Active

This profile is actively maintained

Active

This profile is actively maintained| Website | https://www.mizuhogroup.com/ |

| Headquarters |

1–5–5, Otemachi, Chiyoda–ku 100–8176

Tokyo

Japan

|

| CEO/chair |

Masahiro Kihara President & Group CEO |

| Supervisor | |

| Ownership |

listed on NYSE, Osaka Securities Exchange & Tokyo Stock Exchange

Mizuho's shareholder structure can be accessed here. |

Mizuho Financial Group is one of three Japanese megabanks, along with Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group. Mizuho offers a broad range of service including banking, trust banking and securities, and other business related to financial services. Under the umbrella of the holding company Mizuho Financial Group, their major group companies include Mizuho Bank, Mizuho Trust & Banking and Mizuho Securities. Muziho Bank became a signatory of the Equator Principles in October 2003, and was the chair bank of the Equator Principles Association from May 2014 until April 2015.

Mizuho's most important sustainability commitments can be found at the website sections listed below.

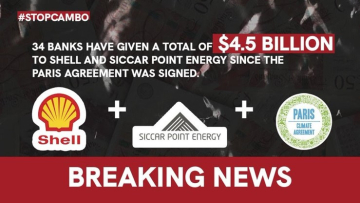

Mizuho Financial Group is linked to a number of companies and projects that BankTrack considers controversial (so called Dodgy Deals), e.g. as a current or past financier or through an expression of interest. The profiles below provide more details on the nature of Mizuho Financial Group's link to these deals.

The dark side of US LNG

The Dark Side of US LNG is the result of a field mission to the United States to uncover the strong and growing ties between Italy, and in particular Italy's largest banking group, Intesa Sanpaolo, and the American liquefied natural gas (LNG) sector. Interviews by ReCommon. Filming, editing and music: Carlo Dojmi di Delupis. www.recommon.org

Mizuho is a member of the Japan Center for Engagement and Remedy on Business and Human Rights (JaCER), which operates a grievance mechanism based on the UN Guiding Principles on Business and Human Rights, the “Engagement and Remedy Platform”. Individuals and communities affected by the bank’s finance can report human rights grievances here. Stakeholders may also raise complaints via the OECD National Contact Points (see OECD Watch guidance).

Mizuho is an Equator Principles signatory. While the Equator Principles have no official grievance mechanism, complaints relating to this bank's financing of Equator Principles projects can be filed through our own website www.equator-complaints.org.

This page evaluates Mizuho Financial Group's responses to instances of alleged human rights violations linked to its finance, raised by civil society organisations. It is not intended to be exhaustive, but covers selected impacts raised by BankTrack and other civil society partners since 2016. For the full scoring methodology, see here. For more information about BankTrack's evaluation of bank responses to human rights impacts, see the 2021 report "Actions speak louder: assessing bank responses to human rights violations".

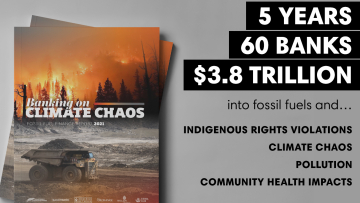

Banks and Climate

The 2025 Banking on Climate Chaos report showed that Mizuho Financial provided $150.9 bn in financing to the fossil fuel industry between 2021 and 2024. In 2024 only, Mizuho Financial provided $40.3 bn, including $22.0 bn for oil, gas and coal companies expanding fossil fuels. Mizuho Financial was the fourth-largest fossil fuel financier in 2024. Find further details on Mizuho Financial's fossil fuel portfolio and how it compares to other large banks globally on the Banking on Climate Chaos website below.

Partner organisation Reclaim Finance tracks the coal, oil and gas policies of financial institutions, including banks, in their Coal Policy Tool (CPT) and the Oil and Gas Policy Tracker (OGPT). BankTrack works closely with Reclaim Finance and endorses their policy assessments. Find further details on their assessment of Mizuho's fossil fuel policy below.

False Solutions Tracker expansion

The purpose of the False Solutions Tracker is to give a clear overview of energy technologies that fall under banks' individual sustainable finance commitments. The tracker lists 11 energy technologies that are usually associated with the energy transition and the decarbonisation of the economy. These technologies are defined here and classified in three categories:

-

Real solutions: Technologies that deliver on a Just Transition towards Energy Democracy. BankTrack considers these technologies as real solutions only if and when they do deliver Energy Democracy.

-

Solutions under strict conditions: Energy technologies that could be real solutions if they deliver on a Just Transition towards Energy Democracy but that could also be false solutions. This is the case of hydrogen and hydropower. On one hand, fossil-free and green hydrogen could be a real solution under certain conditions. However, fossil-based hydrogen and nuclear hydrogen are always false solutions. On the other hand, hydropower lifespan extension could also be a real solution under strict conditions while hydropower expansion is a false solution.

-

False solutions: Energy technologies that are not aligned with a just transition towards Energy Democracy, such as solid biomass, biofuels and carbon capture, utilisation and storage (CCUS).

For each one of the 11 energy technologies, the tracker indicates if it is included in bank's individual sustainable finance commitments:

For Real solutions:

- : Yes, the bank includes its finance towards this energy technology in its sustainable finance reporting.

- : Yes, the bank includes its finance towards this energy technology in its sustainable finance reporting, but under certain conditions. In this case, those conditions are mentioned in the "relevant policy document" section for each bank.

- : No, the bank does not include its finance towards this energy technology in its sustainable finance reporting.

- : It is unclear whether the bank includes or not its finance towards this energy technology in its sustainable finance reporting.

For solutions under strict conditions and for false solutions:

- : Yes, the bank includes its finance towards this energy technology in its sustainable finance reporting.

- : Yes, the bank includes its finance towards this energy technology in its sustainable finance reporting, but under certain conditions. In this case, those conditions are mentioned in the "relevant policy document" section for each bank.

- : No, the bank does not include its finance towards this energy technology in its sustainable finance reporting.

- : It is unclear whether the bank includes or not its finance towards this energy technology in its sustainable finance reporting.

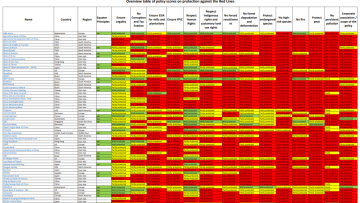

Banks and Human Rights

BankTrack assessed Mizuho Financial Group in its 2024 Global Human Rights Benchmark, where it achieved 11 points out of 15 and was ranked as a “leader”.

The bank scored 0.5 out of 3 points on the new “specific rights indicators”, which assess how banks address human rights defenders, Indigenous Peoples’ right to Free, Prior and Informed Consent and environmental rights in their policies and practices.

In addition, Mizuho Financial Group scored 0.11 out of 3 on how it responds to alleged human rights violations linked to its finance, which were raised by civil society organisations. More information is detailed in the “Accountability” section of this profile.

The table below shows BankTrack's assessment of how Mizuho Financial Group has implemented the UN Guiding Principles on Business and Human Rights. Please click on 'expand all details' and 'explanation' for further information on the methodology.

Our policy assessments are always a work in progress. We very much welcome any feedback, especially from banks included in the assessments. Please get in touch at humanrights@banktrack.org.

Global Human Rights Benchmark 2022

Global Human Rights Benchmark 2024

Banks and Nature

Mizuho’s policies for forest-risk sectors (beef, soy, palm oil, pulp and paper, rubber and timber) have been assessed by the Forests & Finance coalition, achieving an overall score of 6.9 out of 10 and ranking it as a front runner. Mizuho achieved a score of 4.3 out of 10 specifically for its policies related to the beef sector and 7.5 out of 10 for its policies related to the palm oil sector. In addition, BankTrack and the Environmental Paper Network have assessed Mizuho’s policies related to the pulp and paper sector.

Between 2016 and 2022, Mizuho provided USD 9,221 million in credit to companies operating in these forest-risk sectors and held investments amounting to USD 78 million as of 2022. For more information, see the links below.

Forest & Finance Policy Assessment 2022: Overall scores

A bank can obtain a total of 10 points for the quality of its policies. The total score is based on their scores per sector, weighted against their financing and investment for each sector. For further details on this see here. Based on their overall score, banks are then classified as Laggards, Followers, Front runners or Leaders, as follows:

Forest & Finance Policy Assessment 2022: Beef

A bank can obtain a total of 10 points for the quality of its beef policy. The total score is based on their scores per sector, weighted against their financing and investment for each sector. For further details on this see here. Based on their overall score, banks are then classified as Laggards, Followers, Front runners or Leaders, as follows:

Forest & Finance Policy Assessment 2022: Palm Oil

A bank can obtain a total of 10 points for the quality of its palm oil policy. The total score is based on their scores per sector, weighted against their financing and investment for each sector. For further details on this see here. Based on their overall score, banks are then classified as Laggards, Followers, Front runners or Leaders, as follows:

Tracking the Net Zero Banking Alliance

Mizuho is a member of the Net Zero Banking Alliance (NZBA) and has therefore committed to reduce its financed emissions to net zero by 2050; within 18 months of joining the alliance set interim targets for 2030 (or sooner) for high emission priority sectors, and within 36 months set further sector targets; set new intermediary targets every 5 years from 2030 onwards; annually publish data on emissions and progress against a transition strategy including climate-related sectoral policies; and take a robust approach to the role of offsets in transition plans. BankTrack track's implementation of these commitments in the NZBA compliance tracker.

Banks and Steel

As part of the Net Zero Banking Alliance (NZBA), Mizuho is required to set interim targets for 2030 for high emission priority sectors. For Mizuho, this includes its lending to the steel sector. You can see Mizuho’s iron and steel decarbonisation targets, and its progress towards meeting them in our NZBA steel targets compliance tracker:

Partner organisation Reclaim Finance’s 2023 report on metallurgical coal financing showed that Mizuho Financial provided US$ 13.7 billion in loans and underwriting to developers of new metallurgical coal between 2016 and 2022. Find further details on Mizuho Financial’s metallurgical coal financing and and how it compares to other large banks globally in the report.

Reclaim Finance tracks the metallurgical coal policies of financial institutions, including banks, in their Coal Policy Tool. BankTrack works closely with Reclaim Finance and endorses their policy assessments. Find further details on their assessment of Mizuho Financial’s metallurgical coal policy below.

According to a report by Reclaim Finance, between 2016 and June 2023, Mizuho Financial Group provided $9.8 billion in finance to the fossil-steel industry, making it the 8th largest financier worldwide. Find further details on Mizuho Financial's steel financing and how it compares to other large banks globally in the report.

Banks and Russian Aggression in Ukraine

BankTrack is keeping track of the public response of Mizuho Financial Group to Russia's illegal invasion of Ukraine. Mizuho Financial Group did not publicly condemn the war. Mizuho Financial Group is considered by Leave-Russia.org to be "continue operations" in Russia. We consider its exposure to Russia as limited, with over $2.87 billion of financial assets. Mizuho Financial Group supports the Russian fossil fuel industry through investments, loans and underwriting. For further details, see the table linked below.