Active

This profile is actively maintained

Active

This profile is actively maintained| Website | https://www.kbc.com |

| Headquarters |

Havenlaan 2

1080 Brussels

Belgium

|

| CEO/chair |

Johan Thijs CEO |

| Supervisor | |

| Ownership |

listed on Euronext Brussels

KBC's shareholder structure can be accessed here. |

KBC was established in 1998 from a merger between two Belgian banks, the Kredietbank and CERA Bank, and the Belgian insurance company ABB. KBC is an integrated bank-insurance group, catering mainly to retail customers, small and medium-sized enterprises and private banking clients. It operates in its home markets of Belgium and Central and Eastern Europe, where it specialises in retail bank-insurance and asset management activities, as well as in the provision of services to businesses. The group is also active in a selection of other countries in Europe in private banking and services to businesses.

KBC's most important sustainability commitments can be found at the website sections listed below.

KBC is linked to a number of companies and projects that BankTrack considers controversial (so called Dodgy Deals), e.g. as a current or past financier or through an expression of interest. The profiles below provide more details on the nature of KBC's link to these deals.

KBC operates a complaints channel which can be reached via csr.feedback@kbc.be.

KBC is an Equator Principles signatory. While the Equator Principles have no official grievance mechanism, complaints relating to this bank's financing of Equator Principles projects can be filed through our own website www.equator-complaints.org.

This page evaluates KBC's responses to instances of alleged human rights violations linked to its finance, raised by civil society organisations. It is not intended to be exhaustive, but covers selected impacts raised by BankTrack and other civil society partners since 2016. For the full scoring methodology, see here. For more information about BankTrack's evaluation of bank responses to human rights impacts, see the 2021 report "Actions speak louder: assessing bank responses to human rights violations".

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 200

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 200

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 209

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 209

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 217

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 217

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 220

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 220

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 223

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 223

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

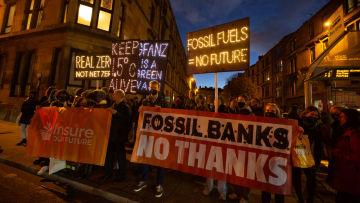

Banks and Climate

Partner organisation Reclaim Finance tracks the coal, oil and gas policies of financial institutions, including banks, in their Coal Policy Tool (CPT) and the Oil and Gas Policy Tracker (OGPT). BankTrack works closely with Reclaim Finance and endorses their policy assessments. Find further details on their assessment of KBC's fossil fuel policy below.

Banks and Russian Aggression in Ukraine

BankTrack is keeping track of the public response of KBC to Russia's illegal invasion of Ukraine. KBC did not publicly condemn the war. KBC is considered by Leave-Russia.org to be "suspending" its operations in Russia. We consider its exposure to Russia as limited. For further details, see the table linked below.