Nordic banks real climate footprint revealed

Jakob König, Project lead Fair Finance Guide, Tel: +46 73 037 92 93, fairfinanceguide.se

Jakob König, Project lead Fair Finance Guide, Tel: +46 73 037 92 93, fairfinanceguide.se

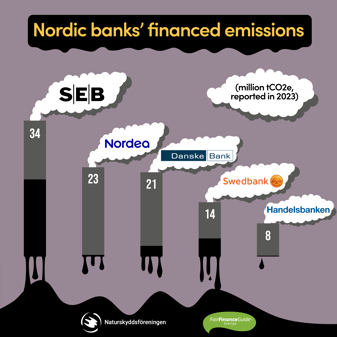

The five largest banks in Sweden report record profits - at the same time they cause climate emissions of close to 100 million tons every year and do far too little to reduce the emissions. This is shown by a new report from the Fair Finance Guide Sweden and the Swedish Society for Nature Conservation.

In the report "The real carbon footprint of Swedish banks", Fair Finance Guide Sweden and the Swedish Society for Nature Conservation have carried out the first mapping of the real climate impact of the five largest banks in Sweden. This is caused almost entirely by the emissions from companies and other activities that the banks finance. The result shows that SEB, Nordea, Danske Bank, Swedbank and Handelsbanken together cause emissions of almost 100 million tons of greenhouse gases each year - which is twice as much as the emissions of the whole of Sweden. However, the differences between the banks are large. SEB's loans cause the largest emissions with 34 million tons and Handelsbanken causes the least with 8 million tons.

"The banks are making record profits while using their clients’ money to enable climate-damaging activities. I think this upsets many Swedish bank clients", says Jakob König, who leads the Fair Finance Guide in Sweden.

Large emissions from billions to oil companies

It is noteworthy that a large part of SEB, Swedbank and Danske Bank's climate impact comes from lending to oil and gas companies. The worst is SEB, where it accounts for over half of the bank's financed emissions (57 percent), despite the fact that loans to oil companies only make up just over two percent of the SEB’s total lending. "This shows how climate-damaging lending to the fossil fuel industry is. The banks have long said that lending to oil companies accounts for a very small part, but our report shows how enormous emissions it causes", says Karin Lexén, secretary general of the Swedish Society for Nature Conservation.

All lack adequate transition plans

The report has also assessed the banks’ transition plans against key UN recommendations. The results shows that the banks have big gaps in their plans to reduce emissions from lending in line with the Paris Agreement. Among other things, none of the banks has targets for reducing emissions in the short term and none demand that all fossil fuel companies have phase-out plans. Only Handelsbanken and Danske Bank have completely stopped lending to companies that expand the extraction of fossil fuels.

Support increased fossil extraction

Fair Finance Guide Sweden has previously revealed how several major Swedish banks continue to give new multi-billion dollar loans to oil companies that exploit new oil discoveries, including in the Arctic. This runs counter to climate research, which says that new extraction of fossil fuels is not compatible with the Paris Agreement's 1.5-degree target. The latest example is the Rosebank oil field outside the Shetland Islands, which is owned by the Norwegian company Equinor and to which SEB and Nordea have lent several hundred million Swedish crowns. Recently, the British climate minister resigned in protest against the new planned oil and gas fields.

More protests are needed

Tens of thousands of Swedish bank customers have so far called on the banks to stop their fossil fuel finance. The banks have responded by making several improvements, including tightening their guidelines and reducing lending to fossil fuel companies. "We see that the protests from bank clients’ have an effect on the banks. But even greater pressure is needed to reach all the way, so that the banks become part of the solution to the climate crisis instead of part of the problem", says Jakob König.

The full report can be downloaded here.

(Reposted from the original press release on the Fair Finance Guide Sweden website here).