Company – On record

This profile is no longer actively maintained, with the information now possibly out of dateBankTrack

Company – On record

This profile is no longer actively maintained, with the information now possibly out of dateBankTrack

Why this profile?

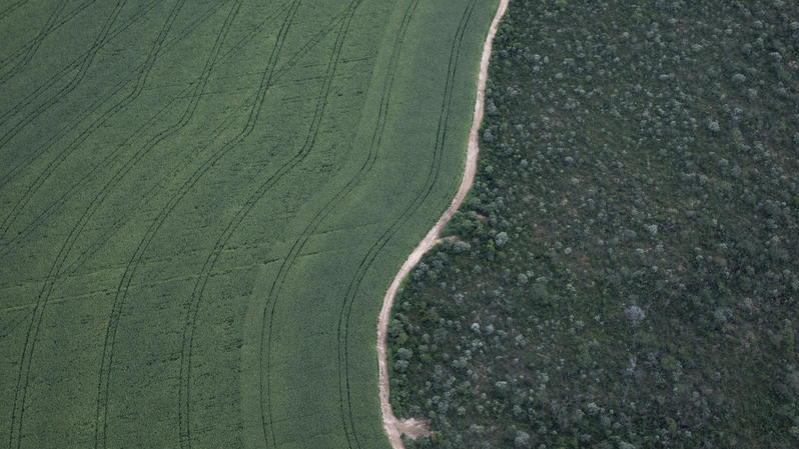

BrasilAgro’s strategy relies on the price appreciation of allegedly underutilised rural properties by transforming land into pastures or cultivations of profitable crops such as grains or sugarcane. This drives land degradation and widespread deforestation in the Brazilian Cerrado and Paraguay’s Chaco region where the company operates. This has also impacted communities that live on or nearby the purchased lands, including through water pollution and cases of land grabbing.

What must happen

Banks should not renew or take on new financing agreements with BrasilAgro until and unless it fully eliminates deforestation and land rights abuses from its entire supply chain. Where engagement with the company does not bring about these results in a timely manner, financial institutions must divest or suspend any existing financial agreements.

| Sectors | Industrial Livestock Production , Commodities Trading |

| Headquarters |

|

| Ownership |

listed on NYSE

Argentinian agricultural company CRESUD S.A.C.I.F. is the main shareholder (38.25%), alongside Charles River Capital (7.54%), Elie Horn (5.93%) and the Brazilian Treasury (3.49%). More information can be found here. |

| Subsidiaries |

Engenho de Maracajú Ltda – Luxembourg (profile)

Ceibo Ltda – Brazil Imobiliária Araucária Ltda – Brazil Imobiliária Cajueiro Ltda – Brazil Imobiliária Cremaq Ltda – Brazil Imobiliária Flamboyant Ltda – Brazil Imobiliária Jaborandi Ltda. – Brazil Mogno Ltda – Brazil |

| Website | https://ri.brasil-agro.com/en/ |

BrasilAgro is a Brazilian real estate firm focused on acquiring, developing and selling land suitable for agriculture. It owns or leases 11 large scale farms, ten of which are situated in the Brazilian Cerrado and one in Paraguay’s Chaco region. The company’s core business consists of clearing native vegetation and adding “high-value-added crops” in order to resell the land as productive agricultural plots. In addition, BrasilAgro produces soy, sugarcane, corn and livestock. Bunge, Cargill and Brenco/ETH Bioenergia are among its main clients.

Impact on human rights and communities

BrasilAgro’s operations have repeatedly caused conflict with communities who lived on or nearby the purchased lands. Near the Fazenda Chaparral, in Correntina municipality, the Capão do Modesto community live in precarious conditions after having been evicted from its original homeland, purchased by BrasilAgro to be developed into a more “productive asset”. As a consequence, the traditional small-scale rice and fruit farms owned by the Capão do Modesto community had to be abandoned. Their struggle is further documented in a report by Global Witness, which names Bunge and Cargill (both among BrasilAgro’s main clients) as major contributors to such abuses. Within the farm, BrasilAgro cleared 12,672 ha of native vegetation between 2012 and 2017 and caused desertification in the area by draining the water table for irrigation purposes. In 2017, the Chaparral and Jatobá farms were occupied by farmers who disrupted their irrigation systems, while a year later protests erupted over water shortages in the area. Tensions rose again in 2022, when armed groups were reported around Correntina, putting pressure on communities to leave the area. Although the company may not be directly involved in such threats, it motivates them by being willing to invest in inhabited land in the Cerrado.

In 2011, BrasilAgro’s operations on Fazenda Parceria II caused landslides in the municipality of Ribeiro Gonçalves and polluted streams with pesticides and oil from harvesting machinery which resulted in local farmers’ cattle getting sick. According to Brazilian law, 200 metres of native vegetation between the farm and the downhill that separates it from nearby municipalities should have been preserved to hold back sand and filter rainwater, but BrasilAgro did not comply. The company eventually pledged to restore the forested belt as well as to indemnify affected families, but there is no evidence to suggest that this happened.

Impact on climate

Thanks to its complex ecosystem, the Cerrado is an important carbon stock on the global scale, storing around 13.7 billion tonnes of CO2, most of which is hidden in its soil and deep roots. However, the Cerrado receives far less public attention than the Amazon ecosystem, and even weaker regulations allow for destructive land practices. About 250 million tonnes of CO2 are already emitted by the Brazilian savanna annually, while up to 8.5 billion could be released by further land transformation. Wildfires are more frequent in recently deforested areas, and the use of fire for land clearing further contributes to global CO2 emissions. BrasilAgro plays a major role in these processes, as fire and land clearance are used on its farms to open space for profitable cash crops.

Impact on nature and environment

Most of BrasilAgro’s farms are situated in the Matopiba region, a border area between the Maranhão, Tocantins, Piauí and Bahia states which hosts most of the Cerrado’s remaining biodiversity. The Cerrado is a biodiversity hotspot, with more than 1600 identified species of mammals, birds and reptiles. Its flora and roots network act as a sponge, retaining water even in the driest months and feeding three large underground water deposits which supply the whole country and regulate all the big rivers in the country. However, gradual destruction for agriculture and cattle raising since the 1970s has left only 20% of its original vegetation intact. Unless action is taken, the whole area will face severe plant extinction and biodiversity collapse.

BrasilAgro is directly responsible for widespread deforestation of native vegetation in the endangered Cerrado ecosystem. The company has been operating the same business model of acquiring land and clearing it of native vegetation since 2006. In 2021, ten of the municipalities with the highest deforestation rates in the Cerrado were to be found in the regions where BrasilAgro has its operations. Chain Reaction Research found that BrasilAgro deforested 21,690 ha of Cerrado vegetation between 2012 and 2017 and an additional 1,194 ha in Fazenda Chaparral in 2018. This number is thought to be an underestimation of its total impact. In 2022, it was reported that BrasilAgro has plans to convert at least 10,000 ha of Cerrado native vegetation for livestock and grain production, which include the drilling of several large-capacity wells, in Fazenda Novo Buriti, located in the Bonito de Minas municipality in the northern part of Minas Gerais. If these plans go ahead it will threaten the bordering Veredas do Peruaçu State Park.

About 90% of deforestation in Brazil is illegal, and most of it is carried out to make space for agriculture. In 2013, BrasilAgro was fined BRL 5.9 million (US$ 1.1 million) by the government's environmental protection agency, IBAMA, for illegal deforestation within a protected area in the Goiás state. The Fazenda Araucária owned by BrasilAgro, in the municipality of Mineiros, is located on the edge of the Emas National Park, a UNESCO World Heritage Site long threatened by illegal logging.

Impact on pandemics

Habitat loss constitutes a particularly high risk for the emergence of zoonotic diseases. Deforestation and fires used to clear land for agriculture set animals on the move to find new livable habitats. They relocate, bringing along pathogens that risk spilling over to other species, including humans. A 2018 study found there could be as many as 1.7 million undiscovered viruses in mammals and birds, of which up to 827,000 could have the ability to infect people. In Brazil, the recent emergence of hantaviruses, among others, has been a clear warning of the dangers of the expansion of anthropogenic activities in the rainforest. By clearing native vegetation in the Cerrado, BrasilAgro contributes to blurring the line between animal and human areas, increasing the risk of a new zoonotic epidemic.

Other impacts

BrasilAgro has set up opaque and illegal structures to evade tax and land ownership laws in Brazil. The ownership of land by companies which are majority-owned by foreign individuals or entities is restricted in Brazil (despite loopholes created by the Bolsonaro administration). BrasilAgro is co-owned by the Argentinian group Cresud (its largest shareholder with a 38.25% stake) and other foreign investors, including the British Autonomy Capital and the Bank of New York, which raises questions about the legitimacy of its land properties. To avoid the issue, BrasilAgro operates several wholly-owned subsidiary companies, involved in the purchase and sale of land, buildings and real estate properties. The subsidiaries operate through their own national registry number (CNPJs), an illegal practice which makes it harder for the Tax Authorities to enquire and prove their links to foreign investors. The National Institute of Colonisation and Agrarian Reform (INCRA) opened an investigation in May 2016, which is still ongoing, accusing BrasilAgro of having bought land without its authorization, necessary for foreign investors.

2021

2021-08-06 00:00:00 | Debt deal with deforester BrasilAgro puts UBS’s green commitment in question

UBS has financed controversial land developer BrasilAgro with a bond issuance that raised $45.5 million. This calls into question the Swiss bank’s sustainability rhetoric, as BrasilAgro has been linked to deforestation, loss of groundwater, and the expulsion of local communities in the Brazilian Cerrado.