Desjardins adopts a robust coal exit policy

The Quebec financial group Desjardins has just published the details of its thermal coal policy. This policy covers all the essential exclusion criteria that will allow it to completely phase out coal by 2030 in the OECD and 2040 in the rest of the world. Desjardins becomes the 17th financial institution to adopt a robust coal exit policy and the 2nd outside France, after Italy’s UniCredit.

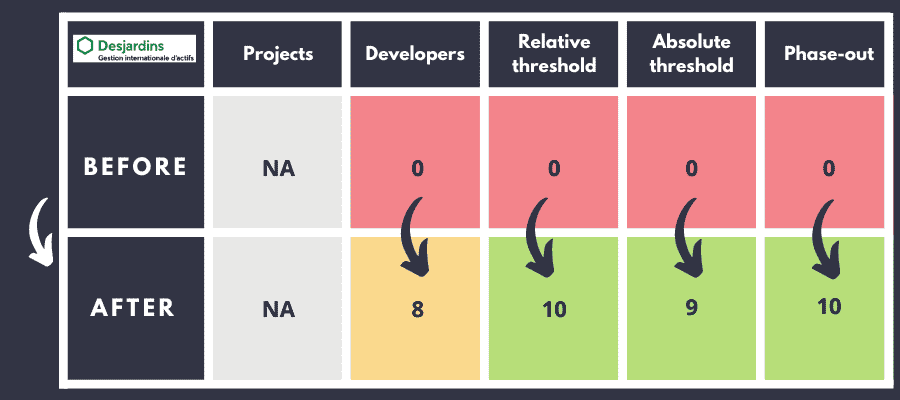

Upon adopting its first sector policy, Desjardins met all the criteria for a good coal exit policy.

- Desjardins takes note of the incompatibility of any new coal project with the objectives of the Paris Agreement and excludes all support for the expansion of the coal sector: Desjardins excludes all direct support for new mining, power plant and infrastructure projects (railways, export terminals, etc.), as well as for existing or renovation projects.

- Desjardins also excludes any support for the companies behind such projects. Desjardins thus becomes the 22nd financial institution to exclude all developers, not to mention infrastructure developers. In contrast, most financial institutions do not exclude any company because of their coal investment plans. This is the case, for example, for the Canadian bank RBC (Royal Bank of Canada), which financed four coal plant developers between 2017 and September 2019 to the tune of USD 728 million, according to the latest available financial data.

- Desjardins excludes all coal-producing companies and all companies that have more than 5GW or 10% of their total installed coal power capacity, among the most restrictive relative and absolute criteria in the world; with a limited number of exemptions for six companies committed to exiting the sector by 2030 in the OECD and 2040 in the rest of the world. This is much better than the 60% threshold adopted by RBC, which only applies to new customers; the other major Canadian banks have none.

Finally, Desjardins is committed to reducing these exclusion thresholds to 0 to have zero exposure to thermal coal by 2030 for Europe/OECD and 2040 worldwide–dates aligned with a 1.5°C scenario.

This policy covers the various activities of the Desjardins group:

- Its banking activities of project finance, corporate loans, and banking intermediation such as share and bond issues;

- Its insurance activities and the management of its equity capital.

On the other hand, on the investment side, the policy will apply only to assets owned by Desjardins, i.e., only 55% of the total assets managed by Desjardins Global Asset Management. The Québec group has yet to extend this coverage to all of its 56 billion dollars of assets under management.

Yann Louvel, Policy Analyst at Reclaim Finance, concludes:

“It’s a little big bang across the Atlantic. Desjardins has just adopted a coal policy far superior to those of its Canadian and North American competitors. The Canadian bank becomes the second non-French financial institution to have adopted a robust coal policy and the 17th internationally. It is now imperative for Desjardins to also extend this approach to the oil and gas sector and we call on RBC, TD Bank, BMO, Scotiabank, and others to follow the path set out today on coal.”

Desjardins Bank’s scores in the Coal Policy Tool

This table shows the scores of Desjardins Bank’s coal policy on each of the criteria of the Coal Policy Tool.

Desjardins Global Asset Management’s scores in the Coal Policy Tool

This table shows the scores of Desjardins Global Asset Management’s coal policy on each of the criteria of the Coal Policy Tool.

Find out more :

- Link to Desjardins’s Position on Coal

- Link to the Coal Policy Tool