Three years after Glasgow: Banks’ global coal financing on the rise again

Katrin Ganswindt | Director of Financial Research at Urgewald | +4917632411130

Dr. Ognyan Seizov | International Communications Director at Urgewald | +4930863292261

Katrin Ganswindt | Director of Financial Research at Urgewald | +4917632411130

Dr. Ognyan Seizov | International Communications Director at Urgewald | +4930863292261

In November 2021, it looked like an end of coal was in sight. At COP26 in Glasgow, 197 countries’ governments agreed to phase down coal and many of the world’s largest commercial banks made pledges to decarbonize their portfolios. Today, Urgewald and 23 NGO partners published research examining the development of commercial banks’ financial flows to coal companies since Glasgow.

The results are sobering: In the past 3 years, commercial banks channeled over $385 billion to the global coal industry.

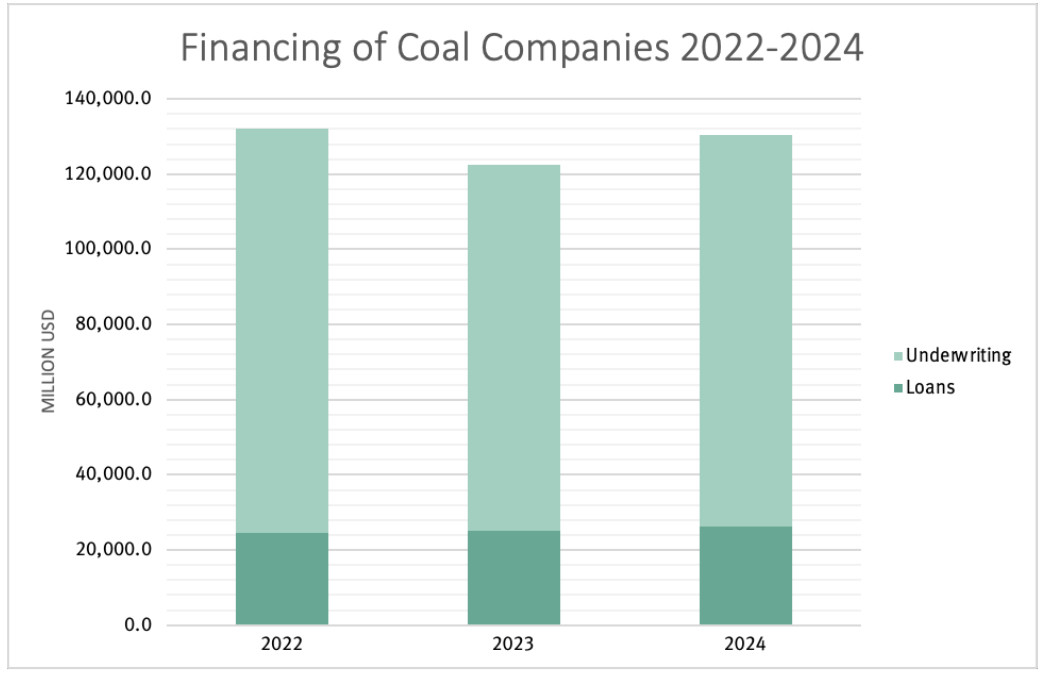

“We were hoping to at least see a consistent downward trend, but the annual breakdown of our data shows that while coal financing dropped from $132 billion in 2022 to $123 billion in 2023, it shot back up to $130 billion in 2024. It’s as if Glasgow never happened,” says Katrin Ganswindt, Director of Financial Research at Urgewald.

The NGOs’ research covers 650 commercial banks worldwide and the full results can be viewed online at www.stillbankingoncoal.org

Countdown to 2030

Proposals for new coal are quickly losing ground as renewables and especially solar have become the cheapest option for building new power plants in almost every country in the world. In 2024, solar and wind already accounted for 90% of power capacity growth worldwide. Although the pipeline of new coal projects is rapidly dwindling, the existing coal plant fleet of over 2,100 GW is not, and its continued emissions are bringing us ever closer to disastrous climate tipping points.

The International Energy Agency (IEA)’s latest Net Zero by 2050 Roadmap warns that coal use needs to end by 2030 in advanced economies and by 2040 globally. (1) 2030 is just around the corner, yet only 24 out of the largest 99 commercial banks have plans to phase out financing of coal companies by these timelines. (2)

“The coal party is over, but most banks still refuse to leave the dance floor”, comments Ganswindt.

Which banks are keeping coal alive?

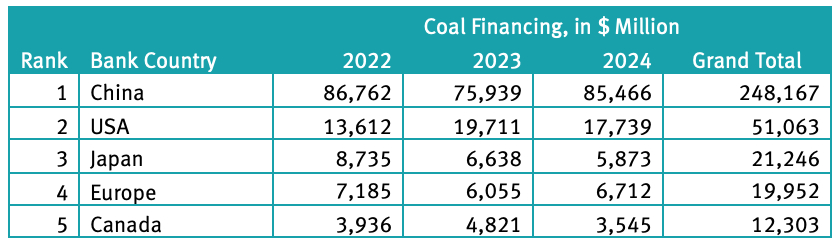

92% of the $385 billion commercial banks channeled to the coal industry between 2022 and 2024 came from banks headquartered in 5 countries or regions: China ($248 billion), the US ($51 billion), Japan ($21 billion), Europe ($20 billion), and Canada ($12 billion). A ranking of the top countries and banks is provided in the annex.

A. North America

USA

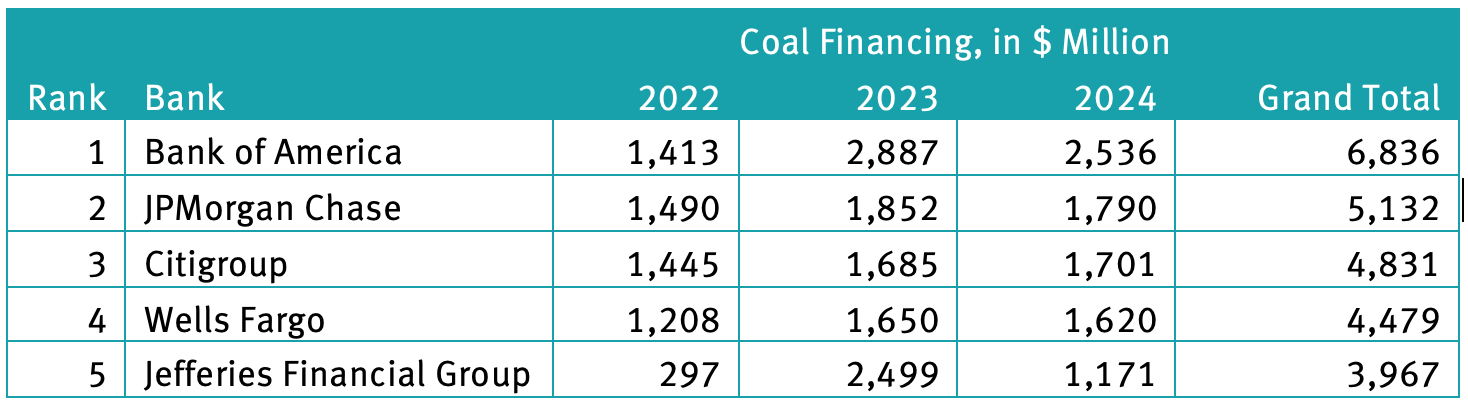

Since 2022, US banks increased their support for the coal industry by over $4 billion, with a financing peak in 2023. The top 5 coal banks in the USA are Bank of America ($6.8 billion), JPMorgan Chase ($5.1 billion), Citigroup ($4.8 billion), Wells Fargo ($4.5 billion) and Jefferies Financial Group ($4 billion). Each of these banks increased their coal financing since the Glasgow COP, and an end is not yet in sight.

On November 27th, 2024, Texas and 10 other Republican-led states sued the world’s biggest asset managers BlackRock, State Street, and Vanguard for their participation in the Climate Action 100 and Net Zero Asset Managers Initiative. The lawsuit claimed that asset managers’ signals of “mutual intent to reduce the output of thermal coal” were in violation of antitrust laws. In the following weeks, Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, and Wells Fargo all exited the Net Zero Banking Alliance. (3) Since this exodus, Citi is the only US bank with a public commitment to phase out coal financing.

Out of the top 5 US coal banks, Jefferies Financial Group stands out as the institution with the fastest growing coal portfolio. Between 2022 and 2024, Jefferies increased its coal financing by almost 400% and is now the biggest financier of the controversial Adani Group. The company is planning to double its coal power production and was indicted by US prosecutors in connection with a scheme to bribe Indian officials. While other US banks dropped Adani, Jefferies provided $2 billion to the company since 2022.

Canada

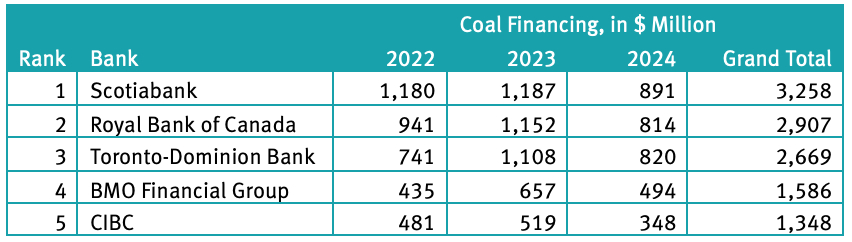

Canada is a founding member of the Powering Past Coal Alliance (PPCA), a network of countries, cities, and businesses that aim to phase out coal by 2030 in OECD and EU countries and by 2040 globally. Out of Canada’s banks, only Desjardins and CDPQ (Caisse de dépôt et placement du Québec) joined the PPCA. The country’s 6 biggest commercial banks, however, have made no commitment to phase out coal.

Since 2022, Canada’s commercial banks channeled $12.3 billion to the coal industry. The country’s top coal financiers are Scotiabank with $3.3 billion, followed by Royal Bank of Canada ($2.9 billion), Toronto-Dominion Bank ($2.7 billion), Bank of Montreal ($1.6 billion), and Canadian Imperial Bank of Commerce ($1.3 billion).

It remains to be seen whether Canada’s Prime Minister, Mark Carney, will take action to ensure that Canadian banks stop undermining efforts to power past coal. 10 years ago, during his tenure as Governor of the Bank of England, Carney held a seminal speech on the financial risks of climate change, and as UN Special Envoy for Climate and Finance, Carney played a key role in launching the Glasgow Financial Alliance for Net Zero (GFANZ) in 2021. (4)

“With their almost non-existing commitments, Canada’s big commercial banks are keeping coal alive. Prime Minister Carney must pursue regulations that drive banks to switch their energy finance from the bad to the good," says Richard Brooks, Climate Finance Director of the Canadian NGO Stand.earth.

B. Europe

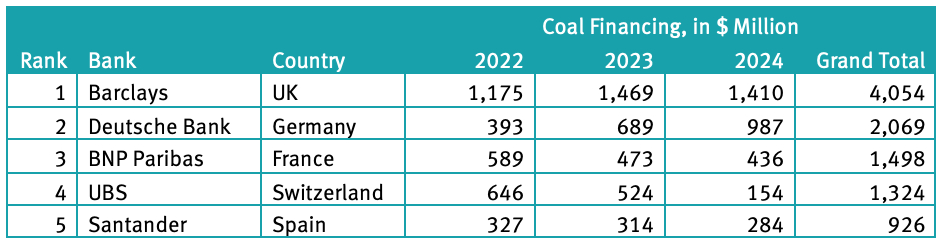

European banks have channelled $20 billion to the coal industry since Glasgow. Europe’s biggest coal banks are Barclays from the UK ($4 billion), Deutsche Bank from Germany ($2 billion), BNP Paribas from France ($1.5 billion), UBS from Switzerland ($1.3 billion) and Santander from Spain ($0.9 billion). While the annual coal financing volumes of BNP Paribas, Santander and UBS have steadily decreased since 2022, Deutsche Bank and Barclays have stepped up their support for the industry. In 2024, Deutsche Bank’s coal financing was 151% higher and Barclays’ was 20% higher than in 2022. This is in stark contrast to UBS, which decreased its coal financing by 76% over the same time period.

A comparison of the coal policies of UBS, Barclays and Deutsche Bank shines a light on why their coal finance trajectories differ so strongly. While UBS excludes companies that generate over 20% of their revenues from coal mining or power, Barclays (5) has only recently moved to a 30% threshold while Deutsche Bank (6) is still using a 50% revenue threshold for coal divestment.

“Barclays and Deutsche Bank need to urgently roll back their coal financing and tighten the revenue thresholds in their policies. The earlier energy companies and the finance industry transition, the easier the change. And the earlier we bring down emissions, the higher our chances of avoiding a breakdown of our climate system,” says Ganswindt.

C. East Asia

China

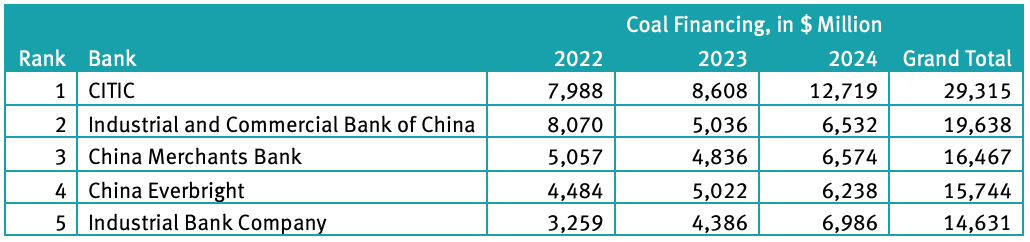

While Chinese commercial banks provided marginally less finance to the coal industry in 2024 than in 2022, they remain the biggest coal bankers worldwide and channelled over $248 billion to the industry since 2022. In contrast to North American, European and Japanese banks, which finance coal companies globally, Chinese banks almost exclusively back Chinese coal companies. Out of the top 5 Chinese coal banks, the Industrial and Commercial Bank of China (ICBC) was the only bank, whose annual coal financing was lower in 2024 than in 2022. The other 4 top banks increased their support for the industry since 2022, whereby CITIC showed the biggest increase with almost $5 billion since Glasgow.

Japan

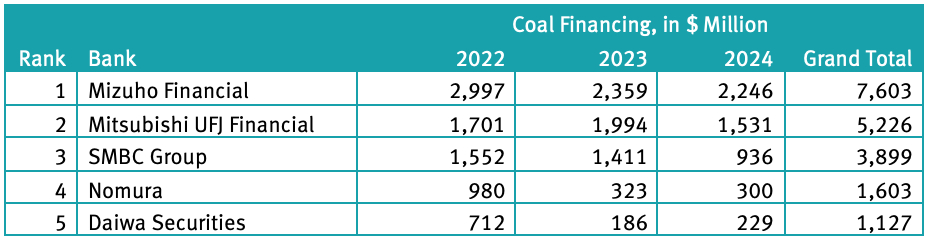

Over the past 3 years, Japanese commercial banks provided over $21 billion to the coal industry. The annual numbers, however, show a clear reduction trend. In 2024, Japanese coal financing was at $5.9 billion, down from $8.7 billion in 2022 – a decrease of almost 32%. The steepest decrease in 2024 came from the SMBC Group and Nomura, which each provided almost $600 million less to the coal industry than in 2022. But if Japanese banks are serious about limiting global warming to 1.5°C or even 2°C, they need to go a step further and make coal phase-out commitments for 2030 in OECD countries and for 2040 in the rest of the world.

“Japanese banks still lack credible transition plans and have yet to adopt policies that are in line with the Paris Climate goal. Especially Mizuho and Mitsubishi UFJ need to stop dragging their feet. Their portfolios read like a who is who of companies that are resisting a transition. Mizuho and Mitsubishi UFJ must adopt firm coal phase-out commitments without loopholes,” comments Ayumi Fukakusa, Director of Friends of the Earth Japan.

D. Southeast Asia

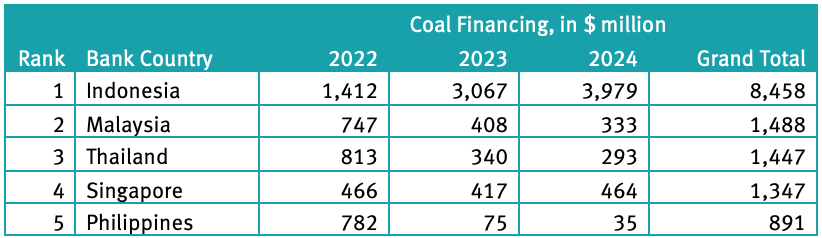

With the collapse of large parts of Southeast Asia’s coal plant pipeline, coal financing by many of the region’s domestic commercial banks has significantly declined. Coal financing from banks in Malaysia and Thailand is now less than half what it was in 2022, and coal financing by Philippine commercial banks decreased by 96% since COP26 in Glasgow.

Indonesia’s banks are, however, the exception and have almost tripled their coal financing since 2022 from $1.4 billion to $4 billion. This is largely due to the fact that over 13 GW of new coal power capacity are still planned in Indonesia. Since many European and Japanese banks are no longer willing to finance new coal projects, Indonesian domestic banks are now trying to fill the gap and have become the most important source of funding for the country’s biggest coal companies.

How the world can quit coal

At least 30% of our planet’s temperature rise is due to the burning of coal. 2024 was the hottest year on record at about 1.55°C above pre-industrial levels. Meeting the commitment of the 2021 Glasgow Climate Summit to phase coal down and out has become more important than ever as more and more of the world’s population is exposed to record-breaking wildfires, droughts, heat waves, floods and other extreme weather events.

Quitting coal is the easiest of the many steps required to achieve net-zero emissions by 2050. Yet many of the world’s commercial banks stubbornly refuse to acknowledge that phasing out coal requires phasing out coal financing.

“Our findings are a call to action for asset owners, financial regulators and civil society organizations who realize that financing coal puts our economy, the financial system and us all at risk. Investors need to reconsider their investments in the banks that are keeping coal alive. Regulators need to curtail financial flows that increase systemic risk. And civil society organizations need to call out each and every bank that is perpetuating the coal industry’s stranglehold on our future,” says Ganswindt.

Methodology

The financial data was drawn from the “BOCC+ 2025” dataset researched by the Banking on Climate Chaos Coalition (including Rainforest Action Network, Indigenous Environmental Network, BankTrack, CEED, Oil Change International, Reclaim Finance, Sierra Club, and Urgewald). The financial dataset was compiled in collaboration with Profundo, a not-for-profit research institute based in the Netherlands. Industry data is based on Urgewald’s Global Coal Exit List (GCEL) 2022, 2023, and 2024. More information on the methodology is available at www.stillbankingoncoal.org/methodology

Notes to editors:

- International Energy Agency: Net Zero Roadmap A Global Pathway to Keep the 1.5 °C Goal in Reach, 2023 Update, p.79-81, 92.

- Reclaim Finance, coalpolicytool.org

- Members of this voluntary initiative commit to reduce their financed emissions to net-zero by 2050. www.unepfi.org/net-zero-banking

- The Glasgow Financial Alliance (GFANZ) is an umbrella organization hosts initiatives like the Net Zero Banking Alliance and Asset Owner Alliance. It was founded at COP26. www.gfanzero.com

- home.barclays/content/dam/home-barclays/documents/citizenship/our-reporting-and-policy-positions/Climate-Change-Statement.pdf

- www.db.com/news/detail/20230302-deutsche-bank-announces-additional-measures-to-reinforce-net-zero-commitment?language_id=1

- This report is endorsed by Abibi Nsroma Foundation, Asian People's Movement on Debt and Development (APMDD), Attac Österreich, Auriga Nusantara, BankTrack, Centre for Environmental Rights, Dayenu, Divest Oregon, EcoDefense, Fair Finance International, First Do No Harm, Fossil Free Berlin, Friends of the Earth Japan, Green America, GroundWork, Just Share, Rainforest Action Network, Reclaim Finance, ReCommon, Stand.Earth, The Climate Reality Project, Toxic Bonds Network, WALHI.