Banks committed to net zero still funding North Sea oil expansion by Equinor

Natasha Ion, Climate Campaigner at BankTrack

Holly Duhig, Outreach executive at Uplift, +44 07360651711

Natasha Ion, Climate Campaigner at BankTrack

Holly Duhig, Outreach executive at Uplift, +44 07360651711

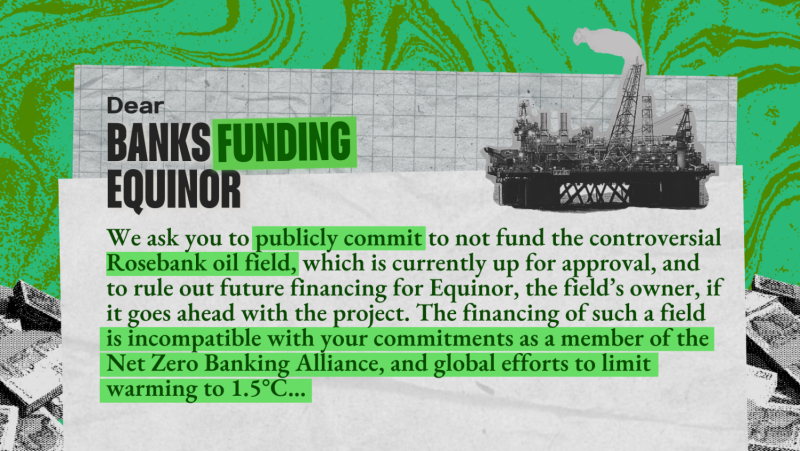

In a letter to 20 of Equinor’s financiers, including Barclays, JP Morgan and BNP Paribas, campaigners point out that funding the Rosebank oil field in the North Sea would be in breach of these banks’ commitment to limit warming to 1.5°C.

The letter was convened by BankTrack and Uplift and signed by over 60 organisations including Action Aid, Friends of the Earth and Greenpeace. It outlines how, due to Rosebank, banks’ financial relationship with Equinor risks being incompatible with their own climate commitments and exposing banks to significant reputational, legal, financial and other risks. The letter calls on the banks not to finance the project directly and to engage with Equinor and push the company to cease its development.

All 20 banks are members of the Net Zero Banking Alliance, which commits them to align their financing with the goals of the Paris Agreement. Rosebank is the largest undeveloped oil field in the North Sea, containing an estimated 500 million barrels of oil. The CO2 emissions from burning this oil would equate to more than the annual emissions of 28 low-income countries combined (1). Rosebank’s emissions would also see the UK oil and gas industry breach climate targets agreed with the government.(2)

From 2016-2022, these 20 banks provided at least US$ 16 billion in financing to Equinor via lending and underwriting. Santander, Barclays, JP Morgan and BNP Paribas alone have provided over US$ 6 billion.(3)

Maaike Beenes, Banks and Climate Campaign Lead at Banktrack, said: "The Rosebank field would be a dangerous step towards overshooting 1.5C of global warming, and by financing Equinor banks share responsibility. Any bank that is genuinely committed to a safe climate must engage with Equinor and cut ties with the company if it continues to develop the field."

Tessa Khan, executive director of Uplift, said: “So far, Equinor has shut its ears to the multiple warnings, from the UN Secretary-General, climate scientists and others, that there can be no expansion of oil if we’re to protect our children from catastrophic climate change. But money talks, and these banks need to join the growing chorus demanding that Equinor cease its plans to expand oil and gas drilling. Their climate commitments, if they have any integrity, bar them from funding Rosebank.”

Climate scientists, the International Energy Agency and others are clear that new oil and gas fields are incompatible with the world meeting its target of limiting warming to 1.5 degrees. This week, the UK government’s own advisors on climate change warned that the expansion of fossil fuel production is not in line with Net Zero.(4)

The UK government is expected to make a decision on Rosebank imminently.

Notes to editors

The letter to the banks and list of signatories is here.

-

World Bank, "CO2 emissions", 2020.

-

The Guardian, "New oilfield in the North Sea would blow the UK’s carbon budget", April 2023.

-

BankTrack, "Equinor company profile", June 2023.

-

Climate change committee, "2023 Progress Report to Parliament", June 2023