New analysis shows bank responses to human rights enquiries worsening

Blog by Oriane Bui, Human Rights Intern at BankTrack

A new update of BankTrack’s Response Tracking database shows that bank responses to letters from civil society groups raising human rights issues are getting worse, not better. However, it also highlights a few positive examples of banks taking their responsibility seriously by clarifying their links to companies and communicating how they are seeking to address human rights impacts and risks.

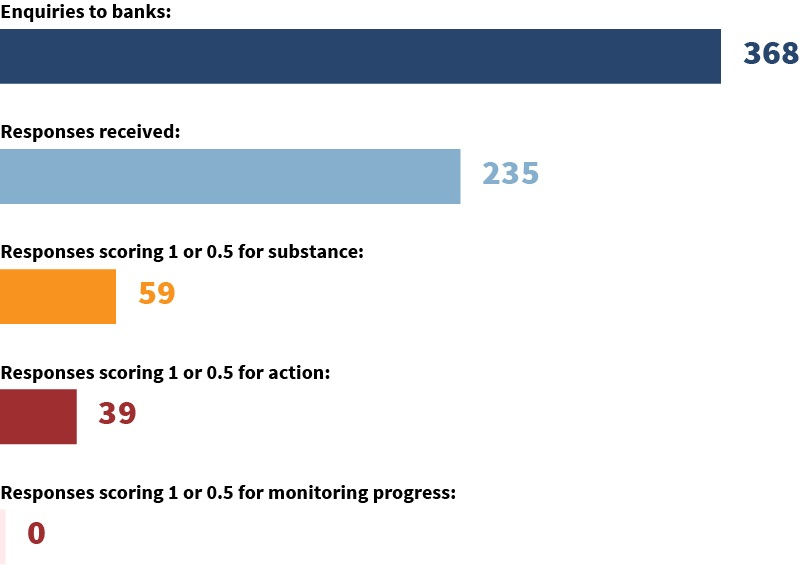

The update adds analysis of 126 responses or non-responses from banks to the database, making a total of 368 communications covering 29 different cases of human rights allegations involving 64 banks. Each bank response is scored on three criteria: quality of response, action taken, and monitoring.

Only six responses out of these 126 gained any score at all. In the remaining cases, banks either did not respond, or where they did, their response neither comment on the substance of the issue raised, acknowledge the bank’s link to the impact, or set out any action taken.

BankTrack’s Response Tracking database was developed in 2021 as part of the Human Rights Benchmarking project. It is designed to supplement the Benchmark’s assessment of bank policies, processes and reporting, with an assessment of how banks respond to civil society organisations alleging specific human rights violations linked to their finance.

The database is, like the Human Rights Benchmark, rooted in the requirements of the UN Guiding Principles on Business and Human Rights. These set out that businesses “should communicate efforts to address human rights impacts externally … particularly when concerns are raised by or on behalf of affected stakeholders.” Following this standard, banks should respond substantively and engage constructively when human rights issues are raised by affected rights holders and their representatives. However, in reality, this is happening less and less.

Trends in responses

The update reveals worrying trends in the quality of bank responses. Out of the 126 letters added to the database, mostly sent since mid-2024, banks responded in 79 cases. However, of these, the great majority were non-scoring responses, meaning banks simply confirmed receipt or described general policy approaches which are already in the public domain. These are responses that neither discuss the substance of the issues raised, nor acknowledge the bank’s link to the impact discussed. Only six responses (under 5%) received any points at all.

Bank responsiveness has stayed steady, with 64% of banks responding both before and after the update. However, there has been a dramatic decrease in the quality of responses received. Before this update, 55 bank responses, or 24% of the total, were assessed as at least somewhat constructive, scoring at least half a point. This update brings the total of somewhat constructive responses to 61 out of a total of 368, or 17%. The database also shows that many banks are inconsistent when it comes to whether and how they respond.

Positive examples from Nordea and Crédit Agricole

The best scoring response in the new update, scoring for both responsiveness and setting out action taken, was from Nordea to BankTrack’s letter regarding Rio Tinto’s proposed Jadar mining project. It explicitly recognises the concerns raised regarding the project, and sets out how the bank has engaged with its client to address the human rights and environmental issues raised. While the bank did not set out further how it has exercised its leverage or taken any further steps to address the impacts, the response serves as a reminder that it is possible for banks to take human rights issues seriously, and show that they are doing so, in line with their responsibilities.

Crédit Agricole received partial scores for two of its responses, clarifying the bank’s relationship with a subsidiary of the Azerbaijani state oil company SOCAR, and discussing the status of the Mozambique LNG project, its dialogue with civil society and its monitoring of the situation. These responses failed to score on setting out action taken in response to the issues, but represent a greater degree of transparency in comparison to other responses analysed.

Contradictions in client confidentiality obligations

Many banks cite “client confidentiality” as an excuse not to address the issues raised, although there are steps banks can take to overcome this. For example, client consent to disclose the fact of a relationship could be sought systematically at the point of onboarding. “Client confidentiality" is a convenient choice for banks looking to avoid transparency.

However, this excuse is used inconsistently, with some banks sometimes commenting specifically on their link or alleged lack thereof to the project, or on the project itself. Société Générale is an example of this discrepancy, having scored multiple times in the past, including a score of 1.5 in a letter recognizing the bank’s link to Vitol and Trafigura, yet citing a policy of “not providing information regarding specific companies or operations” to refrain from commenting on more recent cases. Standard Chartered and SuMi Trust have also at times claimed confidentiality concerns, and at others, responded directly on their financing of specific companies.

ING, Intesa Sanpaolo, and Société Générale all previously claimed they were unable to comment on specific customers for reasons of client confidentiality, but were able to provide specific details regarding the Lefa gold mine project. The context of Russian sanctions against Lefa’s owner, Nordgold, might have made better quality responses easier for banks to sign off internally.

This inconsistency and the varying quality of bank responses underlines a lack of accountability across the sector. Bank transparency should not be dependent on political context, but rather, should be a sector-wide standard.

A message to banks: do better

Alignment with international human rights frameworks implies the adequate implementation of policies and processes to prevent, recognise, and address human rights violations. Bank policies mean nothing if they are not effectively executed, making transparency the bedrock for ensuring compliance with international human rights frameworks in the banking sector. The inconsistency with which banks respond meaningfully to human rights inquiries and existence of higher scoring responses reveal the potential for much more consistent and substantive transparency standards. The concealment of financing activities through client confidentiality obligations calls for a sector-wide levelling up, whereby this alleged legal shield is no longer used to exonerate egregious bank financing from public scrutiny.

Overall, the declining quality of bank responsiveness shown in this update risks disincentivising civil society engagement with banks, and incentivising other more disruptive strategies. It also highlights, once again, the need for stronger sector-wide obligations, such as by extending Europe’s CSDDD regulation to the “downstream” impacts of the finance sector and the development of comparable legislation in other jurisdictions around the world.

Appendix: Issues covered in the new update

This analysis covers bank responses to human rights issues raised by BankTrack or its partners between May 2023 and September 2025:

-

Israeli arms companies: Dutch peace group Pax contacted 11 banks in June 2024 regarding their financing of arms companies supplying Israel, in the context of the country’s assault on Gaza.

-

Jadar lithium mine; Serbia: BankTrack and partners approached 37 banks in May 2025 regarding the severe human rights and environmental impacts of Rio Tinto’s proposed Jadar lithium mine in Serbia.

-

JSW Utkal steel and coal in India: BankTrack contacted 22 banks in February 2025 regarding JSW Steel’s plans to build a massive and expensive steel and coal-fired power plant.

-

Lefa Gold Mine; Guinea: BankTrack approached six banks in May 2023 about their previous finance for Norgold, the Russian mining company responsible for the Lefa gold mine in Guinea. Communities had asked to be relocated following the project’s impacts, and been ignored.

-

Mozambique LNG: A coalition of groups contacted 10 banks (and other non-bank financial sector organisations) in December 2024 regarding TotalEnergies’ LNG project in Mozambique, which is linked to serious human rights violations including an alleged massacre of civilians.

-

PLN and fossil fuel expansion; Indonesia: BankTrack and partners approached 16 banks in March 2025 regarding the impacts of their finance for Indonesia’s state electricity company and largest fossil fuel emitter, Perusahaan Listrik Negara (PLN).

-

Raiffeisen Bank in Russia: BankTrack and partners approached Raiffeisen Bank International in June 2025 regarding its role in Russian gas payments.

-

SOCAR, Azerbaijan's fossil fuel proxy: In response to a report by Urgewald and the CEE Bankwatch Network, Business & Human Rights Resource Centre contacted 12 banks, among other financial institutions, in October 2024 over their financing of SOCAR, Azerbaijan's state owned oil company, including the human rights impacts of its prolific oil and gas exploration.

- Trafigura in DR Congo: The Our Land Without Oil coalition contacted 12 banks in June 2025 to urge engagement with Trafigura to urge the company to withdraw from oil projects in DR Congo.