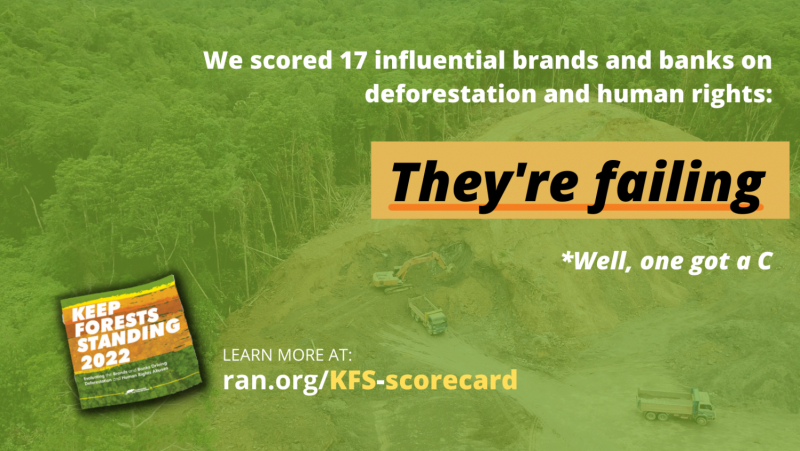

New report: Despite ‘no deforestation’ rhetoric, major brands and banks failing to stop deforestation and human rights abuses

Major multinational brands and banks are failing to stop deforestation and human rights abuses in their business practices, finds the latest report by Rainforest Action Network (RAN). An annual evaluation, the report ranks an influential sample of brands and banks that are connected to forest-risk commodities being produced in the world’s last tropical rainforests. None of the 17 brands and banks evaluated have taken adequate action to address their contribution to the destruction of forests, ongoing land grabs, and violence against local and Indigenous communities, the report finds.

A number of banks and brands performed worse than their peers, receiving ‘F’ grades in the evaluation. Indonesian state-owned bank BNI, Malaysian bank CIMB, and the Chinese state-owned multinational bank ICBC, all performed worst among the banks evaluated. Consumer goods giant Procter & Gamble, confectioner Mondelēz, and Japanese food maker Nissin Foods similarly lagged behind their peers in acting to end deforestation and human rights violations in forest-risk commodity supply chains.

“We know that we stand at a crossroads and any further deforestation will contribute to climate catastrophe lasting for generations,” said Daniel Carrillo, Forest Campaign Director, Rainforest Action Network (RAN). “Meanwhile, the very communities attempting to protect these invaluable rainforests for all of us are facing increasingly violent reprisal.”

Many of these brands and banks have adopted various commitments and policies to achieve “No Deforestation” and uphold Indigenous and human rights in their business practices, especially in the wake of COP26. However, since the adoption of the Paris Agreement, the grouping of influential banks assessed has provided at least USD 22.5 billion to forest-risk commodity companies operating across the three largest tropical forest regions of Indonesia, the Congo Basin, and the Amazon. JPMorgan Chase was the largest, providing USD 6.9 billion, while MUFG followed with USD 4 billion. Similarly, the brands have failed to suspend business with suppliers that persist in violating the customary rights of communities and sourcing from producers that are causing deforestation.

“A handful of powerful brands and banks have serious influence over the continued destruction of rainforests, the stealing of land, and the killing of human rights defenders, and yet they’re doing very little to stop it,” said Carrillo. “The world has no more time for these corporations to keep passing the buck on the impacts that their business model has on forests and communities.”

All of the banks and brands evaluated have failed to require proof that the right to Free, Prior, and Informed Consent (FPIC) is being respected by their clients, suppliers, or investees. To date, not a single bank or brand has published procedures that they would use to ensure Indigenous Peoples and local communities’ rights to say no to development on their customary lands are respected.

Some brands have made improvements to their policies over the past year, including Colgate-Palmolive, Ferrero, and Kao, but still remain behind other peers, like Unilever –– the only brand that has adopted a credible policy to address its impact across all forest-risk commodity supply chains and disclosed its initial forest footprint. Nestlé remains the only brand committed to disclosing its global forest footprint. Some bank laggards adopted the leading commitment of No Deforestation, No Peat, No Exploitation (NDPE) over the past year, including MUFG and JPMorgan Chase, however, there remain major loopholes in these commitments. Malaysian bank CIMB did announce an NDPE policy, however, that announcement did not specify which commodities would be included and it did not include a timeline for the implementation of its policy. RAN warns that claims made by brands and banks on eliminating deforestation or human rights violations can not be trusted due to the absence of credible independent verification mechanisms being used to ensure NDPE policies are being adhered to.

For the full report and methodology used to assess the performance of the multinational brands and banks visit: ran.org/kfs-scorecard/.