Active

This profile is actively maintained

Active

This profile is actively maintained| Website | http://bank.pingan.com/en/index.shtml |

| Headquarters |

No. 5047 Shennan East Road Luohu District Shenzhen

518001 Guangdong

China

|

| CEO/chair |

MA Mingzhe Founder and Chairman |

| Supervisor | |

| Ownership |

listed on Shenzhen Stock Exchange

Ping An Bank is a subsidiary of the Ping An Insurance Group. The bank's complete shareholder structure can be accessed here. |

Ping An Bank is a Chinese joint-stock commercial bank. In June 2012, Shenzhen Development Bank merged with former Ping An Bank into Ping An Bank. The bank primarily operates in Shenzhen, Shanghai, and Fuzhou. Being part of the Ping An Insurance Group of China, Ping An Bank is one of its main subsidiaries. Ping An Bank provides services in insurance, banking, and asset management.

Ping An Bank does not have publicly available bank policies, nor does it have a web page on its sustainability commitments. Its web page on corporate social responsibility only lists the bank's most recent annual CSR reports.

Ping An Bank is linked to a number of companies and projects that BankTrack considers controversial (so called Dodgy Deals), e.g. as a current or past financier or through an expression of interest. The profiles below provide more details on the nature of Ping An Bank's link to these deals.

Ping An Bank does not operate a complaints or grievances channel for individuals or communities that might have been affected by the bank's finance.

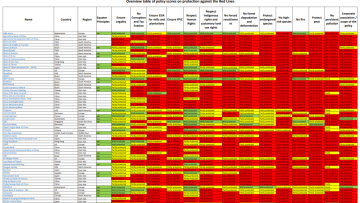

This page evaluates Ping An Bank's responses to instances of alleged human rights violations linked to its finance, raised by civil society organisations. It is not intended to be exhaustive, but covers selected impacts raised by BankTrack and other civil society partners since 2016. For the full scoring methodology, see here. For more information about BankTrack's evaluation of bank responses to human rights impacts, see the 2021 report "Actions speak louder: assessing bank responses to human rights violations".

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 200

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 200

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 209

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 209

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 217

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 217

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 220

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 220

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 223

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 223

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

Banks and Climate

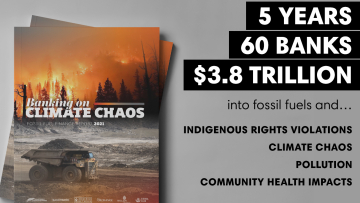

The 2025 Banking on Climate Chaos report showed that Ping An Insurance Group provided $25.4 bn in financing to the fossil fuel industry between 2021 and 2024. In 2024 only, Ping An Insurance Group provided $4.7 bn, including $3.3 bn for oil, gas and coal companies expanding fossil fuels. Find further details on Ping An Insurance Group's fossil fuel portfolio and how it compares to other large banks globally on the Banking on Climate Chaos website below.

Partner organisation Reclaim Finance tracks the coal, oil and gas policies of financial institutions, including banks, in their Coal Policy Tool (CPT) and the Oil and Gas Policy Tracker (OGPT). BankTrack works closely with Reclaim Finance and endorses their policy assessments. Find further details on their assessment of Ping An Bank’s fossil fuel policy below.

Banks and Steel

According to a report by Reclaim Finance, between 2016 and June 2023, Ping An Insurance Group Provided $4.2 billion in finance to the fossil-steel industry, making it the 34th largest financier worldwide. Find further details on Ping An Insurance Group's steel financing and how it compares to other large banks globally in the report.