Climate activists challenge Standard Bank’s plans to fund fossil fuel expansion in Africa

Ryan Brightwell, Human Rights Campaign Lead, BankTrack, +31 6 346 431 16

Annette Gibbs, Communications Manager, Just Share, +2782 467 1295

Ryan Brightwell, Human Rights Campaign Lead, BankTrack, +31 6 346 431 16

Annette Gibbs, Communications Manager, Just Share, +2782 467 1295

At Standard Bank’s annual general meeting (AGM) on 31 May, climate activists from Africa and abroad gathered (virtually) to demand answers from the bank on its involvement in the East African Crude Oil Pipeline (EACOP), gas extraction in Mozambique, and its support for fossil fuel expansion on the continent.

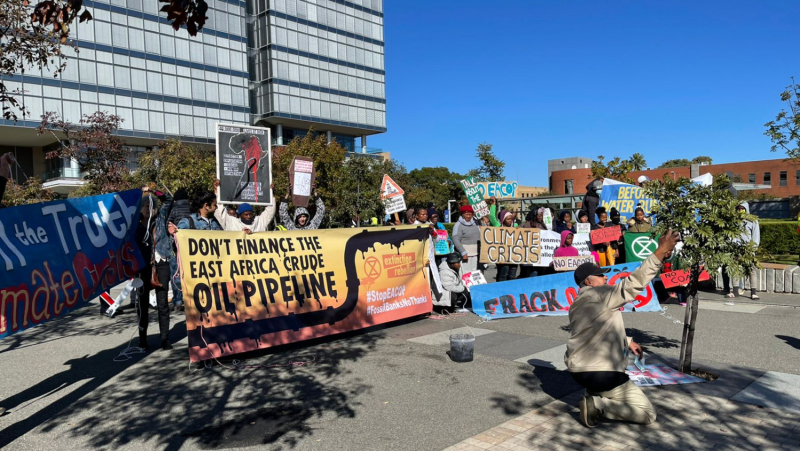

For the fourth year in a row, the board and executives were inundated with questions from members of the global #StopEACOP campaign about the bank’s reckless approach to climate risk in Africa. At the same time, activists from 350Africa, EarthLife Africa, and XR South Africa protested outside Standard Bank’s headquarters, demanding an end to fossil fuel financing, and an immediate commitment to withdraw its involvement in EACOP.

Also at the AGM, 99.7% of shareholders voted in favour of a resolution filed by Just Share and Aeon Investment Management. The resolution requested that the bank calculate and disclose the financed greenhouse gas emissions from its exposure to oil and gas, and set targets for reducing that exposure in line with the goals of the Paris Agreement.

Standard Bank states that it supports the Paris Agreement. However, this support appears to focus exclusively on only one element of the Paris Agreement: “the principle of equity and common but differentiated responsibilities and respective capabilities, in light of different national circumstances”.

This principle recognises that developed nations have contributed most to anthropogenic climate change, and that they should make the fastest and most dramatic cuts to carbon emissions. Developing nations require resources and support from developed nations to achieve their own just transitions, and may require longer to do so.

Standard Bank, however, contends that this principle means that Africa must continue to exploit fossil fuels, because these are necessary to “support access to reliable energy that supports economic growth and poverty alleviation”. This position is not in line with climate science, nor with the reality of fossil fuel extraction in Africa. The financial benefits of this extraction are overwhelmingly exported to developed nations, while Africans bear the brunt of the devastating social and environmental impacts.

The EACOP is a case in point: a 1443km heated crude oil pipeline that will transport oil extracted by TotalEnergies in Uganda (including from inside the Murchison Falls National Park), through multiple areas of sensitive and irreplaceable biodiversity, displacing thousands of local people from their land, to the Port of Tanga in Tanzania, where it will be exported to foreign markets.

Another example is the bank’s financial backing of liquefied natural gas (LNG) projects in Mozambique’s war-ridden gas region. Despite the various gas investment projects, Mozambique remains one of the poorest, least-developed and most heavily-indebted countries in the world. Annual growth rates have progressively fallen, and external debt as a proportion of GDP has trebled. Since most of the domestic gas allocation will be sold overseas, new gas production will not directly support increased energy access in Mozambique. As Ilham Rawoot of Justiça Ambiental (JA!)/Friends of the Earth Mozambique points out, “although many other financiers are doing a full reassessment of their involvement in these LNG projects, Standard Bank continues to fund them. Despite the claims that gas production would improve Mozambican government revenues, support wider economic development, and address energy needs, Mozambicans are poorer than they were a decade ago and the country will be left with stranded assets and no resources to support an alternative development pathway.”

As Diana Nabiruma, from the Africa Institute for Energy Governance (AFIEGO) recently told the Bureau of Investigative Journalism, “which oil-producing community in Africa is rich? Are the communities in the Niger Delta rich? Are the people in the Central African Republic rich? Who are you trying to fool?”

Activist shareholders representing civil society organisations AFIEGO, the Laudato Si Movement, BankTrack, 350Africa, JA!/Friends of the Earth Mozambique, Just Share, and the Centre for Environmental Rights asked detailed and specific questions at the AGM.

Nevertheless, Standard Bank’s CEO, Sim Tshabalala, its Chairman, Thulani Gcabashe, and other executives repeatedly deflected these questions by referring to the Group’s Climate Change Policy, which it states “is based on the imperative of the just transition for Africa and the principle of common but differentiated responsibility for countries at differentiated levels of development codified in the Paris Agreement”.

In a rare direct response, Tshabalala committed to ensuring that the Social and Environmental Consultant’s report into the EACOP project, commissioned by Standard Bank, would be made publicly available, but declined to say whether the final report had raised any “red flags”. The Consultant, named as Golder Associates, has now provided its final report to the lenders and it is under review.

Ryan Brightwell, Human Rights Campaign Lead at BankTrack commented, "Standard Bank repeatedly stressed at its AGM that it has not made a decision about whether to finance EACOP. But the bank has been acting as a financial advisor to the project for four years, so it is helping to facilitate it. Standard Bank is already involved and implicated in the severe social, environmental and climate impacts this oil pipeline will cause and the human rights impacts it has already led to. It is time for the bank to stop prevaricating, step away from EACOP for good, and instead dedicate its resources to supporting an alternative, clean development path for East Africa.”

More than 20 banks, including most of TotalEnergies’ largest bankers, have made it publicly known that they will not join the project loan.