Banks fall for ArcelorMittal’s shiny claims and finance its dirty flames

Yesterday, on the eve of the Olympic torch arriving in Marseille, community defenders from Liberia, South Africa, Brazil, and Mexico held their very own torch ceremony with local residents of Fos-sur-Mer in front of ArcelorMittal’s enormous coal-fired steel plant in Southern France. Instead of the pristine shiny “low carbon steel” Olympic torch which has been manufactured by ArcelorMittal for the Paris 2024 games, the crooked torch bellowed dark smoke. Not an uncommon sight for the people of Fos-sur-Mer, where dust and smoke regularly tumble out of ArcelorMittal’s chimneys, and into the lungs of local residents.

Looking at ArcelorMittal’s impacts on communities and climate around the world, it’s hard to dispute that the sooty black torch is a more accurate symbol of the company's legacy.

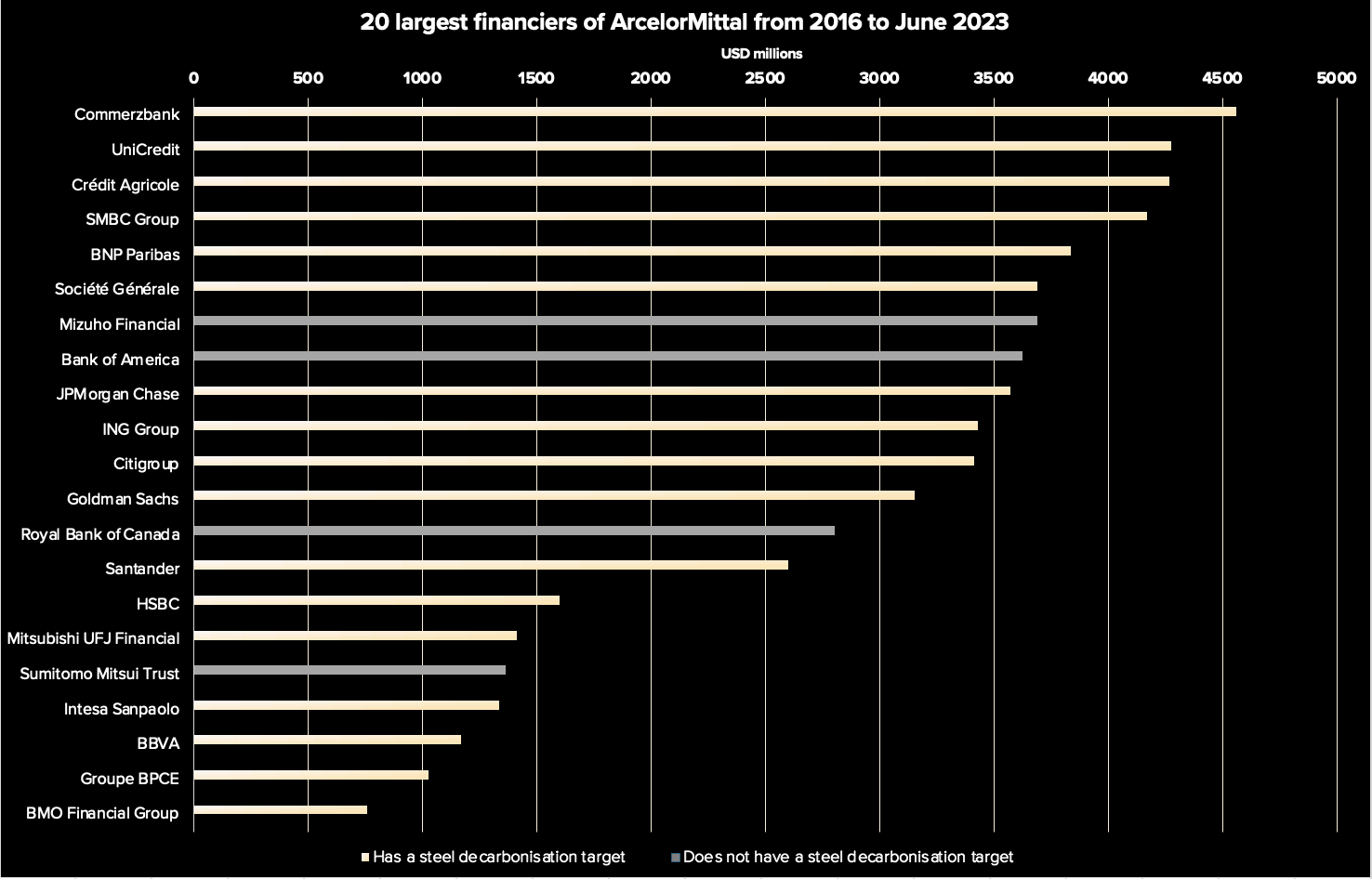

But banks seem to have fallen for ArcelorMittal’s shiny claims on climate action and human rights. According to Reclaim Finance’s report on bank finance for the steel industry, between January 2016 and June 2023, commercial banks have lent over USD 66 billion to ArcelorMittal and its subsidiaries.

Assessing ArcelorMittal’s shiny claims against the reality

Moving towards a world where less steel is produced, and without fossil fuels, would mitigate public health crises caused by pollution, prevent deforestation, and keep coal in the ground where it belongs. But despite ArcelorMittal’s sustainability claims, two brand-new reports by the Fair Steel Coalition and SteelWatch reveal it is actually pushing us in the opposite direction, by expanding its destructive iron ore mining projects and fossil steel production capacity worldwide, with serious, sometimes deadly, consequences for neighbouring communities.

In Mexico, four Nahua Indigenous human rights defenders who spoke out against ArcelorMittal & Ternium’s Peña Colorada Mine in Mexico have been disappeared or found dead since 2020. In South Africa, ArcelorMittal’s air, water, and soil pollution from fossil steel production contributes to increased rates of respiratory diseases, cancer, and infertility among the majority Black residents, a legacy of Apartheid-era industrial planning. And in Liberia, ArcelorMittal is actively trying to triple the size of its iron ore mine, despite opposition from Mano tribal communities who argue that the company has destroyed their land, forests, water and traditional livelihoods without adequate compensation.

Rather than invest in a transition that would mitigate pollution, conflict, and fossil fuel use, a new report from SteelWatch reveals that ArcelorMittal is distributing most of its profits to shareholders, when there is an acute need to use this money for supporting the transition to fossil-free steel. Between 2021 and 2023, the company distributed more than USD 11 billion to its shareholders in the form of buybacks and dividends. This is 22 times the amount invested on decarbonisation during this same period – just USD 500 million.

The banks fuelling ArcelorMittal’s dirty flames need to put the fire out

Out of ArcelorMittal’s top 20 lenders, 16 have public commitments to steel decarbonisation. But if these banks really want to be champions of a just and fossil-free steel industry, they shouldn’t be fooled. ArcelorMittal is delaying a global fossil fuel phase out and prioritising enriching shareholders over investing in a just transition.

In order to hold ArcelorMittal accountable, banks who have a relationship with the company must:

-

Make future finance for ArcelorMittal conditional upon the company, within one year:

-

Submitting concrete action plans to address all social and environmental impacts detailed in the Real Cost of Steel

-

Delivering by 2025 concrete, verifiable asset-by-asset transformation plans to end fossil-based production processes globally

-

Committing to systematically publish its environmental and social action plans

-

-

Banks must also immediately strengthen their environmental and human rights due diligence process by engaging with local communities, and by taking into consideration past and potential cases of environmental racism, violations of safety of human rights defenders, and systemic environmental impacts

-

And finally, banks must immediately adopt a transparent and accessible grievance mechanism at the parent institution level that is able to deliver remedy, in light of the risks of adverse human rights impacts occurring even with high-quality environmental and human rights due diligence processes in place.

For more information on ArcelorMittal, and the steel industry’s shortcomings, visit shiny.claims, and follow the Fair Steel Coalition.