The BankTrack Human Rights Benchmark

BankTrack's Human Rights Benchmark assesses commercial banks on the extent to which they are implementing the UN Guiding Principles on Business and Human Rights, as part of our campaign to ensure banks fully meet the responsibility to respect human rights.

The BankTrack Global Human Rights Benchmark 2024 is out now. Previous global benchmarks were published in 2014, 2016, 2019 and 2022.

Our previous benchmark report was the Human Rights Benchmark Latin America, released March 2024.

As part of our benchmarking project, we also assess the responses of banks to specific alleged human rights impacts associated with their finance. Our Response Tracking database displays the results, which were also summarised in the May 2024 Actions Speak Louder briefing paper.

This page presents the results of our Global and Regional Human Rights Benchmark reports in order of publication.

Jump to:

- BankTrack Global Human Rights Benchmark 2024

- BankTrack Human Rights Benchmark Latin America (2024)

- BankTrack Global Human Rights Benchmark (2022)

- BankTrack Human Rights Benchmark Asia (2022)

- BankTrack Human Rights Benchmark Africa (2021)

- BankTrack Global Human Rights Benchmark (2019)

BankTrack Global Human Rights Benchmark 2024

BankTrack’s 2024 Global Human Rights Benchmark again assessed 50 of the largest commercial banks globally. While once again no commercial banks are fully meeting the UN Guiding Principles, two banks were ranked as 'leaders' and there has been some progress in the development of remedy mechanisms.

This year’s Benchmark also assesses for the first time banks’ policies on Indigenous Peoples’ right to Free, Prior and Informed Consent; the protection of human rights defenders; and the human right to a healthy environment.

BankTrack Human Rights Benchmark Latin America (2024)

BankTrack’s first Regional Benchmark for Latin America assessed 17 major commercial banks headquartered in Latin America. It found that all banks assessed meeting fewer than half of their responsibilities under the UN Guiding Principles. The Benchmark covers banks headquartered in Brazil, Mexico, Colombia, Chile, Peru and Argentina, as well as subsidiaries of international banks. It forms the latest part of BankTrack’s Human Rights Benchmark report series, and is its third regional benchmark, after similar reports covering banks in Africa and Asia (covered below on this page.

-

Translated versions: Portuguesa (PDF), Español (PDF).

BankTrack Global Human Rights Benchmark (2022)

BankTrack’s 2022 Human Rights Benchmark assessed 50 of the largest commercial banks globally. It found that no commercial banks are fully meeting the UN Guiding Principles. Although there was some progress since 2019, no banks were ranked as 'leaders' and there has been a lack of action to address key gaps on reporting and remedy.

BankTrack Human Rights Benchmark Asia (2022)

BankTrack’s 2022 Human Rights Benchmark Asia assessed the human rights policies and processes of 18 mid-tier Asian banks. It finds that, nearly eleven years after their endorsement by the UN Human Rights Council, implementation of the UN Guiding Principles on Business and Human Rights by these banks is at an early stage.

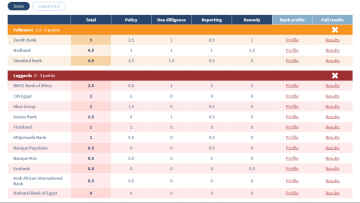

BankTrack Human Rights Benchmark Africa (2021)

BankTrack’s 2021 Human Rights Benchmark Africa assessed 14 large banks headquartered in Africa. It finds that only four have made a clear commitment to respect human rights, and none have a clear human rights due diligence process in place or publish detailed human rights reporting.

BankTrack Global Human Rights Benchmark (2019)

BankTrack’s 2019 Human Rights Benchmark assessed 50 of the largest commercial banks globally. It found banks generally failing on human rights, with Lloyds, Bank of America, Goldman Sachs and Société Générale among the worst performers.

- Full report (PDF)

- Four-page summary (PDF).

- Webinar presentation (YouTube, 26 minutes).

- Media release