Swedish banks dump global meat companies after protests

Jakob König, Head of Fair Finance Guide Sweden: jakob@fairfinanceguide.se; 073 037 92 93

Jakob König, Head of Fair Finance Guide Sweden: jakob@fairfinanceguide.se; 073 037 92 93

Originally published (in Swedish), on the Fair Finance Guide's website here.

Nordea, Swedbank, Handelsbanken and Länsförsäkringar have reduced their investments in large global meat companies by an average of 89 percent. This follows Fair Finance Sweden's review two years ago that showed the abysmal conditions the animals endure at the hands of these companies, which led to thousands of Swedish bank customers protesting. But almost a billion of Swedes' savings and pension money is still invested in companies that run animal factories. This is shown in our new report together with World Animal Protection Sweden.

"It's good that the banks have listened to the criticism and moved large investments away from meat companies that continue with painful methods. It shows that the bank customers' protests have made a difference," says Jakob König at Fair Finance Guide.

The Still Cruel Investments report also shows that no Swedish bank or pension fund is investing in the controversial Brazilian meat giant JBS anymore – a company that is linked to both painful animal husbandry and the destruction of rainforest in the Amazon.

Several banks have also improved their guidelines on animal welfare. Länsförsäkringar is particularly highlighted for its work to actively influence companies to improve the conditions for animals. Länsförsäkringar is the only bank to participate in the international industry initiative Business Benchmark on Farmed Animal Welfare (BBFAW), which has systems for following up on the companies' work.

Continued large Swedish investments in animal factories

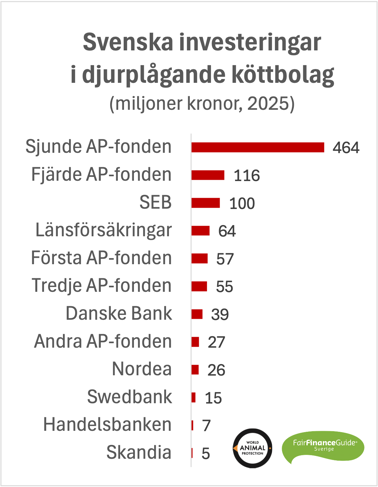

At the same time, the report shows that Swedish banks and AP funds are still investing a total of SEK 975 million in three of the world's largest meat companies in pig and chicken production: BRF SA (Brazil), Tyson Foods (USA) and WH Group (China). The companies operate in countries with weak animal welfare and have been repeatedly criticised for serious shortcomings, such as cramped cages for sows, tail clipping without stunning and extremely tight rearing systems for chickens.

"This leads to great suffering for millions of animals around the world and is a method that is illegal in Sweden. The fact that Swedish pension money continues to be invested in this type of animal factory is completely unacceptable," says Roger Pettersson, Secretary General of World Animal Protection Sweden.

Animal factories also in green funds

A large part of Swedish investments – over 70 percent – are also made through green-coloured funds that promise to take extra account of sustainability.

"Here again, there is a clear gap between what the funds promise and what the money actually goes to. It becomes very misleading when funds that are marketed as green contribute to extensive animal suffering," says Jakob König at Fair Finance Guide.

Some have increased investments

While several of the major banks have sharply reduced their investments, the AP Funds have instead increased their investments in the meat companies in question, on average by almost 60 percent since 2023. By far the largest increase has been made by the Seventh AP Fund, which now has close to half a billion SEK in the companies. The fund manages the pension money of over six million Swedes. SEB and Danske Bank have also increased investments in the companies since 2023 by over SEK 90 million.

Calls for animal factory-free funds

The report makes several recommendations to investors, including setting higher animal ethical requirements for meat companies and that the Swedish fund industry should offer funds that completely exclude investments in animal factories.

"Animal welfare is important to 98 percent of Swedes when they shop in the grocery store, so it should be an equally important issue when the bank invests their money. This issue needs to be put more on the radar of the banks," says Jakob König at Fair Finance Guide.

- Read the Still Cruel Investments report

- Read comments from Handelsbanken, Skandia and SEB

- See which specific funds invest in the companies

- Read about the previous report from 2023