Global finance sector failing to apply conservation criteria to pulp and paper funding

- Merel van der Mark, EPN Pulp Finance Working Group Coordinator, merel@environmentalpaper.org

- Luisa Colasimone, EPN International Coordinator, luisa@environmentalpaper.org, +351 910 678 050

- Joshua Martin, EPN North America Coordinator, joshua@environmentalpaper.org, +1 828 242 4238

- Merel van der Mark, EPN Pulp Finance Working Group Coordinator, merel@environmentalpaper.org

- Luisa Colasimone, EPN International Coordinator, luisa@environmentalpaper.org, +351 910 678 050

- Joshua Martin, EPN North America Coordinator, joshua@environmentalpaper.org, +1 828 242 4238

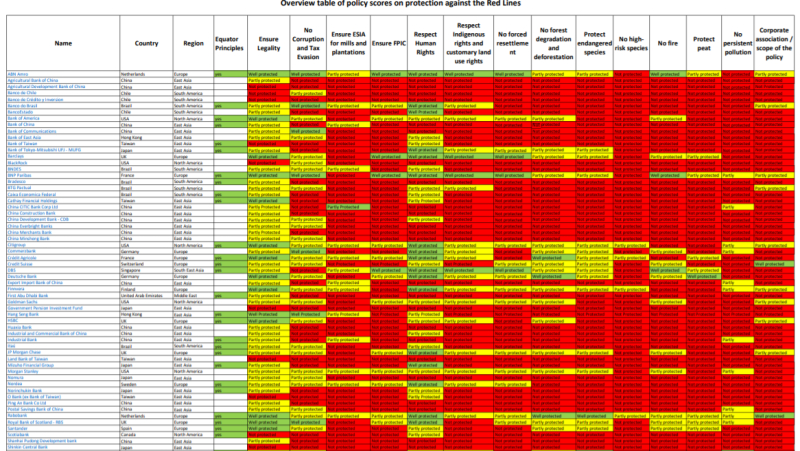

On the U.N. International Day of Forests, the Environmental Paper Network (EPN) has for the second time assessed the policies of major banks and funders of the pulp and paper industry worldwide against baseline environmental and social criteria developed by a global network of experts, known as the “Red Lines.” Despite having three years to improve their policies since the first publication of In the Red, the new analysis shows that, on average, financial institutions only scored “well protected” on 5 out of the 14 categories of Red Lines. The analysis reveals a high level of social and environmental risk in the sector for investors and an urgent need for stronger safeguards.

Merel van der Mark, EPN Pulp Finance Working Group Coordinator, said: “Our analysis shows banking institutions are far from getting a passing grade – the pulp and paper industry keeps ignoring basic environmental and social criteria but investors continue to pump money into their activities without proper guardrails. Financial institutions have the duty to require their clients and business partners take appropriate action and meet the required standards.”

According to the report, ‘In the Red 2020,’ financial institutions are failing to implement adequate protections on most of the EPN’s ‘Red Lines.’ The ‘Red Lines’ are 14 absolute minimum criteria that a large, international coalition of conservation organizations have determined all financial institutions should ensure their clients comply with, and are fully described in the Green Paper, Red Lines report.

In the 2020 assessment, the highest scores were obtained for requiring legality and respect for human rights, and there are significant improvements from the 2017 assessment in the “respect indigenous rights and customary land rights” criteria. (2) The worst scores earned by banks stem from the lack of requirements for full Environmental Impact Assessments and the lack of commitments to not introduce high-risk species, which include genetically engineered trees.

The 2020 assessment also analyzed the sufficiency of using standards such as the International Finance Corporation Performance Standards, the Equator Principles, The Chinese Green Credit Guidelines and the Forest Stewardship Council (FSC) principles and criteria to reduce risk in the 14 categories of Red Lines. The findings show that these standards only protect against a maximum of three Red Lines.

The construction and operation of pulp and paper mills can lead to a range of long-term negative social and environmental impacts. To stop funding controversial projects, financial institutions must set up a full public investment policy framework for the sector, open the door to communication with civil society organisations, and ensure that all policies are implemented through adequate due diligence procedures.

---

** The Environmental Paper Network and our 156 member organisations want to acknowledge the extraordinary circumstances of this moment, given the terrible impacts of COVID-19 for people around the world. The urgent need to respond to the pandemic and its impacts is rightly taking priority. However, climate change and deforestation remain existential threats, they make similar outbreaks in the future even more likely and reduce our resilience to them. Like coronavirus, they will require unprecedented global action in solidarity with those most vulnerable. We believe that the analysis contained in this report will prove useful in addressing that threat and is relevant to the emerging science (1) that protecting forests may be critical in keeping viruses at bay.

Notes to Editors

- Could keeping forests standing help keep viruses at bay?, 19 March 2020, Fern

- Due to some methodological adjustments to increase coherence, some scores changed between the 2017 and the 2020 assessment, although policies stayed the same.