Global LNG fleet’s annual CO₂e emissions soar past 12 billion tonnes while orderbooks shrug off overcapacity warning

Antonette Tagnipez,

Communications Officer,

SFOC,

antonette.tagnipez@forourclimate.org

Antonette Tagnipez,

Communications Officer,

SFOC,

antonette.tagnipez@forourclimate.org

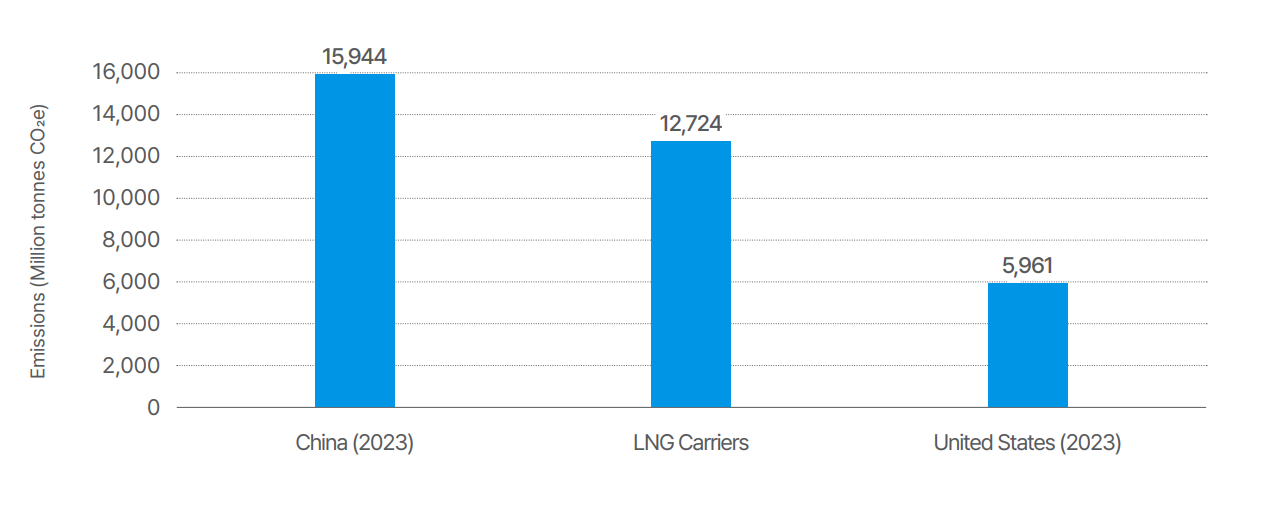

A new report by Solutions for Our Climate (SFOC) reveals that the global fleet of liquefied natural gas (LNG) carriers is responsible for enabling approximately 12.7 billion metric tonnes of carbon dioxide equivalent (CO₂e) emissions every year, rivaling China’s total annual emissions of 15.9 billion tonnes. The sector’s massive climate footprint is incompatible with the 1.5°C pathway, yet industry players continue to expand their fleets, hurtling towards an overcapacity crisis that threatens both global climate targets and financial stability.

Emissions cover-ups and methane leaks debunk “clean bridge fuel” claims

The estimated footprint attributed to LNG carriers covers both direct emissions from vessel operations and the far larger enabled emissions across the LNG lifecycle, including stages from extraction, liquefaction and maritime transportation to regasification and final combustion.

While shipping companies typically disclose operational emissions, they fail to report the much larger lifecycle emissions of the LNG they transport. This creates a significant accountability gap in global greenhouse gas (GHG) inventories.

Methane leakage accounts for a significant share of total LNG emissions yet remains a major blind spot in industry reporting. Methane, a GHG 80 times more potent than CO₂, can leak throughout the LNG lifecycle, from extraction and liquefaction to potential slips during maritime transport. The emissions from these leaks are widely underreported and undermine the industry’s longstanding claim that LNG is a cleaner “bridge fuel.” When overall emissions are fully accounted for, LNG, in fact, emits more CO₂ than coal.

The LNG carrier boom: driven by few, backed by billions

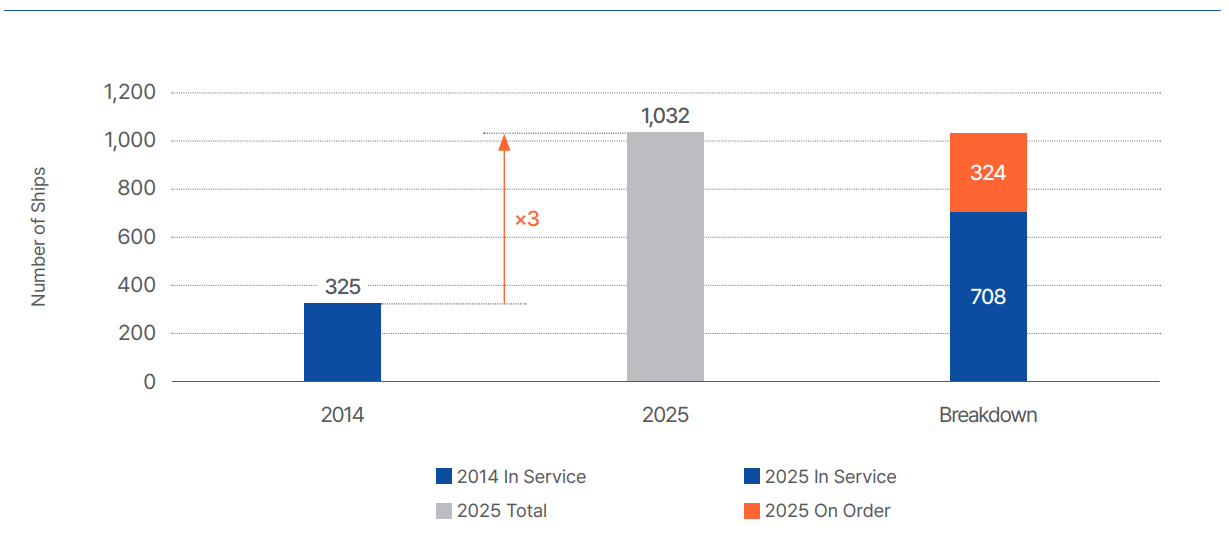

Despite growing climate concerns and slowing demand projections, the LNG shipping industry is rapidly expanding. The global fleet has tripled to 1,032 vessels since 2014, with an additional 324 under construction and expected to operate for at least 30 years. This surge in orders raises concerns about potential stranded assets and an oversaturated freight market.

Greece now leads in global LNG ship ownership with 195 carriers, enabling roughly 2.4 billion tonnes of CO₂ emissions annually through the LNG they transport. Japan and China follow with 175 and 112 carriers, respectively.

Qatar’s Nakilat remains the world’s largest LNG shipowner with 79 vessels, followed closely by Japan’s Mitsui O.S.K. Lines and NYK Lines, Greece’s Angelicoussis Group, and Norway’s Knutsen OAS Shipping. South Korean shipyards (Hanwha Ocean, Hyundai Heavy Industries, and Samsung Heavy Industries) are at the forefront of this building spree, responsible for the construction of nearly 80% of new LNG carriers.

Big banks and public institutions fueling LNG shipping expansion

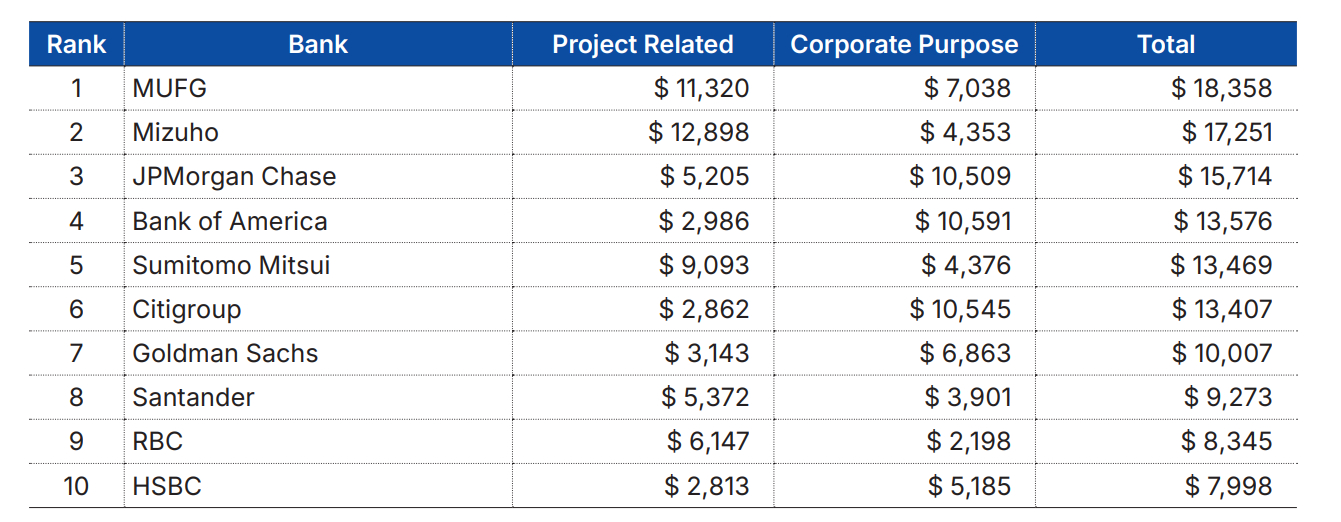

Over the past five years, US$335 billion has been funneled into LNG maritime financing through 175 transactions. Almost 40% of this amount has been funded by just 10 banks, including Mitsubishi UFJ, Mizuho, and JPMorgan Chase.

Strikingly, general-purpose corporate loans (US$65.6B) have surpassed project-specific financing, suggesting that LNG expansion is being propped up through unrestricted capital flows rather than strategic energy investments.

The South Korean government has emerged as a major public financier, with public support peaking at US$12 billion in 2022. Over the past decade, South Korea has provided US$44.1 billion in public support across 652 financing instances, raising questions about the credibility of its pledge to phase out fossil fuel subsidies and achieve carbon neutrality.

Rachel Eunbi Shin, SFOC Gas Team Consultant, said: “There’s a clear contradiction – major banks spending billions to finance LNG carriers while simultaneously pledging to reach net zero by 2050. Many of these same institutions have policies not funding upstream and downstream LNG facilities but still fund the ships that transport this fossil fuel. With freight rates at historic lows due to oversupply, building more LNG carriers isn’t just climate-destructive – it’s economically senseless. The International Maritime Organization just approved its Net-Zero Framework at MEPC 83 in April, mandating GHG reductions and fuel levies starting in 2028. The solution to reduce shipping emissions couldn’t be clearer: stop building ships we don’t need.”

This press release was first published by SFOC here.