The Green Central Banking Scorecard: 2022 edition

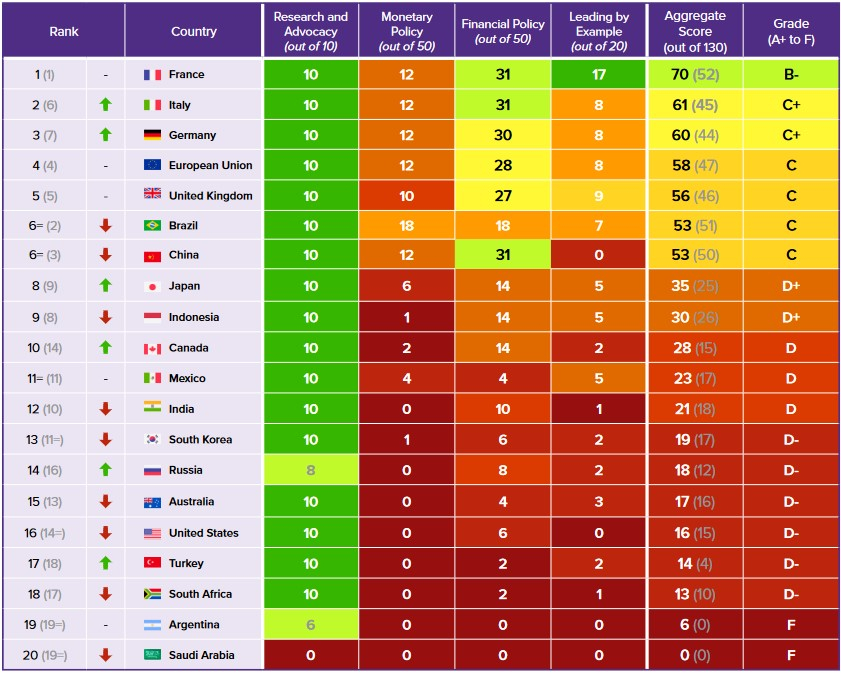

The 2022 Green Central Banking Scorecard updates Positive Money’s ranking of G20 central banks and prudential regulators based on their environmental credentials, to show which countries are leading the way, and which are falling behind.

Central banks are operating in a period of multiple, overlapping crises, yet are failing to use all the tools at their disposal to deal with these emergencies. The acute physical impacts of climate change are materialising globally, with droughts, floods, wildfires and heat waves causing significant economic, social, and human damage. Simultaneously, inflation, driven by the volatile price of fossil fuels, has highlighted that the transition to renewable energy can no longer be delayed.

The report argues that the events of this year demonstrate the ways in which the environmental crisis can undermine the basic conditions for price and financial stability and jeopardise central banks’ ability to fulfil their core mandates. It also warns that interest rate rises risk choking off capital-intensive green investments whilst doing little to address supply-side inflation. While progress has been made since the 2021 edition (particularly in the ‘Research and Advocacy’ category), other than the Banque de France, all G20 central banks and financial regulators continue to score Grade C+ and below.

Leaders and laggards

- The Eurosystem central banks (France, Germany, Italy, and the ECB) have topped the Scorecard due to their leadership on greening monetary policy. The ECB has committed to limit the amount of carbon intensive assets financial institutions can pledge as collateral, as well as decarbonising its own asset purchasing schemes. Senior figures from the ECB have also been discussing the potential for a green lending scheme.

- Japan and China both have green lending schemes, yet have been held back by their failure to decarbonise their monetary policy. China has increased its support for coal over the past year, with billions of Renminbi provided by the People’s Bank of Canada for coal lending. Japan continues to keep fossil fuel assets in its collateral frameworks and asset purchasing schemes.

- Despite the Federal Reserve’s recent commitment to conduct a climate scenario analysis in 2023, the US is trailing behind in 16th place. Compared to other economies with high levels of large historical emissions, the US is a laggard on climate-related monetary and financial policy.

- The UK has just held on to its 5th place position due to keeping pace with the ECB on financial regulation and disclosures. The Bank of England will have to be more ambitious on greening monetary policy to stay in the top 5.

- Brazil, home to the world’s largest tropical rainforest, has slipped from second place to joint sixth due to the central bank’s relatively slow progress in implementing its formal commitments, and India has also fallen one place to 12th position.

Key recommendations for central banks

Research and advocacy: Central banks and financial regulators should promote and adopt the precautionary approach and a double materiality framework to manage environmental risks. G20 central banks with the greatest historic contribution to climate change should bear the most responsibility for action.

Monetary policy: Central banks should green and expand monetary policy toolkits by creating green lending facilities and negatively screening for environmentally harmful activities in asset purchasing programmes and collateral frameworks.

Financial regulation: Financial regulators should actively supervise environmental risks by adapting capital requirements and implementing limits on lending to the most environmentally destructive projects and companies. Financial institutions should be required to show supervisors how they will transition with credible short term targets.

Leading by example: Central banks should lead the way by aligning their own non-monetary policy portfolios with the Paris Agreement and environmental goals.

Notes:

The original press release can be accessed here.

An interactive version of the scorecard is available here.

The full report can be downloaded here.