headquarters |

55 Fuxingmennei Avenue, Xicheng District

10032 Beijing

China

|

| CEO/chair |

Chen Siqing Chairman and Executive Director |

| Supervisor | |

| Ownership |

listed on Hong Kong Stock Exchange & Shanghai Stock Exchange

The Chinese government owns via Central Huijin Investment 34.71% of ICBC shares. ICBC's complete shareholder structure can be accessed here. |

The Industrial and Commercial Bank of China (ICBC) is a joint-stock commercial bank based in the People's Republic of China. Founded in 1984, ICBC is the world's largest bank by asset value. ICBC has expanded its operations outside of China through mergers and acquisitions, as well as registering branch offices in foreign countries. In 2007, ICBC acquired PT. Bank Indonesia and Heng Seng Bank, as well as a 20% stake in Standard Bank of South Africa. It also set up offices in Russia, Dubai, Doha, Sydney and New York.

ICBC does not have publicly available bank policies nor does it have a web page on its sustainability commitments. The bank's webpage on corporate social responsibility only lists the bank's most recent annual csr reports.

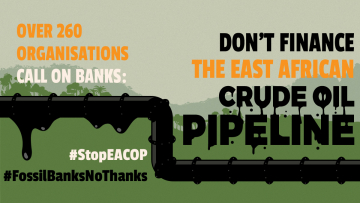

Industrial And Commercial Bank Of China (ICBC) is linked to a number of companies and projects that BankTrack considers controversial (so called Dodgy Deals), e.g. as a current or past financier or through an expression of interest. The profiles below provide more details on the nature of Industrial And Commercial Bank Of China (ICBC)'s link to these deals.

EACOP: a crude reality, documentary

Industrial and Commercial Bank of China does not operate a complaints channel for individuals and communities that may be adversely affected by its finance.

This page evaluates Industrial and Commercial Bank of China (ICBC)'s responses to instances of alleged human rights violations linked to its finance, raised by civil society organisations. It is not intended to be exhaustive, but covers selected impacts raised by BankTrack and other civil society partners since 2016. For the full scoring methodology, see here. For more information about BankTrack's evaluation of bank responses to human rights impacts, see the 2021 report "Actions speak louder: assessing bank responses to human rights violations".

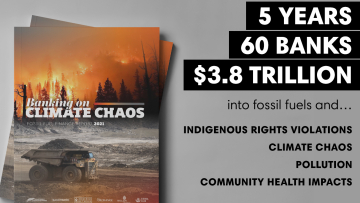

Banks and Climate

The 2025 Banking on Climate Chaos report showed that Industrial and Commercial Bank of China provided $72.7 bn in financing to the fossil fuel industry between 2021 and 2024. In 2024 only, Industrial and Commercial Bank of China provided $15.8 bn, including $11.6 bn for oil, gas and coal companies expanding fossil fuels. Find further details on Industrial and Commercial Bank of China's fossil fuel portfolio and how it compares to other large banks globally on the Banking on Climate Chaos website below.

Partner organisation Reclaim Finance tracks the coal, oil and gas policies of financial institutions, including banks, in their Coal Policy Tool (CPT) and the Oil and Gas Policy Tracker (OGPT). BankTrack works closely with Reclaim Finance and endorses their policy assessments. Find further details on their assessment of ICBC's fossil fuel policy below.

Banks and Human Rights

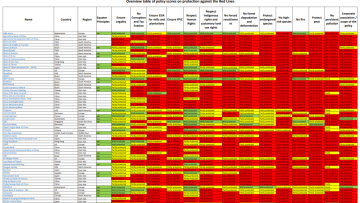

BankTrack assessed ICBC in its 2024 Global Human Rights Benchmark, where it achieved 0.5 points out of 15 and was ranked as a “laggard”.

The bank scored 0 out of 3 points on the new “specific rights indicators”, which assess how banks address human rights defenders, Indigenous Peoples’ right to Free, Prior and Informed Consent and environmental rights in their policies and practices.

In addition, ICBC scored 0 out of 3 on how it responds to alleged human rights violations linked to its finance, which were raised by civil society organisations. More information is detailed in the “Accountability” section of this profile.

The table below shows BankTrack's assessment of how ICBC has implemented the UN Guiding Principles on Business and Human Rights. Please click on 'expand all details' and 'explanation' for further information on the methodology.

Our policy assessments are always a work in progress. We very much welcome any feedback, especially from banks included in the assessments. Please get in touch at humanrights@banktrack.org.

Global Human Rights Benchmark 2022

Global Human Rights Benchmark 2024

Banks and Nature

ICBC’s policies for forest-risk sectors (beef, soy, palm oil, pulp and paper, rubber and timber) have been assessed by the Forests & Finance coalition, achieving an overall score of 0.5 out of 10 and ranking it as a laggard. ICBC achieved a score of 0.5 out of 10 specifically for its policies related to the beef sector and 0.5 out of 10 for its policies related to the palm oil sector. In addition, BankTrack and the Environmental Paper Network have assessed ICBC’s policies related to the pulp and paper sector.

Between 2016 and 2022, ICBC provided USD 3,428 million in credit to companies operating in these forest-risk sectors and held investments amounting to USD 3 million as of 2022. For more information, see the links below.

Forest & Finance Policy Assessment 2022: Overall scores

A bank can obtain a total of 10 points for the quality of its policies. The total score is based on their scores per sector, weighted against their financing and investment for each sector. For further details on this see here. Based on their overall score, banks are then classified as Laggards, Followers, Front runners or Leaders, as follows:

Forest & Finance Policy Assessment 2022: Beef

A bank can obtain a total of 10 points for the quality of its beef policy. The total score is based on their scores per sector, weighted against their financing and investment for each sector. For further details on this see here. Based on their overall score, banks are then classified as Laggards, Followers, Front runners or Leaders, as follows:

Forest & Finance Policy Assessment 2022: Palm Oil

A bank can obtain a total of 10 points for the quality of its palm oil policy. The total score is based on their scores per sector, weighted against their financing and investment for each sector. For further details on this see here. Based on their overall score, banks are then classified as Laggards, Followers, Front runners or Leaders, as follows:

Banks and Steel

Partner organisation Reclaim Finance’s 2023 report on metallurgical coal financing showed that Industrial and Commercial Bank of China provided US$ 2.3 billion in loans and underwriting to developers of new metallurgical coal between 2016 and 2022. Find further details on Industrial and Commercial Bank of China’s metallurgical coal financing and and how it compares to other large banks globally in the report.

Reclaim Finance tracks the metallurgical coal policies of financial institutions, including banks, in their Coal Policy Tool. BankTrack works closely with Reclaim Finance and endorses their policy assessments. Find further details on their assessment of Industrial and Commercial Bank of China’s metallurgical coal policy below.

According to a report by Reclaim Finance, between 2016 and June 2023, Industrial and Commercial Bank of China provided $8.9 billion in finance to the fossil-steel industry, making it the 12th largest financier worldwide. Find further details on Industrial and Commercial Bank of China's steel financing and how it compares to other large banks globally in the report.