Active

This profile is actively maintained

Active

This profile is actively maintained| Website | http://www.hsbc.com |

| Headquarters |

8 Canada Square

E14 5 HQ London

United Kingdom

|

| CEO/chair |

Georges Elhedery CEO |

| Supervisor | |

| Ownership |

listed on Bermuda Stock Exchange, Hong Kong Stock Exchange, London Stock Exchange & NYSE

HSBC Holdings' shareholder structure can be accessed here. |

Headquartered in London, HSBC is one of the largest banking and financial services institutions in the world. The HSBC Group is named after its founding member, The Hongkong and Shanghai Banking Corporation, which was established in 1865 to finance the growing trade between China and Europe. HSBC operates from around 6,100 offices in 72 countries and territories. The bank provides financial services including: personal financial services, commercial banking, corporate, investment banking and markets and private banking.

HSBC's most important sustainability commitments can be found at the website sections listed below.

HSBC is linked to a number of companies and projects that BankTrack considers controversial (so called Dodgy Deals), e.g. as a current or past financier or through an expression of interest. The profiles below provide more details on the nature of HSBC's link to these deals.

The power of finance to slow new coal plants

Revealed: HSBC is funding forest destruction

HSBC does not operate a complaints or grievances channel for individuals and communities that may be adversely affected by its finance. However, customers can contact the bank at sustainable.finance@hsbc.com whereas other stakeholders may raise complaints via the OECD National Contact Points (see OECD Watch guidance).

Furthermore, HSBC is a member of the Roundtable on Sustainable Palm Oil (RSPO), which operates a grievance mechanism to address violations of its standards, including concerns about human rights abuses in the palm oil industry. Affected communities can access this mechanism here.

HSBC is also an Equator Principles signatory. While the Equator Principles have no official grievance mechanism, complaints relating to this bank's financing of Equator Principles projects can be filed through our own website www.equator-complaints.org.

This page evaluates HSBC's responses to instances of alleged human rights violations linked to its finance, raised by civil society organisations. It is not intended to be exhaustive, but covers selected impacts raised by BankTrack and other civil society partners since 2016. For the full scoring methodology, see here. For more information about BankTrack's evaluation of bank responses to human rights impacts, see the 2021 report "Actions speak louder: assessing bank responses to human rights violations".

Following the bank's response: The bank has not provided details on how it monitored the progress of specific companies or how the bank monitored the impact on rights-holders involved in raising the issue with the bank of its own action of updating the Agriculture sector policy. Therefore, the score remains unchanged.

The bank initially responded without commenting on the project.

Following the bank's response: As indicated in the bank's feedback, it later confirmed that it is not involved in the financing for the project. It did not comment on or respond to the substance of the issues raised, therefore it receives a half score.

No information available on whether the bank engaged with its client or took appropriate action.

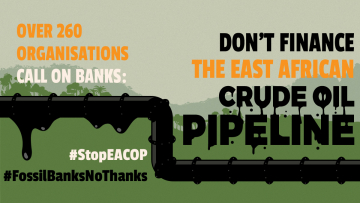

Following the bank's response: The bank confirmed that it is not involved in financing for the project; however, the bank remains exposed to TotalEnergies, the project developer, and it has not (yet) set out specific actions that it requires (or will require) the company to take to address the impacts raised.

Banks and Climate

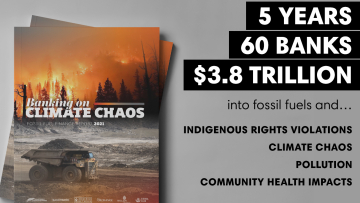

The 2025 Banking on Climate Chaos report showed that HSBC provided $67.5 bn in financing to the fossil fuel industry between 2021 and 2024. In 2024 only, HSBC provided $16.2 bn, including $7.6 bn for oil, gas and coal companies expanding fossil fuels. HSBC was one of the 20 largest fossil fuel financiers in 2024. Find further details on HSBC's fossil fuel portfolio and how it compares to other large banks globally on the Banking on Climate Chaos website below.

Partner organisation Reclaim Finance tracks the coal, oil and gas policies of financial institutions, including banks, in their Coal Policy Tool (CPT) and the Oil and Gas Policy Tracker (OGPT). BankTrack works closely with Reclaim Finance and endorses their policy assessments. Find further details on their assessment of HSBC's fossil fuel policy below.

False Solutions Tracker expansion

The purpose of the False Solutions Tracker is to give a clear overview of energy technologies that fall under banks' individual sustainable finance commitments. The tracker lists 11 energy technologies that are usually associated with the energy transition and the decarbonisation of the economy. These technologies are defined here and classified in three categories:

-

Real solutions: Technologies that deliver on a Just Transition towards Energy Democracy. BankTrack considers these technologies as real solutions only if and when they do deliver Energy Democracy.

-

Solutions under strict conditions: Energy technologies that could be real solutions if they deliver on a Just Transition towards Energy Democracy but that could also be false solutions. This is the case of hydrogen and hydropower. On one hand, fossil-free and green hydrogen could be a real solution under certain conditions. However, fossil-based hydrogen and nuclear hydrogen are always false solutions. On the other hand, hydropower lifespan extension could also be a real solution under strict conditions while hydropower expansion is a false solution.

-

False solutions: Energy technologies that are not aligned with a just transition towards Energy Democracy, such as solid biomass, biofuels and carbon capture, utilisation and storage (CCUS).

For each one of the 11 energy technologies, the tracker indicates if it is included in bank's individual sustainable finance commitments:

For Real solutions:

- : Yes, the bank includes its finance towards this energy technology in its sustainable finance reporting.

- : Yes, the bank includes its finance towards this energy technology in its sustainable finance reporting, but under certain conditions. In this case, those conditions are mentioned in the "relevant policy document" section for each bank.

- : No, the bank does not include its finance towards this energy technology in its sustainable finance reporting.

- : It is unclear whether the bank includes or not its finance towards this energy technology in its sustainable finance reporting.

For solutions under strict conditions and for false solutions:

- : Yes, the bank includes its finance towards this energy technology in its sustainable finance reporting.

- : Yes, the bank includes its finance towards this energy technology in its sustainable finance reporting, but under certain conditions. In this case, those conditions are mentioned in the "relevant policy document" section for each bank.

- : No, the bank does not include its finance towards this energy technology in its sustainable finance reporting.

- : It is unclear whether the bank includes or not its finance towards this energy technology in its sustainable finance reporting.

Banks and Human Rights

BankTrack assessed HSBC in its 2024 Global Human Rights Benchmark, where it achieved 7 points out of 15 and was ranked as a “follower”.

The bank scored 0.5 out of 3 points on the new “specific rights indicators”, which assess how banks address human rights defenders, Indigenous Peoples’ right to Free, Prior and Informed Consent and environmental rights in their policies and practices.

In addition, HSBC scored 0.08 out of 3 on how it responds to alleged human rights violations linked to its finance, which were raised by civil society organisations. More information is detailed in the “Accountability” section of this profile.

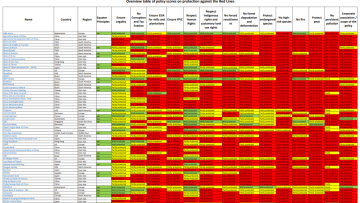

The table below shows BankTrack's assessment of how HSBC has implemented the UN Guiding Principles on Business and Human Rights. Please click on 'expand all details' and 'explanation' for further information on the methodology.

Our policy assessments are always a work in progress. We very much welcome any feedback, especially from banks included in the assessments. Please get in touch at humanrights@banktrack.org.

Global Human Rights Benchmark 2022

Global Human Rights Benchmark 2024

Banks and Nature

HSBC’s policies for forest-risk sectors (beef, soy, palm oil, pulp and paper, rubber and timber) have been assessed by the Forests & Finance coalition, achieving an overall score of 4.3 out of 10 and ranking it as a front runner. HSBC achieved a score of 3.9 out of 10 specifically for its policies related to the beef sector and 6.9 out of 10 for its policies related to the palm oil sector. In addition, BankTrack and the Environmental Paper Network have assessed HSBC’s policies related to the pulp and paper sector.

Between 2016 and 2022, HSBC provided USD 7,907 million in credit to companies operating in these forest-risk sectors and held investments amounting to USD 66 million as of 2022.

BankTrack has also assessed HSBC’s policies related to the wood biomass sector and found that while it does mention biomass in its policy, it refers to it as a source of renewable energy and does not exclude it from finance. For more information, see the links below.

Forest & Finance Policy Assessment 2022: Overall scores

A bank can obtain a total of 10 points for the quality of its policies. The total score is based on their scores per sector, weighted against their financing and investment for each sector. For further details on this see here. Based on their overall score, banks are then classified as Laggards, Followers, Front runners or Leaders, as follows:

Forest & Finance Policy Assessment 2022: Beef

A bank can obtain a total of 10 points for the quality of its beef policy. The total score is based on their scores per sector, weighted against their financing and investment for each sector. For further details on this see here. Based on their overall score, banks are then classified as Laggards, Followers, Front runners or Leaders, as follows:

Forest & Finance Policy Assessment 2022: Palm Oil

A bank can obtain a total of 10 points for the quality of its palm oil policy. The total score is based on their scores per sector, weighted against their financing and investment for each sector. For further details on this see here. Based on their overall score, banks are then classified as Laggards, Followers, Front runners or Leaders, as follows:

Tracking the Net Zero Banking Alliance

HSBC left the Net Zero Banking Alliance (NZBA) on 11 July 2025. Before that, as a NZBA member it had committed to reduce its financed emissions to net zero by 2050; within 18 months of joining the alliance set interim targets for 2030 (or sooner) for high emission priority sectors, and within 36 months set further sector targets; set new intermediary targets every 5 years from 2030 onwards; annually publish data on emissions and progress against a transition strategy including climate-related sectoral policies; and take a robust approach to the role of offsets in transition plans. BankTrack will keep track of HSBC and other ex-NZBA member banks' climate action.

Banks and Steel

As part of the Net Zero Banking Alliance (NZBA), HSBC is required to set interim targets for 2030 for high emission priority sectors. For HSBC, this includes its lending to the steel sector. You can see HSBC’s iron and steel decarbonisation targets, and its progress towards meeting them in our NZBA steel targets compliance tracker:

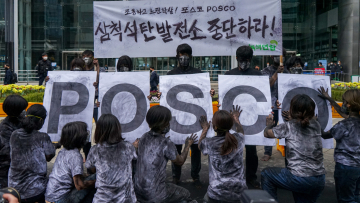

Partner organisation Reclaim Finance’s 2023 report on metallurgical coal financing showed that HSBC provided US$ 3.2 billion in loans and underwriting to developers of new metallurgical coal between 2016 and 2022. Find further details on HSBC’s metallurgical coal financing and and how it compares to other large banks globally in the report.

Reclaim Finance tracks the metallurgical coal policies of financial institutions, including banks, in their Coal Policy Tool. BankTrack works closely with Reclaim Finance and endorses their policy assessments. Find further details on their assessment of HSBC’s metallurgical coal policy below.

According to a report by Reclaim Finance, between 2016 and June 2023, HSBC provided $4 billion in finance to the fossil-steel industry, making it the 37th largest financier worldwide. Find further details on HSBC's steel financing and how it compares to other large banks globally in the report.

Banks and Russian Aggression in Ukraine

BankTrack is keeping track of the public response of HSBC to Russia's illegal invasion of Ukraine. HSBC's public position on the war is unclear. HSBC is considered by Leave-Russia.org to be "withdrawing" its operations in Russia. We consider its exposure to Russia as limited. HSBC supports the Russian fossil fuel industry through investments, loans and underwriting. For further details, see the table linked below.