As the world chokes in plastic, banks continue to finance plastic production

Profundo, Jan Willem van Gelder, +31 (0)6 12 79 21 39

BankTrack, Johan Frijns, +31 (0)6 12 42 16 67

Plastic Soup Foundation, Jeroen Dagevos, +31 (0)6 468 378 86

Profundo, Jan Willem van Gelder, +31 (0)6 12 79 21 39

BankTrack, Johan Frijns, +31 (0)6 12 42 16 67

Plastic Soup Foundation, Jeroen Dagevos, +31 (0)6 468 378 86

Most commercial banks are blind to the risks associated with financing companies in the plastic supply chain, in particular the detrimental impact of plastic on climate, nature, human health and communities. As a result, very few banks have policies in place to effectively deal with these risks, let alone exclude finance for the plastics industry altogether.

This is the main conclusion from a first assessment of bank policies on plastic conducted by the Plastic Banks Tracker, an initiative from Profundo, BankTrack and the Plastic Soup Foundation, aimed at exposing the role of commercial banks in financing the plastics life cycle: from polymer producers via the food industry and retail companies to the waste management sector. (1)

Assessment of commitment, policies and implementation

This first assessment covered twenty of the biggest banks that play a prominent role in financing companies in the global plastics lifecycle, including some banks that participate in the UNEP Finance Leadership Group on Plastics. (2) Our methodology assesses three different phases a bank must go through to properly finance the plastics transition: Acknowledgement of their role in perpetuating the plastics crisis and Commitment to be part of the solution; Policy development (‘Policies’) to guide their financing decisions, and Implementation of these policies through screening, engagement with clients and providing attractive financing conditions for alternatives. Based on their scoring for these phases, banks are then categorized on a laggards to leaders scale.

Most banks are laggards

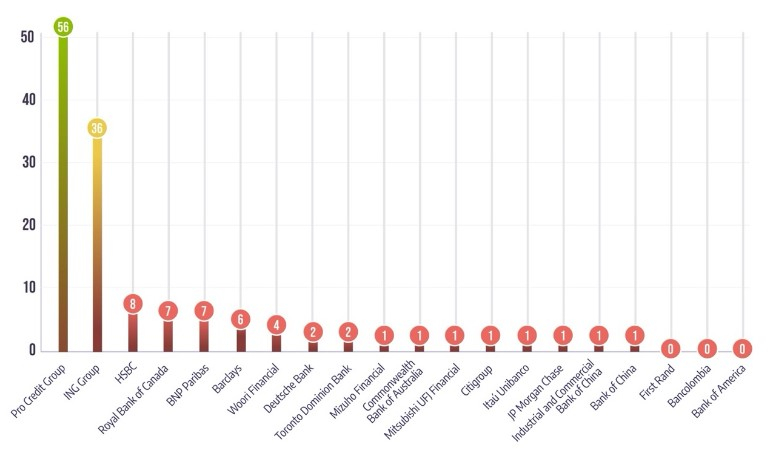

A new website published today, www.plasticbankstracker.org, shows that, of the twenty banks investigated, none of them can be considered a leader. Only two banks score reasonably well on Acknowledgement and Commitment. As a result, Germany based ProCredit qualifies in our ranking as a moderate achiever, while Dutch banking group ING is seen as a follower.

Disappointingly, the other 18 banks rank as laggards. Some of these banks, such as Mitsubishi UFJ, Barclays and BNP Paribas, do have relevant policies in place on for instance climate change, nature protection, or health and communities. However, because they lack proper acknowledgement and commitment related to the plastics crisis, they cannot be expected to strictly implement these policies in their financing relationships with companies in the plastics lifecycle.

Based in on the Plastic Banks Tracker methodology, all banks received a score on a scale from 0-100.

Jan Willem van Gelder, Director of Profundo, which conducted the research, commented: “It is striking to see that so many banks heavily exposed to companies in the plastics life cycle fail to acknowledge the severity of the plastics crisis and their own specific responsibility for it. While most banks have high-level policies on health, human rights and climate change, these will not help solving the plastics crisis as long as they do not commit to prioritize implementation of these policies with their clients in the plastics lifecycle.”

Maria Westerbos, Director of the Plastic Soup Foundation: “The research reveals there is a total lack of urgency in the banking sector to deal with the current global plastic crisis. The current plastic production of 500 million tons a year is out of control; we eat, drink and breathe plastic, and scientists found plastic in our blood and recently even in our brains. The projections show plastic production will triple in the next decades if no serious measures are taken. As the financiers of this system, banks can play a crucial role in changing the direction of plastic production."

Johan Frijns, Director of BankTrack, further commented: “The ever-increasing production and consumption of plastics is widely seen as a major environmental and human health crisis, for which at some point not only plastic producers but also their financiers will be held accountable. Banks must understand that being perceived as a ‘Plastic Bank’, bankrolling plastics production, carries the same severe reputational risk as financing the continued exploration of fossil fuels as a ‘Fossil Bank’. Banks must disentangle themselves from these two strongly connected industries and instead focus on financing the energy and plastics transition.”

Notes:

(1) The Plastic Banks Tracker (www.plasticbankstracker.org) is an initiative from Profundo, BankTrack and the Plastic Soup Foundation. It is open for other civil society organizations to join. The Plastic Banks Tracker seeks to encourage commercial banks to support a global transition away from unbridled and toxic plastics production, towards sustainable utilization, and effective waste management. It seeks banks to acknowledge the problem of ever-expanding plastic production and use, and their own specific role in creating this crisis; to commit to shift financing away from further plastics production, and to use their leverage over clients to move towards a production cycle based on reduce, reuse and recycle.

The tracker covers the following 20 banks:

* Bancolombia (Colombia)

* Bank of America (USA)

* Bank of China

* Barclays (UK)

* BNP Paribas (France)

* Citigroup (USA)

* Commonwealth Bank of Australia

* Deutsche Bank (Germany)

* FirstRand (South Africa)

* HSBC (UK)

* Industrial and Commercial Bank of China

* ING Group (Netherlands)

* Itaú Unibanco (Brazil)

* JPMorgan Chase (USA)

* Mitsubishi UFJ Financial (Japan)

* Mizuho Financial (Japan)

* ProCredit Group (Germany)

* Royal Bank of Canada

* Toronto-Dominion Bank (Canada)

* Woori Financial (South Korea)