Active

This profile is actively maintained

Active

This profile is actively maintained| Website | http://www.natixis.com/ |

| Headquarters |

30, avenue Pierre Mendès France

75013 Paris

France

|

| CEO/chair |

Stéphanie Paix CEO |

| Supervisor | |

| Ownership |

listed on NYSE

Majority shareholder is BPCE, which directly holds 71% of Natixis share. |

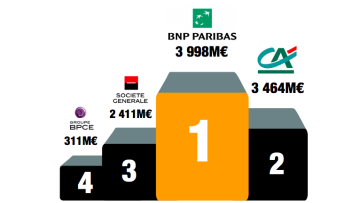

Natixis is a French corporate and investment bank created in 2006 from the merger of the asset management and investment banking operations of Natexis Banque Populaire (Banque Populaire group) and IXIS (Caisse d'Epargne group). Natixis is the wholesale banking, investment management and financial services arm of Groupe BPCE, the cooperative bank born out of the merger between Banques Populaires and Caisses d'Epargne. Natixis is affiliated to the group's central body, i.e. BPCE, which directly holds 71% of its capital. As such, Natixis benefits from the group's financial solidarity system.

Natixis' most important sustainability commitments can be found at the website sections listed below. Natixis is a subsidiary of Groupe BPCE and as such follows Groupe BPCE's sustainability commitments and sector policies.

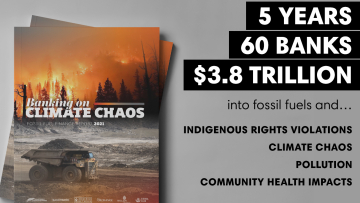

Natixis is linked to a number of companies and projects that BankTrack considers controversial (so called Dodgy Deals), e.g. as a current or past financier or through an expression of interest. The profiles below provide more details on the nature of Natixis's link to these deals.

Natixis operates a complaints channel which can be accessed here.

Natixis is an Equator Principles signatory. While the Equator Principles have no official grievance mechanism, complaints relating to this bank's financing of Equator Principles projects can be filed through our own website www.equator-complaints.org.

This page evaluates Natixis's responses to instances of alleged human rights violations linked to its finance, raised by civil society organisations. It is not intended to be exhaustive, but covers selected impacts raised by BankTrack and other civil society partners since 2016. For the full scoring methodology, see here. For more information about BankTrack's evaluation of bank responses to human rights impacts, see the 2021 report "Actions speak louder: assessing bank responses to human rights violations".

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 200

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 200

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 209

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 209

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 217

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 217

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 220

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 220

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 223

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 223

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once