Active

This profile is actively maintained

Active

This profile is actively maintained| Website | http://www.dzbank.com/ |

| Headquarters |

Platz der Republik

60265 Frankfurt am Main Hessen

Germany

|

| CEO/chair |

Cornelius Riese CEO |

| Supervisor | |

| Ownership |

DZ BANK is the central institution of the Volksbanken Raiffeisenbanken Cooperative Financial Network and the central bank for more than 700 cooperative banks in Germany, in which it holds a majority interest. |

DZ Bank, founded in 2001, is the second largest bank in Germany by assets, and acts as the central banking institution for more than 700 cooperative banks. It is part of the Volksbanken Raiffeisenbanken co-operative network, one of Germany's largest private sector financial institutions. In this network DZ Bank functions as a central institution. The DZ Bank Group includes DVB Bank, a transportation finance bank; Bausparkasse Schwäbisch Hall, a building society; DG HYP, a provider of real estate finance; DZ PRIVATBANK Gruppe; R+V Versicherung, an insurance company; TeamBank, a provider of consumer finance; Union Investment Group, an asset management company; VR LEASING; and other institutions.

DZ Bank's most important sustainability commitments can be found at the website sections listed below.

Links

DZ Bank is linked to a number of companies and projects that BankTrack considers controversial (so called Dodgy Deals), e.g. as a current or past financier or through an expression of interest. The profiles below provide more details on the nature of DZ Bank's link to these deals.

DZ Bank has not established any complaints or grievance mechanisms able to address human rights concerns and open to individual and communities who might be adversely affected by its financing activities. It is however possible to lodge a complaint with the OECD National Contact point (see OECD Watch Guidance).

DZ Bank is an Equator Principles signatory. While the Equator Principles have no official grievance mechanism, complaints relating to this bank's financing of Equator Principles projects can be filed through our own website www.equator-complaints.org.

This page evaluates DZ Bank's responses to instances of alleged human rights violations linked to its finance, raised by civil society organisations. It is not intended to be exhaustive, but covers selected impacts raised by BankTrack and other civil society partners since 2016. For the full scoring methodology, see here. For more information about BankTrack's evaluation of bank responses to human rights impacts, see the 2021 report "Actions speak louder: assessing bank responses to human rights violations".

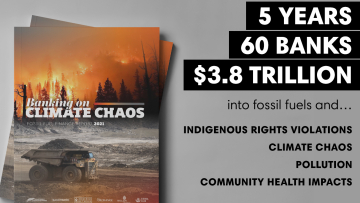

Banks and Climate

The 2025 Banking on Climate Chaos report showed that DZ Bank provided $6.6 bn in financing to the fossil fuel industry between 2021 and 2024. In 2024 only, DZ Bank provided $1.3 bn, including $318 mn for oil, gas and coal companies expanding fossil fuels. Find further details on DZ Bank's fossil fuel portfolio and how it compares to other large banks globally on the Banking on Climate Chaos website below.

Partner organisation Reclaim Finance tracks the coal, oil and gas policies of financial institutions, including banks, in their Coal Policy Tool (CPT) and the Oil and Gas Policy Tracker (OGPT). BankTrack works closely with Reclaim Finance and endorses their policy assessments. Find further details on their assessment of DZ Bank’s fossil fuel policy below.

Banks and Human Rights

BankTrack assessed DZ Bank in its 2024 Global Human Rights Benchmark, where it achieved 4 points out of 15 and was ranked as a “follower”.

The bank scored 0 out of 3 points on the new “specific rights indicators”, which assess how banks address human rights defenders, Indigenous Peoples’ right to Free, Prior and Informed Consent and environmental rights in their policies and practices.

In addition, DZ Bank scored 0.38 out of 3 on how it responds to alleged human rights violations linked to its finance, which were raised by civil society organisations. More information is detailed in the "Accountability" section of this profile.

The table below shows BankTrack's assessment of how DZ Bank has implemented the UN Guiding Principles on Business and Human Rights. Please click on 'expand all details' and 'explanation' for further information on the methodology.

Our policy assessments are always a work in progress. We very much welcome any feedback, especially from banks included in the assessments. Please get in touch at humanrights@banktrack.org.

Global Human Rights Benchmark 2022

Global Human Rights Benchmark 2024

Banks and Nature

Forest & Finance Policy Assessment 2022: Overall scores

A bank can obtain a total of 10 points for the quality of its policies. The total score is based on their scores per sector, weighted against their financing and investment for each sector. For further details on this see here. Based on their overall score, banks are then classified as Laggards, Followers, Front runners or Leaders, as follows:

Forest & Finance Policy Assessment 2022: Beef

A bank can obtain a total of 10 points for the quality of its beef policy. The total score is based on their scores per sector, weighted against their financing and investment for each sector. For further details on this see here. Based on their overall score, banks are then classified as Laggards, Followers, Front runners or Leaders, as follows:

Forest & Finance Policy Assessment 2022: Palm Oil

A bank can obtain a total of 10 points for the quality of its palm oil policy. The total score is based on their scores per sector, weighted against their financing and investment for each sector. For further details on this see here. Based on their overall score, banks are then classified as Laggards, Followers, Front runners or Leaders, as follows:

Banks and Steel

Partner organisation Reclaim Finance’s 2023 report on metallurgical coal financing showed that DZ Bank provided US$ 1.2 billion in loans and underwriting to developers of new metallurgical coal between 2016 and 2022. Find further details on DZ Bank’s metallurgical coal financing and and how it compares to other large banks globally in the report.

Reclaim Finance tracks the metallurgical coal policies of financial institutions, including banks, in their Coal Policy Tool. BankTrack works closely with Reclaim Finance and endorses their policy assessments. Find further details on their assessment of DZ Bank’s metallurgical coal policy below.