Banks and meat

The industrial meat industry has far-reaching nature, climate and human rights impacts as well as concerning links to an increased risk of future pandemics. Since 1970, the Earth has lost half of its wildlife but tripled its livestock population. Intensive meat and dairy production has widespread and known links to deforestation and land degradation across some of the world’s most vulnerable ecosystems. Beef production alone is the top driver of deforestation in the world’s tropical forests and drives conversion of non-forest landscapes such as grasslands and savannahs. On top of this, around 80% of the world’s soybean production is used to feed animals to produce meat and dairy products, with soybean production being the second biggest driver of tropical deforestation. Halting and reversing deforestation in natural ecosystems such as the Amazon is of extreme urgency, but research shows that, as of 2020, some 57 million hectares, which is roughly 10%, of the Brazilian Amazon is now under cattle ranching. Livestock is also the most significant contributor to nitrogen and phosphorus pollution of streams, rivers and coastal waters worldwide.

In addition to its nature impacts, the industrial meat sector’s impact on the climate is staggering. Recent research by the UNEP and the IPCC has shown that, in addition to cutting carbon dioxide emissions, drastically reducing methane emissions is the best way to rapidly avert the climate crisis and limit global warming to 1.5°C. Although methane only stays in the atmosphere for around nine years, it has a warming impact 84 times that of CO2 over a 20-year period and is responsible for almost a quarter of global warming. It also means that cutting methane emissions now can rapidly reduce the rate of warming in the near-term. The livestock sector alone is responsible for 32% of all human caused methane emissions and, if current trends continue, the global meat and dairy industry will account for almost half the world’s 1.5°C emissions budget by 2030. Therefore, an urgent shift to restrict and reverse the growth of industrial livestock is essential to avert the climate crisis.

Furthermore, scientists have warned that intensive livestock farming leads to an increased risk for the development of zoonotic diseases. This is directly caused by the growing demand for affordable meat, which leads to cheaper and less controlled agricultural and farming practices. This results in zoonotic diseases - such as bird flu - that spread more easily under intensive agricultural practices and tightly packed farms. Deforestation and agricultural system change are both considered significant factors in the emergence of zoonotic and vector-borne diseases. In addition, The World Health Organisation has stated that the overuse of antibiotics for livestock is considered one of the biggest current threats to global health, food security, and development.

Finally, the industrial meat industry continues to violate and abuse the rights of Indigenous and local communities, and workers, along the production chain. An investigation by Greenpeace Brazil showed that security forces working for a major soya producer in Brazil harassed, detained, abducted and shot members of the traditional geraizeira communities. Cattle farming is the main driver of illegal land seizures on Reserves and Indigenous Territories in the Brazilian Amazon. Mongabay has documented how violent displacement and killings of indigenous peoples in Nicaragua have been committed in pursuit of grazing cattle on deforested land. Additionally, evidence of worker exploitation including modern slavery and child labour has been found throughout the industry, particularly in Brazilian and Paraguayan bovin stockbreeding, and in meatpacking plants globally.

Role of banks

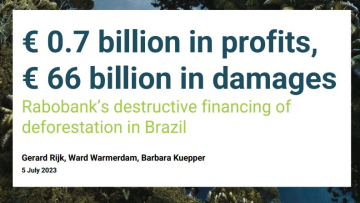

According to Portfolio Earth, in 2019, the largest fifty financial institutions in the world provided more than US$ 380 billion of finance to the food sector, including activities related to agriculture, fisheries and aquaculture. This sector was identified as one of the largest drivers of global biodiversity loss and 20% of the finance provided to the sector was associated with direct impacts on biodiversity, particularly in areas including farming. In 2022, the Forests & Finance coalition – of which BankTrack is a part – published an updated analysis of finance provided to the beef sector and found that, since 2016, over US$67 billion has been provided to the Brazilian beef sector. This includes finance to some of the biggest and baddest companies like JBS, Minerva and Marfrig.

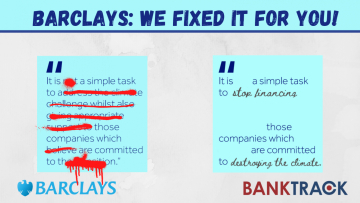

Despite providing large amounts of finance to the industrial meat sector, in particular for beef production, financial institutions’ policies are not robust enough to meet key environmental, social and governance criteria, as found by the Forest & Finance coalition. In its policy analysis of 200 financial institutions, scores awarded for the beef sector were the worst across all the criteria assessed. You can see more details about individual bank policy scores in the Policy Analysis section below.

Read more about the role of banks in curbing the expansion of industrial beef production in our blog: Our nature and climate demand a reduction of industrial beef production, but banks missed the memo

The Forest & Finance coalition, of which BankTrack is a part, assess the policies of 200 of the largest banks and investors active in six key commodities sectors driving deforestation and land degradation in Southeast Asia, Central and West Africa, and parts of Latin America.

The table below presents the analysis of commercial and development bank’s policies related to beef. For a summary of the compiled policy assessments and for the details on the scoring criteria, check the Forests & Finance website here.

Forest & Finance Policy Assessment 2022: Beef

A bank can obtain a total of 10 points for the quality of its beef policy. The total score is based on their scores per sector, weighted against their financing and investment for each sector. For further details on this see here. Based on their overall score, banks are then classified as Laggards, Followers, Front runners or Leaders, as follows: