Company – Active

This profile is actively maintainedBankTrack

Company – Active

This profile is actively maintainedBankTrack

Why this profile?

EPH has taken over many coal assets that were divested from by other utilities because of climate and pollution reasons. As a result, rather than being closed down rapidly as required by the Paris Agreement, these assets stay in operation longer than they otherwise would have. These assets continue to exacerbate climate change even when converted to allegedly cleaner energy sources such as biomass or gas, threatening a socially just energy transition in Europe.

The majority of the EPH shares belong to its CEO, Daniel Křetínský. Křetínský is considered a controversial figure in the Czech Republic and increasingly in Europe due to its growing hold on the European media.

What must happen

Banks should avoid financing EPH because of its significant coal and gas operations. EPH continues to invest in new coal power and plans to keep its coal power stations operational until 2038, whereas limiting global warming to 1.5 degrees means coal should be phased out in OECD countries by 2030. Additionally, EPH is converting coal power plants to burning wood biomass which emits more carbon, per-unit of energy, than coal. EPH fails to align its business model with the goals set in the Paris Climate Agreement. (See also the Principles for Paris-aligned Financial Institutions).

| Sectors | Biomass Electric Power Generation, Coal Electric Power Generation , Coal Mining, Electric Power Distribution, Hydroelectric Power Generation, Nuclear Electric Power Generation, Pipeline Transportation of Natural Gas, Solar Electric Power Generation, Wind Electric Power Generation |

| Headquarters |

|

| Ownership |

EPH is privately owned. The majority share is owned by Daniel Kretínský, a Czech businessman, and the remaining shares belong to J&T Energy Holding and a group of EPH managers. |

| Subsidiaries | |

| Website | https://www.epholding.cz/en/ |

EPH (Energetický a Průmyslový Holding) is a Czech-based multinational company operating predominantly in the Central European energy sector. The company operates the Eustream pipeline, which transports gas between Russia and the EU, as well as gas storage facilities in Slovakia, Czechia and Austria. It also produces energy from a variety of sources, including coal, biomass, gas, oil, solid fuels, thermoelectric, hydroelectric, nuclear, wind and photovoltaic. Across Europe, the company currently operates seven biomass plants or units that mainly burn wood, four coal power plants that co-fire with wood, and five coal power plants. In addition, EPH operates Mibrag and Leag, two of the largest coal mining companies in Germany.

Impact on human rights and communities

Health impacts: In 2018, a report by Europe Beyond Coal found EPH to be the second most harmful coal company to health in Europe. EPH operates a major share of the lignite power plants in Germany, which have negative health impacts on communities living in close proximity to the plants. The report links an estimated 1,460 premature deaths to EPH’s operations in 2016, along with other respiratory and cardiovascular diseases caused by the company’s activities.

In 2012, EPH’s subsidiary Biomasse Crotone, which operates two biomass power plants in Southern Italy, was sued by local farmers for lack of compliance with air pollution monitoring policies. They also reported a high incidence of tumours and lung diseases in the area, later confirmed by the regional healthcare agency. In October 2022, Biomasse Crotone among other energy companies was accused of illegal waste trafficking, association with criminal groups and fraud against the Italian National Energy Service Manager (Gse). Until 2017, their plants were allegedly burning wood chip biomass mixed with rubbish and waste, such as tar, asphalt and tires, releasing toxic substances and harming the health of nearby communities.

Landfilling: The community of Caslav, a small Czech town, has been suffering from the impacts of landfilling for decades. The Caslav landfill, which is operated by EPH’s subsidiary AVE CZ, is located less than 2 kilometres from the centre of the town. Landfilling is the dirtiest way of waste treatment. The impacts and risks from the landfill include air and noise pollution from increased truck traffic and increased risk of fires.

Local resistance has been growing since 2022, when EPH’s subsidiary AVE CZ announced its plans of expansion of the landfill to three times its current size. A petition against the expansion received 4000 signatures and a piece about the landfill was recently released on Czech television. The expansion of the landfill is currently at standstill as the Ministry of the Environment asked the company to revise plans, asking for a more detailed assessment of how the expansion of the landfill will affect the environment and how the company plans to balance it.

Impact on climate

Carbon emissions: EPH is Europe’s third most polluting power utility, with annual coal CO2 emissions of about 62.5 million tonnes CO2 in 2021 – nearly as much as Italy’s entire power sector. In 2019, EPH was estimated to be responsible for about 11% of all coal-related CO2 emissions in the EU. According to the 2022 Global Coal Exit List, EPH’s annual thermal coal production is 37.5MT. Of the power it produces, 32% is generated by coal.

EPH claims to be a leader in decarbonisation, and it has committed to reducing its CO2 emissions from existing power plants by 60% by 2030, as well as reaching net zero emissions by 2050. However, according to a recent report by Ember, EPH has one of the worst decarbonization plans amongst all European energy companies due to its plans to develop more fossil gas power stations in Europe and to continue coal operations until 2038.

Between 2019 and 2022 the EPH group acquired coal assets in Germany and France, gas-fired plants in the Netherlands, thermal power plants in Ireland, and biomass power plants in Italy. While such deals are often justified by the seller as efforts to reduce their own exposure to CO2 emissions, they routinely result in plants staying operational for longer. Companies should rather take responsibility for closing down their coal and biomass projects while engaging in site rehabilitation.

Coal: EPH has been capitalising on Europe’s decarbonisation efforts by buying up coal plants other companies divested from, and prolonging their lifespan in various ways. EPH for example acquired Vattenfall's lignite mines and power plants (LEAG) in 2016. The LEAG power plants produced 7.6 percent of the emissions of the entire energy sector of the EU in 2022. While presenting this take-over as an investment in renewable energy, EPH has been expanding the mines and has lobbied to keep coal plants in operation beyond 2030 (Germany’s coal exit date) and to receive compensation for their accelerated shutdowns.

In September 2023, it was revealed that LEAG signed confidentiality agreements with German municipalities to cover up the water pollution caused by their lignite mining operations.

Coal to biomass conversion: EPH operates a significant number of biomass-fired plants and is converting more coal-powered plants to biomass. The IPCC has said that biomass emits more carbon emissions than almost any other fuels. According to a recent report by Fern, EPH is projected to burn about 4.2 million tons of wood in its biomass and coal power plants in 2022 alone, corresponding to 6.2 million tons of CO2. Burning this amount of wood will, however, only produce around 4.5 GWh of electricity which is only 5.3% of Czechia’s estimated power consumption.

In February 2022, EPH reopened France’s biggest biomass plant Gardanne. Gardanne’s operating permit was cancelled in 2017 by the Marseille Administrative Court. The decision was based on the inadequacy of the environmental impact assessment, which did not include the potentially harmful effects of intensive logging for the Gardanne power plant. After being overturned by the Court of Appeal in 2020, the decision was recently reaffirmed by the Council of State.

Fossil gas: According to research by Ember, amongst Europe’s 21 most significant coal-burning power utilities, EPH has the biggest development plans for fossil gas power stations in Europe with almost 6 GW in planned installed fossil gas capacity by 2035. It has also recently acquired two operating power plants in the Netherlands.

Impact on nature and environment

Forest destruction: Burning wood for energy not only exacerbates climate change through increased carbon emissions, it also drives forest destruction around the world. EPH holds all or a majority of the shares of 11 biomass plants in Czech Republic, UK, Italy, France and Slovakia, which burn wood chips or pellets from various logging companies in Central Europe. EPH claims to source wood from local and national suppliers, as well as from wood remainders of local forests, but its biomass supply chains lack transparency. Biomass power plants operated by EPH in the UK and Italy have been linked to unsustainable forestry practices. The huge demand for biomass has been boosting the growth of the European logging sector, dominated by companies such as Graanul Invest, the largest European pellet producer which is also involved in unsustainable forestry practices including logging in protected forests.

A 2022 Italian investigation found that about 1 million tons of wood is burned every year by EPH’s two biomass power plants in Calabria, Italy: the Crotone and Strongoli plants operated by EPH subsidiary Biomasse Crotone. Although detailed information is not made available by Biomasse Crotone, over half of the ships of wood chips that arrive in the harbour which serves these plants arrive from Tuscany, central Italy. Wood biomass producers in this region are routinely accused of causing biodiversity loss, soil degradation and preventing forest regeneration through irresponsible logging practices. In 2022, illegal logging was also reported near the EPH plants in Calabria and attributed to biomass sourcing, leading to a series of arrests and ongoing investigations.

In 2016, EPH acquired the Lynemouth power station in the UK, the second biggest biomass plant in the UK after Drax. Around 1.6 million tonnes of wood pellets are burned in Lynemouth a year. These wood pellets are supplied by Pinnacle Renewable Energy (that was recently acquired by Drax) and Enviva. Both of these wood pellet suppliers use unsustainable forestry practices, including clear-cutting forests, using whole trees to make pellets, and damaging protected forest areas. Enviva was also reported to harvest healthy trees from North Carolina and Georgia, USA.

Water and soil pollution in Lombardy: The EPH-owned Ostiglia Gas Power Plant is located in Mantova in the Lombardy region in Italy, one of the most polluted areas in Europe. The station produces 5 times more energy than needed by the locals, who have been resisting the expansion of the plant since the expansion was approved in 2021.

According to locals, the doubling of the plant will have serious consequences for the ecosystems and the health of the people of Mantova. The proposed expansion area is near the regionally protected natural areas such as Parco del Mincio and River Mincio.

Impact on pandemics

Wood biomass is associated with high rates of deforestation as well as monocultures of various crops. There is a growing body of evidence that shows the connection between deforestation and an increased risk for disease outbreaks and pandemics. For example, monocultures like eucalyptus plantations reduce biodiversity leaving species like rats and mosquitoes, which are more likely to spread dangerous pathogens, to thrive. This biodiversity decline results in a loss of natural disease regulation and poses a risk for human, animal and environmental health.

Other impacts

Misrepresentation of carbon emissions

An investigation in the Czech Republic revealed that EPH has been misrepresenting its impact on the climate by excluding some of its most polluting assets from its emission accounting. The company claims this is due to a difference in exercising ‘operational’ versus ‘managerial’ control over these assets. This allowed EPH to declare less than half of its emissions in 2022. Moreover, EP Corporate Group, the parent company of EPH, set up ‘EP Energy Transition’, a sister company that has the same shareholder structure as EPH. In October 2023, EP Energy Transition acquired a 20% stake in LEAG, one of the largest coal mining companies in Germany. The expectation is that this new company will take over more of EPH’s most carbon-intensive operations. This will create a parallel structure, allowing EPH to appear free from coal by 2025.

Converting coal plants to biomass plants also plays a role in EPH’s misrepresentation of its emissions. Since the European Union classifies biomass as a carbon-neutral source, EPH was able to conceal a quarter of its emissions in 2022. EPH also receives subsidies for converting these plants: it received 195 billion pounds in 2020 from the UK government for the conversion of the Lynemouth power station.

Tax avoidance

According to Czech law, landfill operators must collect fees from the companies they take waste from, and transfer these fees to the municipalities under a compensation scheme. A court case in 2020 confirmed that AVE failed to pay these fees to the Caslav municipality. The company is currently facing charges for tax avoidance.

Freedom of the press

Another issue of concern to civil society has been Kretinsky’s hold on several media outlets. The CEO owns several media outlets in the Czech Republic, stakes in Le Monde and he recently showed interest in acquiring the Telegraph UK. Allegations recently surfaced when the editors of Kretinsky-owned French political weekly Marieanne issued a statement on their Twitter account last year, accusing Kretinsky of "a serious attack on the editorial independence of Marianne" by moderating criticism of Emmanuel Macron ahead of the French presidential elections.

Commercial banks finance EPH via corporate loans and bonds issuance underwriting. See below for more details on banks involved.

2022

2022-04-22 00:00:00 | Coal and gas development still a possible future in Czech Republic thanks to companies like EPH

In the Czech Republic, national energy companies for decades have driven dependence on coal and are now promoting themselves as key players for a gas-based energy transition. However, these companies, including EPH, have been building coal-fired power plants and mines thanks to the financial support of banks and insurance groups. Read more here.

2021

2021-06-01 00:00:00 | UniCredit loses its “best in class” credentials by Reclaim Finance after financing EPH

In September 2020, UniCredit adopted a coal policy that ranked the best practise in Reclaim Finance’s Coal Policy Tool. But less than a year later, the bank lost its ‘best of class’ credentials for participating in a billion euro financing operation for European coal addict EPH. Read more here.

2021-04-15 00:00:00 | Société Générale risks missing its divestment plans by financing EPH

Société Générale’s coal policy has not withstood the test of time, allowing the bank to continue financing key coal players like EPH, which operates coal-fired power stations burning 40 million tons of coal per year and generating 20% of the company's annual turnover. As per the bank’s coal policy, it should no longer be able to finance EPH since the company has no plan to exit coal by 2030. Read more here.

2016

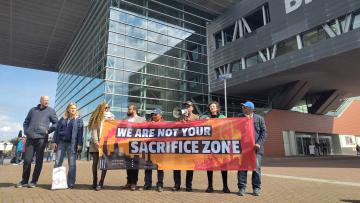

2016-07-05 00:00:00 | Environmental organisations call on major European and American banks to stop bankrolling EPH

A group of environmental organisations has sent a series of open letters to major banks involved in granting over EUR three billion in loans to Czech energy company EPH since 2012. The letters call attention to the role of these banks in financing the expansion of EPH into Europe's old fossil fuel assets to the point where the company is set to become the third-most polluting utility on the continent, despite only having existed for seven years. Signatories of the letters comprise BankTrack, E3G, urgewald and Sandbag. Friends of the Earth France has signed the letter directed at Société Générale.

2016-04-18 00:00:00 | EPH and PPF Investments sign agreement for the acquisition of Vattenfall’s German lignite activities

A consortium of EPH and its financial partner PPF Investments Ltd., announced the signing of an agreement for the acquisition of lignite operations in Saxony and Brandenburg from Vattenfall AB (source: EPH).