“Pay Up ING”: frontline communities and campaigners issue ING with a “Bill of Destruction” and several climate demands at its AGM

Henrieke Butijn, Banks and Oil&Gas campaigner and researcher at BankTrack

Camilla Perotti, Banks and Coal campaigner at BankTrack

Unathi Hlalele, Banks and Climate intern at BankTrack

Henrieke Butijn, Banks and Oil&Gas campaigner and researcher at BankTrack

Camilla Perotti, Banks and Coal campaigner at BankTrack

Unathi Hlalele, Banks and Climate intern at BankTrack

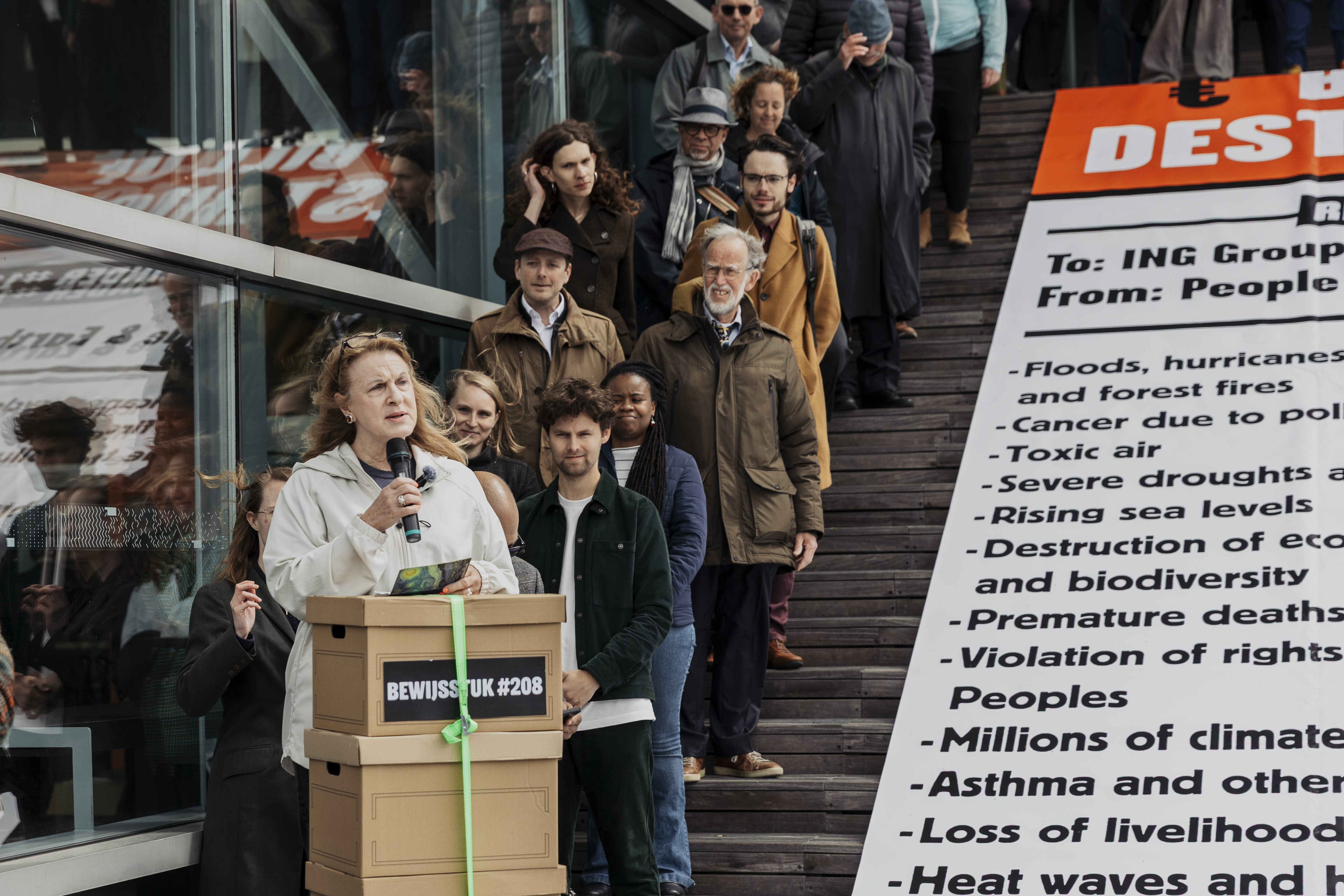

Dutch banking giant ING was served a giant 12-metre “Bill of Destruction” at its Annual General Meeting (AGM) held in Amsterdam. The bill, spread out to reveal the long list of damages linked to ING’s fossil fuel financing, was presented by US Gulf South communities and Dutch climate and human rights organisations BankTrack, Fossielvrij and Milieudefensie.

ING finances fossil fuel expansion projects and companies wreaking havoc in communities around the world, resulting in adverse health impacts, human rights violations, displacements, and loss of livelihoods. BankTrack campaigners asked the ING board questions on its financing and its policies and demanded that ING strengthen its coal, gas and human rights policies.

Past Due: End LNG expansion

Facilitated by BankTrack and Fossielvrij, Melanie Oldham, founder and director of Better Brazoria, and John Beard, Founder and CEO of the Port Arthur Community Action Network, travelled across the Atlantic from their respective communities in Freeport and Port Arthur, Texas, to demand an end to ING’s financing of LNG. The predominantly low-income, Black, Indigenous and Latinx communities around the LNG facilities in the Gulf South – seven of which are directly financed by ING – are overburdened by extreme climate-related weather conditions and elevated rates of cancer and pulmonary diseases due to high pollution levels.

While ING has committed to stop direct financing of LNG export terminals, this commitment will only come into effect in 2026 and is limited to project-specific finance, leaving space for finance to keep flowing to the companies responsible for these projects.

As the group of campaigners unveiled the “Bill of Destruction”, Melanie and John took to the podium to call attention to the impact of ING's finance in their communities. Melanie Oldham said:

"I live 3 miles from Freeport LNG, one of seven U.S. LNG plants that ING has financed, which has caused destruction, severe health problems and human rights violations. Why does ING continue to finance Freeport LNG, even after Freeport LNG’s explosion and ongoing risks, danger and human rights violations in our U.S. communities? Freeport LNG has consistent, ongoing problems emitting large (amounts of) Trump methane gas. The process is dangerous – from fracking to leaking pipelines to LNG plants on the Gulf. Trump methane gas is killing us and killing our earth. ING bank, do the right thing and stop financing Trump methane gas. We ask, no - demand that ING bank stop killing us that live near LNG plants in the U.S. and stop facilitating human rights violations. ING, set targets to reduce finance for fossil fuel projects and instead transition now to increase financing of renewable energy, NOW."

“That’s a mighty big bill, I hope they’ve got enough money in the bank for it, because they have to pay”, said John Beard. “The damage that is being caused by the financing of LNG by ING in communities like mine or my colleague in Brazoria, Texas, Melanie’s, is high. We already have enough petrochemical industries as it is, causing people harm and hurting them, the air quality is some of the worst in America.”

Inside the AGM, John Beard also presented a bill focused on the impacts of US LNG projects in his own community and other Gulf South communities. He took the opportunity to ask the ING board:

“Does ING care and respect that all people have inalienable human rights, to clean air, a healthy and sustainable living environment, and the right to a safe climate? When is ING going to take responsibility – as I’m outlining here, in this bill – for the harm done to communities in the Gulf?”

In addition, John called ING out on the fact that only yesterday the bank underwrote another bond issued by Venture Global, a company whose sole activity is to produce LNG and which is expanding LNG production. ING engaged in the deal despite its public acknowledgement that there is no more need for LNG export terminals.

In its answer, ING again referred back to its commitment to end new direct financing of new LNG export terminals. This ignores the fact that its finance for companies like Venture Global and Cheniere Energy still enables LNG expansion, and that its commitments fall short of addressing the short- and long-term human impacts of its finance.

Lieke Weima, from Fossielvrij, highlighted ING’s finance for US LNG by also calling into question policy loopholes that will still allow for LNG expansion via corporate finance, and asking “do you realize that financing Trump Gas fuels Trump’s repressive power and dissolution of democracy?”

Reminder 112: Stop Coal financing

The massive “Bill of Destruction” included a reminder to ING: April 2025 marks 112 months since the Paris Agreement, in which countries around the world committed to limit the global temperature increase to 1.5℃ above pre-industrial levels by 2100. According to the International Energy Agency, we must reduce global coal use by 90% by 2050, and we must have no new unabated coal power plants. Although ING has committed to align its financing with the Paris climate goals, the bank continues to finance coal expansion companies such as the Adani Group, the conglomerate with coal mining interests founded by Indian billionaire Gautam Adani; PLN, Indonesia’s coal-dominated power utility; and EPH, a Czech-based multinational company with significant coal and gas operations.

Despite mounting evidence of Adani’s illicit business conduct and its market manipulations, including funnelling the finance raised for its green energy projects to its coal business, ING has repeatedly been a bookrunner for Adani Green’s bonds. This includes the last two rounds of bonds issued in 2024, which were soon withdrawn in the wake of investor distrust in the group and Gautam Adani’s indictment in the US. The reputational risk for ING is huge.

ING currently also has more than USD 60 million in loans and bonds still outstanding for PLN, most maturing after 2030 and some even in 2049 and 2050. PLN currently operates 135 coal-fired power plants in Indonesia, with plans to expand coal power in the country up until 2030 by installing 13.8 GW of new coal power capacity, and relying on the false solution of biomass co-firing. PLN’s coal operations are reportedly causing severe public health issues, as higher rates of respiratory diseases (such as asthma, bronchitis and tuberculosis) have been recorded in the communities living close to PLN’s plants, particularly among children.

Although ING’s coal policy excludes project finance for new coal-fired power plants and corporate finance for companies with more than 5% revenue from coal by the end of 2025, it still leaves room for project finance for the expansion of existing coal-fired projects. It also leaves ING exposed to coal until as late as 2050 (e.g. PLN) and leaves room for ING to keep underwriting bonds for coal developers or its subsidiaries.

Camilla Perotti, Coal Campaigner at BankTrack, said to the ING board: “A coal policy that takes into account coal-related risks in full would rule out any kind of financial services for companies with coal expansion projects. This commitment should include bond underwriting and other corporate finance, both for companies still involved in coal power expansion and their subsidiaries. When does ING plan on updating its coal policy to address coal-related risks in full?”

In response, ING repeated the commitment to the current coal policy and didn’t commit to any updates that would address BankTrack’s crucial concerns.

What about financing the energy transition?

On behalf of ShareAction, BankTrack and Reclaim Finance, Henrieke Butijn, Climate Campaigner and Researcher at BankTrack, asked the ING board:

“ING has a renewable‑power financing target but, with Europe’s grids and storage still underfunded, much of the energy from new wind and solar projects is being wasted. Leading analysts say 38‑47 % of power‑sector investment should flow to grids and batteries, yet Europe’s biggest banks currently devote only about a quarter of their clean‑energy financing to these areas. Given that ING's renewable target will expire later this year, will the bank commit to updating it with a revised ambitious renewable power target? And will ING set a new complementary target for financing grids and storage, also underpinned by a credible climate scenario, to ensure ING's renewable power financing has its intended impact?”

ING committed to looking into grid and storage financing, encouraging Henrieke to contact its head of sustainability.

Inside action from climate campaigners

The AGM was also attended inside the building by Milieudefensie (Friends of the Earth Netherlands), Fossielvrij, Reclaim Finance and Extinction Rebellion Netherlands.

ING currently faces a climate lawsuit filed by Milieudefensie and 30,000 co-plaintiffs calling for the bank to stop financing companies developing new oil and gas projects and to cut its emissions by 50% by 2030.

Reclaim Finance pointed at the inconsistencies in ING’s current oil and gas policy in only excluding companies active exclusively in upstream oil and gas, rather than extending this exclusion to major integrated players as well as LNG export companies who contribute significantly to the expansion of oil and gas.

Activists from Extinction Rebellion blew whistles and horns while shouting “bullshit alarm” during CEO Steven van Rijswijk’s sustainability statement, resulting in the temporary suspension of the AGM and the removal of some activists from the venue.