Banks and Oil & Gas

For any feedback or questions on this page please contact us at

climate@banktrack.org, or diogo@banktrack.org

For any feedback or questions on this page please contact us at

climate@banktrack.org, or diogo@banktrack.org

Whereas global carbon dioxide emissions from burning coal have levelled off since 2010, emissions from oil and gas have continued to rise. Despite having a lower carbon dioxide intensity than coal, global carbon dioxide emissions from burning oil are now almost as high as those from coal and emissions from gas are increasing faster than both coal and oil. Although gas is often marketed as a 'transition fuel', it consists predominantly of the powerful greenhouse gas methane, which has a stronger ability to trap heat in the atmosphere than carbon dioxide and has been shown to often leak during processing, storage or distribution.

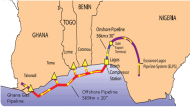

Historical opposition and campaigns against fossil fuels have for a large part focused on coal, with initial oil and gas opposition focused on the most polluting and unconventional sub sectors such as tar sands and fracked oil and gas. Now campaigning has expanded to include conventional oil and gas fields and infrastructure such as Pipelines, Liquified Natural Gas (LNG) and Floating Liquified Natural Gas (FLNG) projects due to their impacts on the environment, human rights and nature. Oil and gas projects have been linked to adverse impacts on the health and livelihoods for local populations near these sites, undeclared flaring incidents that increase greenhouse gas emissions and destruction of local ecosystems during construction and operation.

The policies adopted by banks over the past few decades regarding fossil fuels mirror the focus of the opposition to different sectors, especially in Europe. Most restrictions have been placed on the financing of coal, with far fewer restrictions being placed on financing oil and gas, excluding mostly the most environmentally destructive forms of oil and gas such as tar sands, Arctic oil and gas, and fracked oil and gas.

Financing of oil and gas

In order to meet the 1.5 degrees celsius temperature goal set in the Paris Climate Agreement, global carbon dioxide emissions must be more than halved from 2010 levels by 2030 and reach ‘net zero’ by 2050. This gives us a 50% chance of staying below a 1.5 degrees temperature increase by 2100. By 2030, emissions from burning oil and gas have to decrease by at least 35% and 18%, from 2019 levels respectively, to achieve the International Energy Agency (IEA)’s Net Zero Emissions by 2050 scenario. The IEA scenario also states that no new conventional oil and gas projects are required to meet net zero emissions by 2050 and that the current annual investment in oil and gas supply needs to be halved by 2030 to meet declining demand.

Despite these clear climate goals and projections of declining demand, oil and gas investment has increased, completely ignoring the goals set in the Paris Climate Agreement and devastating local ecosystems. Banks must end support for all new oil and gas activities and implement a full phase-out for financing oil and gas projects and companies in line with the Paris Climate Agreement.

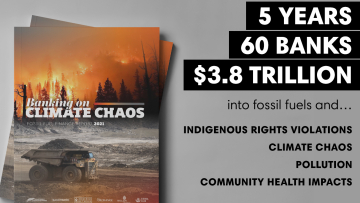

Since signing of the Paris Climate Agreement, the 65 largest banks in the world have financed the fossil fuel industry with more than USD 7.9 trillion. The world's four biggest financiers are US banks JP Morgan Chase, Citi, Bank of America and MUFG from Japan.

See here for banks' exposure to oil and gas sectors in 2016-2024.

What banks must do

For an oil & gas sector compatible with a safe climate for present and future generations, banks must:

-

Adopt policies immediately excluding new finance for projects & companies expanding oil & gas production

-

Endorse the Fossil Fuel Non-Proliferation Treaty

-

Adopt policies phasing out all oil & gas finance in line with a just transition within a 1.5ºC-warming scenario

Oil and Gas Policy Tracker

Reclaim Finance tracks the oil and gas policies of financial institutions, including banks, in the Oil and Gas Policy Tool. The table can be filtered by Country and for Net-Zero commitment membership (e.g. Net-Zero Banking Alliance). For more information about the tool and methodology, see www.oilgaspolicytracker.org

BankTrack also monitors the sectoral decarbonisation targets of key banks, for more on that see here.

Feedback welcome

Our policy assessments are always a work in progress and we very much welcome any feedback, especially from banks included in them. You can of course also contact us for more information on specific scores and the latest policy changes. Please get in touch at climate@banktrack.org.

Fracking is Hell: Allen and the YPF Trap

YPF drilled more than 200 wells in the Allen area and since then there have been explosions, spills and various accidents.

The dark side of US LNG

The Dark Side of US LNG is the result of a field mission to the United States to uncover the strong and growing ties between Italy, and in particular Italy's largest banking group, Intesa Sanpaolo, and the American liquefied natural gas (LNG) sector. Interviews by ReCommon. Filming, editing and music: Carlo Dojmi di Delupis. www.recommon.org