Overview: closed complaints on banks

This page gives an overview of OECD Guidelines complaints with results of particular relevance to private sector banks. For a full overview of OECD complaints relating to the financial sector, see the OECD Watch case database.

BankTrack, Worth Rises and Northern Manhattan Coalition for Immigrant Freedom vs. Swiss National Bank, UBS, HSBC and Barclays.

The complaints against the three commercial banks were accepted, although all three refused mediation. The Swiss NCP's Final Statement recommended UBS make improvements, such as including passive investments in its overall risk screening, and reviewing its existing holdings. The UK NCP's Final Statement is still to come.

Society for Threatened Peoples Switzerland vs. UBS Group (Filed June 2020, concluded Dec 2021)

Upon accepting the complaint, the Swiss NCP affirmed that “a direct link between UBS’s products and services and the alleged human rights violations could not be excluded”. This represents the first time an NCP has recognized the responsibility banks have for their passive investments through indexed funds.

However, on a second element of the complaint, the NCP concluded that no business relationship between UBS and Hikvision exists in relation to UBS’s role as custodian for Hikvision shares on behalf of clients. BankTrack and OECD Watch wrote to the UN Human Rights office, which subsequently clarified that banks do have responsibilities when it comes to the impacts of companies in which they hold shares on behalf of clients.

- OECD Watch Case Database

- Final Statement

- UN Human Rights Office letter

- BankTrack & OECD Watch reaction

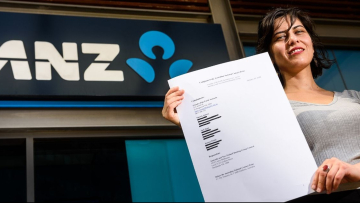

Australian bushfire victims and Friends of the Earth Australia vs. ANZ Bank (filed January 2020, concluded December 2021)

The Australian NCP concluded that ANZ’s lending and investment practices are ‘consistent’ with the Guidelines, which resulted in disappointment for the complainants. Nonetheless, the NCP called for the OECD guidelines to be updated to address human rights threats caused by climate change, a statement welcomed by OECD Watch.

However, OECD Watch considers the NCP’s decision to be a conservative interpretation of the OECD Guidelines, particularly the responsibility of an entity in the financial sector for their adverse impacts, as well as the scope of due diligence vis-a-vis climate change.

ING’s contribution to climate change (Filed May 2017, Cocluded April 2019)

The Dutch NCP concluded that ING Bank must set concrete climate goals for its financial services that are in line with the Paris Climate Agreement. The parties reached an agreement on several points. Firstly, ING will adopt the Terra approach, with the underlying PACTA and PCAF methodologies, to measure, set targets, and steer the bank’s climate impact. Secondly, ING committed to reduce its thermal coal exposure to close to zero by 2025 and refrain from financing new coal-fired power plants. Thirdly, ING would collaborate with BankTrack, Greenpeace, Milieudefensie, and Oxfam Novib to call upon the Dutch Government to request the International Energy Agency to develop as soon as possible two models that both provide a 66% chance to limit global warming to below 1.5 degrees. This complaint saw the Dutch NCP take a clear position on climate goals for the first time.

Credit Suisse and the Dakota Access Pipeline (Filed April 2017, Concluded October 2019)

Credit Suisse agreed to update its internal guidelines on project financing. Credit Suisse agreed to incorporate language on project financing for the oil & gas, mining, and forestry & agribusiness sectors to set an expectation for clients to demonstrate alignment with the key objectives and requirements of the International Finance Corporation Performance Standard 7 – Indigenous Peoples, which incorporates the principles of FPIC. The parties also agreed that the Swiss NCP would follow-up to ensure Credit Suisse’s implementation of its commitment. The Society for Threatened Peoples (STP) noted that Credit Suisse’s compliance with FPIC is limited only to project financing, excluding company financing and stock broking, therefore it is only a small step in the right direction when it comes to comprehensive protection of indigenous communities.

ANZ’s role in displacing and dispossessing Cambodian families (Filed Oct 2014, concluded June 2018)

The Australian NCP stated that ANZ needs to strengthen its due diligence mechanisms and establish a grievance mechanism. As a result, in 2021 the bank launched the first fully elaborated grievance mechanism in the banking sector. The NCP recommended that ANZ take steps to promote internal compliance with its own corporate standards and to visibly demonstrate the proper application of the standards to ensure they are in line with the OECD Guidelines. However it NCP failed to call on the bank to provide concrete remedies for the harms to which it contributed. Following fiurther advocacy, in February 2020, five years after the complaint was filed, ANZ agreed to provide a financial package to the Cambodian families that were forcibly displaced, setting an additional human rights precendent for the global banking sector.

- OECD Watch Case Database

- Final Statement

- IDI Press Release

- Letter to ANZ by BankTrack and OECD Watch

Rabobank's loans to palm oil company Bumitama (Filed June 2014, concluded January 2016)

The complaint by Friends of the Earth resulted in a commitment by Rabobank will modify its complaints procedure. The NCP stressed that financial institutions have a responsibility to exercise leverage to seek to prevent or mitigate the impact of their business conduct, to increase their leverage on their own clients if necessary, and respond to identified adverse impacts through engagement or, as last resort, divestment. The NCP further urged companies to develop their own policies towards genuine sustainable production of palm oil.

POSCO's involvement in HR and environmental impact in India (Filed Oct 2012, concluded March 2013)

The cases filed seperately against POSCO, the Dutch pension fund ABP and the Norwegian Government Pension Fund Global set an important precedent regarding the applicability of the OECD Guidelines to the financial sector. The Dutch NCP confirmed that the OECD Guidelines also apply to minority shareholding of financial institutions.