TotalEnergies financiers beware: EACOP is eating up money, nature and livelihoods

Ryan Brightwell, Human Rights Campaign Lead, BankTrack: ryan@banktrack.org

Coleen Scott, Senior Legal and Policy Associate, Inclusive Development International: coleen@inclusivedevelopment.net

Ryan Brightwell, Human Rights Campaign Lead, BankTrack: ryan@banktrack.org

Coleen Scott, Senior Legal and Policy Associate, Inclusive Development International: coleen@inclusivedevelopment.net

A new analysis shows that the developers of the East African Crude Oil Pipeline, led by France’s TotalEnergies, are being forced to self-finance the project almost entirely. The analysis, part of a new Finance Risk Update from a coalition of African and International civil society organisations, shows that the companies have abandoned plans to raise 60% of the project’s growing costs from bank loans, and are now on the hook for almost 90% of the costs themselves.

The EACOP is under construction from Hoima in Uganda to the port of Tanga in Tanzania. While a recent “first tranche” of lending for the project was recently finalised, the analysis of EACOP Ltd.’s recent financial disclosures indicates this amounts to only $755 million in total. This means the project companies now need to finance the whole remainder of the project’s $5.6 billion total price tag themselves. This means Total and its partners (The China National Offshore Energy Corporation (CNOOC), and the national oil companies of Uganda and Tanzania) look set to sink more than three times their originally planned contribution of $1.4 billion into the project.

The EACOP has been rejected by almost all of Total’s biggest bankers, based on its extreme risks to communities and the region’s rich nature. Over 40 commercial banks have made clear they will not finance the project directly. As a result of the decision to self-finance the project, Total and its bankers and investors are far more exposed to the accelerating risks to communities, nature and climate being caused by the oil pipeline than was previously thought.

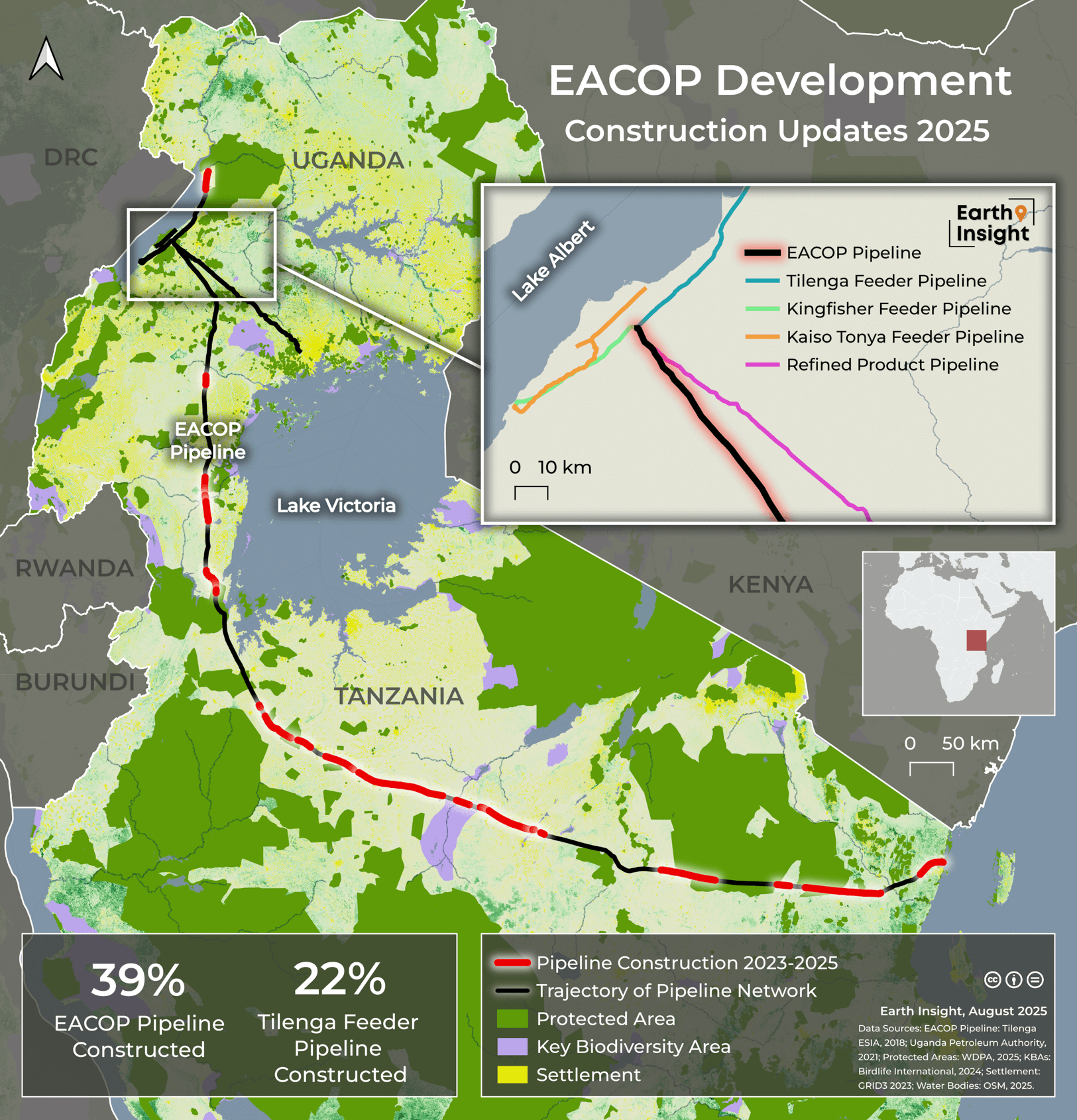

The pipeline has been described by the project companies as over 60% complete. However, analysis of satellite imagery by EarthInsight shows less than 40% of the pipeline has been laid. The same analysis also shows roads cleared for the pipeline reaching the Victoria Nile riverbank, signalling an imminent, high-risk crossing of this river in an area that overlaps with protected wetlands and the Murchison Falls National Park. Well pads which will feed the pipeline are being constructed in the National Park, with tragic consequences for local people as vibrations from drilling rigs cause elephants to move to surrounding communities. The elephants are destroying cropland, and have killed at least five people in the area in 2023 and 2024.

The new Finance Risk Update, which details these impacts for financiers exposed to Total and CNOOC, is the sixth in a series which has been produced by a coalition of civil society groups led by BankTrack. It is endorsed by Africa Institute for Energy Governance (AFIEGO), Both ENDS, EarthInsight, Environment Governance Institute EGI-Uganda, Inclusive Development International, Just Share and Reclaim Finance.

As the project becomes more expensive for Total, its financiers become more exposed to its risks. Several banks including Citi, BBVA, Deutsche Bank, JPMorgan Chase, MUFG, Royal Bank of Canada, Société Générale, and Wells Fargo underwrote bonds for TotalEnergies in March and June 2025 – money which may fund the construction of the EACOP, despite the banks’ commitments not to finance the project directly. The briefing warns that any additional bond issuances by the company could be critical sources of financing for EACOP.

“Ugandans need to concern themselves with the borrowing that the government is doing to invest in the EACOP and related oil projects. Forecasters have been warning that demand for combustible fossil fuels could peak as early as 2027. However, the Ugandan government is indebting poor citizens amidst this bleak outlook. Citizens must say enough is enough! They should demand that investments are made into green economic sectors as opposed to the oil industry,” said Diana Nabiruma, Senior Communications Officer at AFIEGO.

“It's clear that projects like EACOP come at an unbearable cost to people and nature. TotalEnergies’ growing self-financing is not a show of strength but a warning sign: when even the world’s largest banks walk away, it’s because the financial, social, and environmental risks are too great. Uganda and Tanzania deserve better investments, ones that uplift communities instead of deepening harm and inequality,” said Samuel Okulony, Director at Environment Governance Institute (EGI).

"Investors such as Amundi, BlackRock and Deutsche Bank that buy TotalEnergies' new bonds, are providing critical support to finance its oil and gas projects, including EACOP. Any investor that wants to take meaningful action against climate chaos, environmental destruction and human rights violations must immediately commit to stop purchasing new bonds from TotalEnergies and other oil and gas majors," said Antoine Bouhey, Defund TotalEnergies campaign coordinator at Reclaim Finance.

"It’s insulting to the public when a bank distances itself from a project like EACOP by refusing to fund it directly, only to provide a blank check to the project’s main backer TotalEnergies. Any new general-purpose loans or underwriting for Total can fund the EACOP and all its impacts. Banks funding the project, directly or indirectly, should be prepared to be held accountable for remedying these impacts," said Ryan Brightwell, Human Rights Campaign Lead at BankTrack.

The EACOP Finance Risk Update can be downloaded here.

An accompanying Public Statement by the StopEACOP Coalition can be downloaded here.