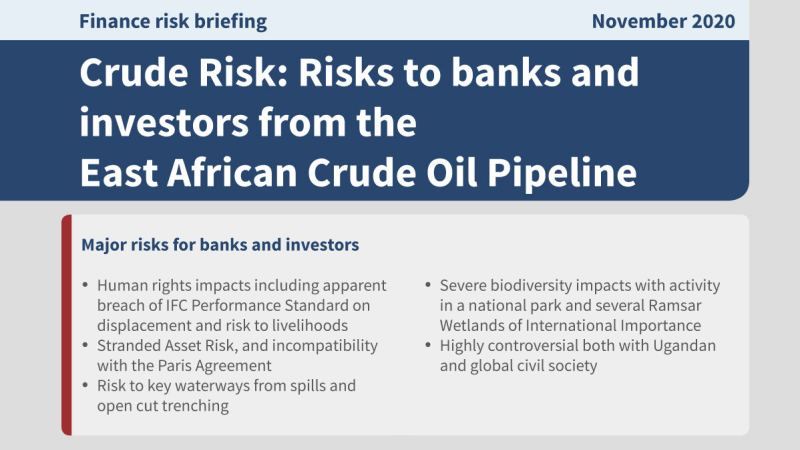

Crude Risk: Risks to banks and investors from the East African Crude Oil Pipeline

BankTrack: Ryan Brightwell; ryan@banktrack.org; +31 634 643 116

Just Share: Robyn Hugo; rhugo@justshare.org.za; +2782 389 4357

BothENDS: Cindy Coltman; c.coltman@bothends.org; + 31 20 530 6600

BankTrack: Ryan Brightwell; ryan@banktrack.org; +31 634 643 116

Just Share: Robyn Hugo; rhugo@justshare.org.za; +2782 389 4357

BothENDS: Cindy Coltman; c.coltman@bothends.org; + 31 20 530 6600

French oil company Total is aiming to ensure the much-delayed Final Investment Decision on the controversial East African Crude Oil Pipeline (EACOP), a 1,445 kilometer pipeline from Hoima in Uganda to the port of Tanga in Tanzania, is signed before the end of this year. If completed, it will be the longest heated crude oil pipeline in the world.

Debt financing for the project is yet to be finalised, but Stanbic Bank Uganda (a subsidiary of South Africa’s Standard Bank), Japan’s Sumitomo Mitsui Banking Corporation and China’s ICBC have all been linked to the project as advisors or lead arrangers. Meanwhile the risks associated with this continue to mount, and controversy is likely to follow Total and banks as this project progresses.

A new briefing issued today from BankTrack and partners Africa Institute for Energy Governance (AFIEGO), BothENDS, Just Share and Inclusive Development International outlines the many risks that investors and banks could face from the EACOP, and provides questions to help prospective financiers understand those risks and assess whether a decision to proceed with or finance the EACOP is in their long-term interests.

The briefing sets out severe and unacceptable social, environmental and human rights impacts associated with the project and argues that these pose risks to financiers that cannot be adequately mitigated. As such, the briefing advises that banks avoid financing the pipeline and seek ways to allocate their capital to promote an alternative, clean development model for East Africa that is in line with global climate goals.

The Dakota Access Pipeline (DAPL) in the United States was a stark and painful lesson for financial institutions about the commercial materiality of the social and environmental risks from oil pipeline construction. The EACOP, which like DAPL will need to comply with the Equator Principles, will be a test of whether banks have learned those lessons.

Major risks for banks and investors:

-

Human rights impacts including apparent breach of IFC Performance Standard on displacement and risk to livelihoods

-

Stranded Asset Risk, and incompatibility with the Paris Agreement

-

Risk to key waterways from spills and open cut trenching

-

Severe biodiversity impacts with activity in a national park and several Ramsar Wetlands of International Importance

-

Highly controversial both with Ugandan and global civil society