Seven financiers abandon TotalEnergies' EACOP pipeline in a week

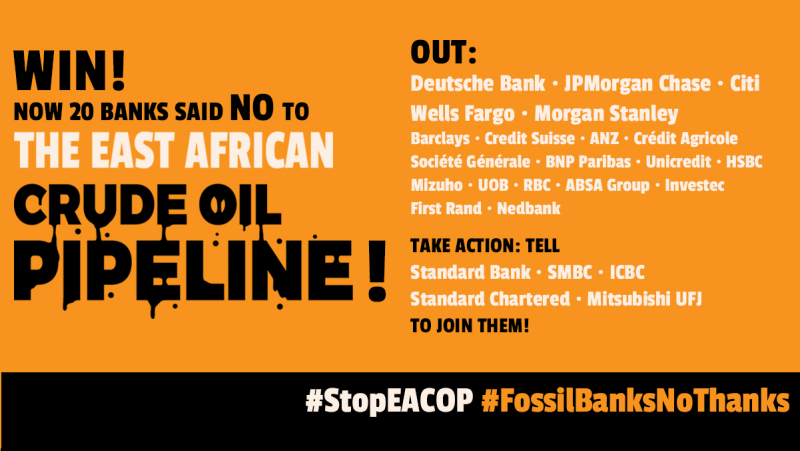

The coalition to #StopEACOP celebrates this week’s news that five banks including Deutsche Bank, Citi, JPMorgan Chase, Wells Fargo and Morgan Stanley have confirmed they will not join the project loan to finance the EACOP. They are joined by the insurer Beazley Group and the Italian export credit agency SACE.

This takes the number of banks that want nothing to do with the EACOP project loan to 20 and the number of insurers to eight. The list of banks rejecting the project includes seven of Total’s ten largest lenders.

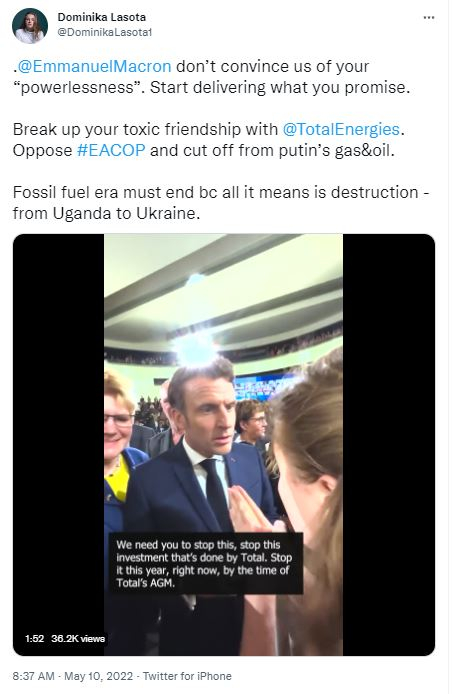

If TotalEnergies was planning to ask for public finance on the pipeline, they will also have to look elsewhere. This week the Italian Export Credit Agency (ECA) SACE turned down an application to support the project. ECAs from the UK and Germany have also ruled out support for EACOP, while French President Emmanuel Macron told activists last week that he would stop any remaining public finance to EACOP.

The news of the US banks’ rejection of the EACOP project loan came as the Financial Times revealed, together with the Bureau of Investigative Journalism, Marsh McLennan is arranging the insurance coverage for EACOP, despite protests from more than 100 of its staff citing the “disastrous consequences” for the climate and the company’s reputation.

Should the pipeline be completed, it will pump up to 34 million of carbon dioxide equivalent per year at peak production - more than double the current emissions of Uganda and Tanzania.

The pipeline also impacts the human rights of over 100,000 people and puts in jeopardy wildlife, forests and water resources including more than 200 rivers, and Africa’s largest freshwater lake, Lake Victoria, which supports over 40 million people.

Despite all these impacts, even the economic benefits of the pipeline to Uganda and Tanzania are minimal at best since TotalEnergies and China National Offshore Oil Company together own 70% of the shares while Uganda and Tanzania keep 15% each - this makes them minority shareholders of a resource that comes from their region.

Perhaps even more troubling is the fact that the two countries have passed laws that, among other things, give the project developers a ten-year corporate tax holiday (on a tax which is normally set at 30% of the profits made) and a withholding tax of 5% (as opposed to 15% as required by law). The project developers also are exempted from any VAT deductions of materials and equipment that will be imported for the project.

Omar Elmawi, the Coordinator of the #StopEACOP Coalition stated, “Total and allies were in a hurry to announce their final investment decision in early February this year. Since then the list of banks and insurers staying away from EACOP has been growing. It is no secret that this project will impact people, nature and the climate and it is becoming clear to all those involved, except for the project developers who are fueled by greed, that it is in everyone’s best interest to put a stop to this impending disaster and corporate colonialism.”

Ryan Brightwell, Human Rights Campaign Lead at BankTrack, said, "The global banking sector's wholesale rejection of Total's dangerous plans for the East African Crude Oil Pipeline is becoming clearer by the day. The news from the FT that Citi and JPMorgan Chase won't join the project loan for this pipeline is particularly significant, as they number among Total's five biggest lenders. Now all five have declared themselves out of the running, and the total number of banks to have made clear they won't support EACOP stands at 20. The problem now is that many of the same banks that have said "no" to supporting EACOP directly are keeping on providing general-purpose loans to Total, which leaves them linked to the damages and exposed to the risks in any case. It's time for banks to say "no" to all further finance for Total unless and until it shelves plans for the EACOP and all other new fossil fuel projects and gets serious about 1.5 degrees."

Take action and write to the banks still considering joining the project loan for the EACOP!