Banks and offshore oil and gas

For any feedback or questions on this page please contact us at climate@banktrack.org

For any feedback or questions on this page please contact us at climate@banktrack.org

Go to offshore oil and gas policy table Go to offshore oil and gas exclusion table

Offshore oil and gas

Offshore oil and gas refers to all exploration taking place at sea. Oil and gas can be extracted by drilling a borehole below the seabed and transporting the oil or gas to onshore facilities by either a pipeline or via oil/LNG-carrying ships. Offshore oil and gas production is more challenging than land-based installations due to rough seas, a lack of pre-existing infrastructure, and the need to anchor the platform to the seabed or keep it in place using GPS systems, called dynamic positioning. Drilling at sea is also very expensive – up to many hundred millions of US dollars per well – and can only be profitable when the oil or gas price is high. Recent exploration has opened new areas for offshore oil and gas drilling in Guyana, Suriname, the Mediterranean, and South Africa.

Drilling offshore for oil and gas is dangerous and several disasters have occured in the last decades, of which the blowout and oil spill of Deepwater Horizon in 2010 remains arguably the most dire example. But even when oil or gas spills do not occur, offshore operations have a negative impact. The drilling itself, its production water (which contains oil and suspended solids), and daily operations on the platform all negatively affect the environment. Finally, the costs of decommissioning an oil platform at the end of operations can cost up to a couple of hundred million US dollars per platform, which oil companies are often not willing to pay. As a consequence, companies often leave these platforms, or parts of them, to deteriorate.

Banks and offshore oil and gas

The severity of the climate crisis requires that banks must urgently take steps to disengage from financing all business activities and projects that continue the world's reliance on fossil fuels. Banks must therefore end support for all new offshore oil and gas projects and implement a full phase-out for financing offshore oil and gas, in line with the Paris climate agreement.

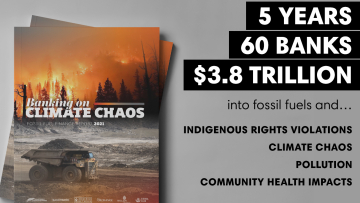

The biggest financiers of offshore oil and gas since the Paris Climate Agreement (2016-2021) are BNP Paribas (USD 36.5 billion), JPMorgan Chase (USD 35 billion) and Citi (USD 34.5 billion).

Bank policies on offshore oil and gas are assessed below. These assessments follow the methodology of our Banking on Climate Chaos 2022 report, published in March 2022. The details section in the table contains further detail on the exact scoring per bank, as well as an overview of relevant policies.

See here for banks' exposure to the offshore oil and gas sector during 2016-2021.

Banks excluding finance for offshore oil and gas

A number of banks have already taken steps to fully or partially exclude offshore oil and gas projects or companies involved in offshore oil and gas operations from their investments. The table below lists banks that have taken such steps.

Exclusion table offshore oil and gas

This table lists banks that have adopted a full ( ) or partial ( ) exclusion policy for offshore oil and gas projects and/or companies. Click on 'Details' for the rationale of this assessment for each bank.

Feedback welcome

Our policy assessments are always a work in progress and we very much welcome any feedback, especially from banks included in them. You can of course also contact us for more information on specific scores and the latest policy changes. Please get in touch at climate@banktrack.org.