Company – On record

This profile is no longer actively maintained, with the information now possibly out of dateJulia Hovenier, Banks and steel campaigner, BankTrack

Company – On record

This profile is no longer actively maintained, with the information now possibly out of dateJulia Hovenier, Banks and steel campaigner, BankTrack

Why this profile?

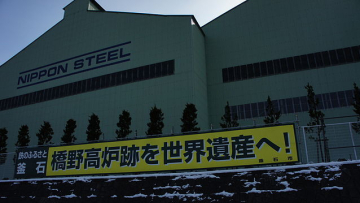

Nippon Steel is Japan's largest steelmaker and the fourth largest globally, making it a massive polluter. It lobbies against carbon pricing, supports nuclear power over renewables, and has recently invested in coking coal mines in Australia and Canada. These actions raise serious doubts about its commitment to combating climate change to the scale and urgency needed.

What must happen

In light of Nippon Steel's acquisition of US Steel and delayed climate action, Nippon Steel must immediately:

- Develop phase-out plans for each of their blast furnace sites, in line with a just transition

- Provide realistic coal-phase out plans in line with the 2050s global goal of net-zero greenhouse gas emission, through the end of coal use and transition to becoming a fossil free steel company.

Bank financiers of Nippon must:

- Urgently conduct due diligence to assess the impact of US Steel's acquisition pre-financing

- Immediately stop financing this acquisition, unless transition plans are presented for the phase out of blast furnaces for fossil free steel production.

| Sectors | Iron and Steel Manufacturing , Coal Mining |

| Headquarters |

|

| Ownership |

Nippon Steel Corporation and Sumitomo Metal Corporation. The company's complete shareholder structure can be accessed here. |

| Subsidiaries |

|

| Website | https://www.nipponsteel.com/ |

Nippon Steel is the forth-largest producer in the world, producing 66 megatons of crude steel in 2023. 82% of Nippon's steelmaking capacity is coal-based. Nippon Steel's major facilities are in Japan, but in recent years it has acquired facilities in India through a joint partnership with ArcelorMittal and more recently in 2023, working to acquire US Steel in a $14.1 billion deal funded through a $16 million loan from three large Japanese banks.

Nippon Steel has set a target of reducing total CO2 emissions by 30%, compared to the 2013 baseline. It plans to meet its target by investing in risky and unproven technologies that still rely on fossil fuels, moving further away from aligning with the 1.5 degrees climate goals. Nippon Steel cites a reduction of emissions of 30% since 2013, however this is due to reduced production- as opposed to planned climate action. With the acquisition of US Steel however, its emissions are set to rise again, unless there is a serious turn to fossil free steelmaking.

Impact on human rights and communities

Buying toxic assets with no transition plan: Nippon Steel's acquisition of US Steel has raised serious concerns among environmental and community groups in the United States. The US Steel facilities that Nippon bought release hazardous air pollution that is attributable to over 120 deaths yearly in nearby communities. Nippon Steel's investor presentation about the acquisition of US Steel says nothing about pollution control. Failure to prioritise transition plans away from polluting blast furnaces perpetuates the exploitation of vulnerable communities and undermines human rights. Without any commitments from Nippon Steel to transition away from coal, local communities are concerned Nippon will continue to perpetuate massive health and environmental damage.

Leaving communities behind: Nippon Steel's move to acquire US Steel is being met with resistance by union workers, citing concerns that Nippon Steel will not respect existing labour, job security and retirement agreements. Thus far, Nippon Steel has only committed to upholding these agreements until the current collective bargaining agreement expires. Nippon Steel's reluctance to invest in cleaner technologies, such as green hydrogen direct reduced iron, could threaten the long term job security of the US steelworkers as blast furnaces are at risk of becoming stranded assets.

Impact on climate

Locking in coal for steel: Nippon Steel's continued reliance on outdated coal-fired blast furnaces poses a dire threat to climate mitigation efforts. Additionally, Nippon Steel owns a stake in a number of coal mines (five, according to the Global Energy Monitor) and is looking to further expand its coal mine ownership, further indicating that it's relying on a coal-based future. Nippon Steel's acquisition of US Steel comes at a grave cost to people and environment, as it will keep coal-fired furnaces running longer than a stable climate can afford, leaving the least responsible people to bear the brunt of climate injustice. Blast furnaces, which rely on coal, are the main technologies used by Nippon steel and US Steel. Although Nippon Steel reports a 33% reduction of emission and a draw to their 2030 goal of 75 million tons, this has been brought about by reduction in production as opposed to transitioning to fossil-free steelmaking technologies, leaving many doubts that an increase in production via US Steel won't bring back higher emissions.

Inadequate climate plans: Nippon Steel's failure to provide a concrete transition and phase-out plan for blast furnaces underscores a blatant disregard for international climate agreements and basic human rights. Central to achieving the target set out within the Paris Agreement is the rapid decarbonization of industries reliant on fossil fuels, such as steel production. Nippon Steel's slow adoption of transitory measures and ending the use of coal undermines the industrial decarbonization goals, jeopardises the collective effort to avert catastrophic climate change, especially with its position as fourth-largest steel producer.

Lobbying against climate action: According to Lobby Map, Nippon Steel has consistently lobbied against new climate policy, which undermines the legitimacy of its commitment to climate action. They have lobbied against the adoption of policies including a carbon tax and emission trading undermines action towards climate change. Additionally, Nippon Steel's president Hashimoto opposed the EU Emissions Trading Scheme, stating that carbon taxing does not meet the purpose of reducing CO2.

Impact on nature and environment

Pollution of the waterways- a health hazard: In 2022, Nippon Steel's East Nippon Works in Kimitsu Japan was found to be discharging cyanide into nearby waterways. This happened at least 59 times over a span of five years. Under the Water Pollution Prevention Law, the standard for "no detection" of cyanide is less than 0.2 milligram per liter. However, Nippon Steel's internal investigation uncovered instances where cyanide levels exceeded acceptable limits, posing significant risks to public health and the environment.

The repercussions of cyanide pollution extend beyond immediate health hazards. Nippon Steel's failure to disclose these findings in a timely and transparent manner erodes trust within the local community and undermines efforts to address climate change. The company's reluctance to acknowledge the presence of cyanide in waterways near its facilities reflects a disregard for environmental regulations. Furthermore, Nippon Steel's attempt to downplay the severity of the situation by attributing it to misunderstanding underscores systemic shortcomings in its environmental management practices.

2025

2025-06-18 00:00:00 | Japan's Nippon seals controversial US Steel deal after Trump pact

Nippon's $14.9 billion acquisition of U.S. Steel will create one of the world’s largest steel producers and position Nippon as a key player in the U.S. market.

2025-01-04 00:00:00 | Biden blocks Nippon Steel acquisition of US Steel

Citing national security concerns, the Biden administration has blocked Nippon Steel's takeover of US Steel.

2024

2024-08-29 00:00:00 | Back to the Future 2: Japanese steelmaker Nippon Steel commits to coal-fired steel in USA for decades

Nippon Steel announced that it will invest in extending the production life of a coal-dependent, carbon-intensive blast furnace currently operated by U.S Steel. Nippon’s $US14.1 billion acquisition of U.S Steel is still pending approvals, and this new investment is in addition to the $1.4 billion capital injection previously committed. Moreover, Nippon seeks to spend $300 million to reline blast furnace #14 at Gary Works- an investment intended to extend the life of US Steel's largest manufacturing plant's blast furnace for up to 20 years.

2024-08-29 00:00:00 | Nippon Steel’s coal promise will lock U.S. Steel into decades of high emissions if bid succeeds

Nippon Steel is further digging itself into coal, endangering the global climate as well as the company’s own future given the risk of stranded assets. The Gary Works blast furnace 14's current capacity is around 2.5Mtpa and with the projected 90% utilisation rate and lifetime extension of 20 years, it would produce more than 100 MtCO2 of cumulative CO2 emissions over the lifetime of the new blast furnace, according to Steel Watch's calculations.

With the purchased 20% stake in Whitehaven's BlackWater coal mine, Nippon Steel is endagering the company;s future as compared to other steel manufacturing companies adopting the shift to green steel production through their investment in new hydrogen-ready ironmaking production.