Banks ready to finance false solutions to the climate crisis

As COP29 starts in Baku today, the pilot version of a new tracker from BankTrack finds that most banks include ‘false solutions’ in their sustainable finance targets. These are energy technologies – such as nuclear power, burning biomass, and carbon capture, which are inconsistent with promoting a just transition towards energy democracy.

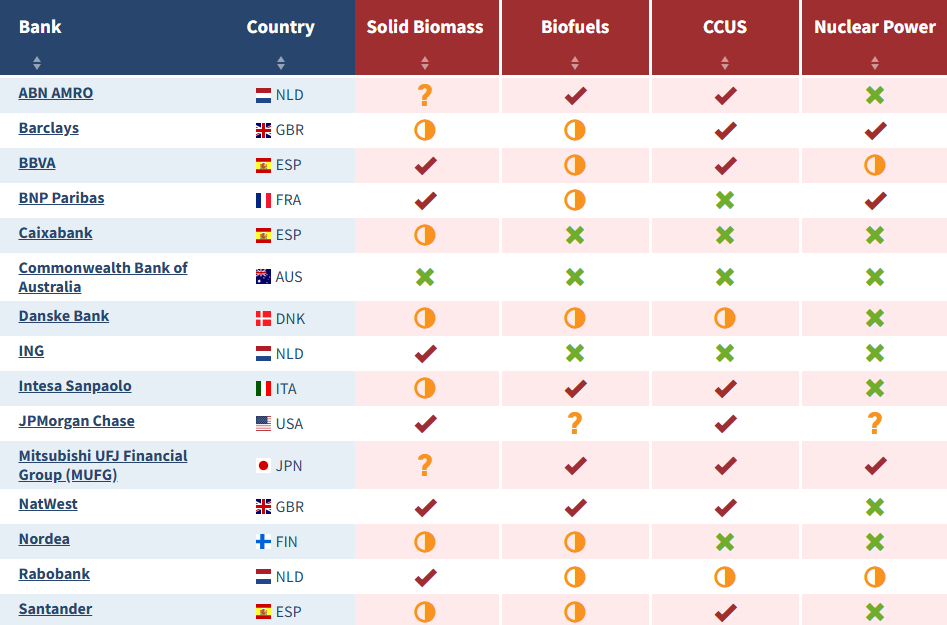

BankTrack’s False Solutions Tracker assesses 15 banks on which energy sources they include within their sustainable or green finance commitments. These energy sources are classified into three categories: ‘real solutions’, ‘solutions under strict conditions’ and ‘false solutions’. While almost all banks are ready to finance real solutions such as wind and solar, most of them also have false solutions in scope, potentially reducing the amount of financing available for real solutions.

At the 2023 COP28 in Dubai, the first global stocktake of the Paris Agreement recognised that a tripling of renewable energy capacity globally by 2030 was required to align with a 1.5ºC pathway, with investments in renewable energy capacity to match. While many banks have produced sustainable finance targets aimed at meeting this challenge, the finding that many banks are including technologies widely considered unsustainable or unlikely to deliver a just transition will add to concerns at this year’s UN climate conference about the volume of capital available for financing genuine solutions.

The pilot tracker shows Barclays, BBVA and Rabobank as using the widest definition of what they consider sustainable finance solutions, including all four of the energy technologies widely considered as false solutions (solid biomass, biofuels, CCUS and nuclear power) with or without conditions. On the other side of the scale, Commonwealth Bank of Australia is the only bank that excludes all four false solutions from its sustainability funding target.

Solid biomass and biofuels are the false solutions most commonly featured in the scope of banks’ sustainable finance targets, with respectively 12 and 11 of the 15 banks assessed including them. The situation is roughly the same for Carbon Capture, Utilisation and Storage (CCUS) which is included by 10 of the 15 banks. Nuclear power is excluded from finance by 9 of the 15 banks assessed, with only five banks considering finance for it as part of their sustainable finance targets.

Although public commitments of banks on the volume of sustainable or green finance that they are going to provide often make headlines, it is usually hard to understand the exact scope of their commitments, with each bank using a different definition.(1) BankTrack is urging banks to ensure the whole of their sustainable finance target is used to finance energy solutions that contribute to a just transition.

Quentin Aubineau, Policy Analyst at BankTrack, said: “As COP29 starts in Baku, it is crucial to ensure that false solutions are excluded from bank climate finance goals, and to avoid building a green energy system that replicates many of the same problems of the current fossil energy system, such as adverse impacts on local communities and the environment. To ensure this, banks need to be transparent about the scope of their sustainable finance target, and to exclude false solutions that are incompatible with a just transition towards energy democracy.”

Notes:

(1) The 15 banks were contacted prior to the publication of the tracker, 12 of them provided feedback. For each bank, relevant policy documents are listed in the False Solutions Tracker.