New letter from 30 organisations urges investors and banks to note major risks of exposure to Amazon deforestation of buying shares in global meatpackers JBS and Marfrig

Shona Hawkes

Heather Iqbal, Senior Communications Advisor

+44 (0) 20 7492 5890

Shona Hawkes

Heather Iqbal, Senior Communications Advisor

+44 (0) 20 7492 5890

A new letter from 30 civil society organisations across the globe is urging investors and banks to think twice before buying new JBS and Marfrig shares, both of which may soon be placed on the market.

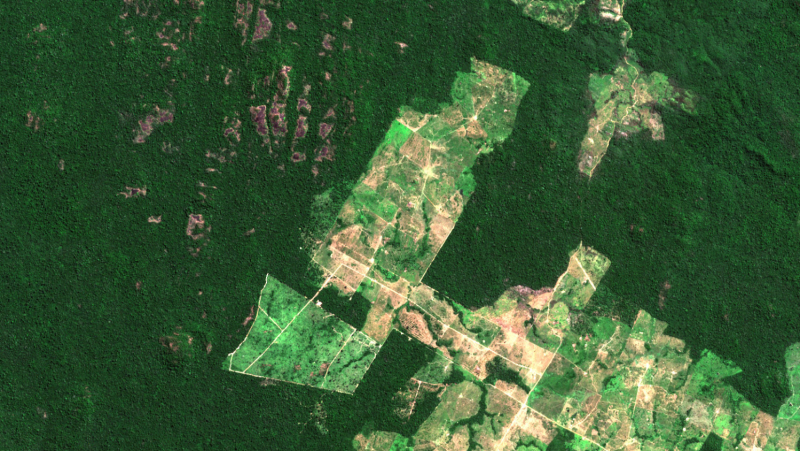

JBS and Marfrig, two of the world’s largest beef traders operating in Brazil, have been linked multiple times to deforestation of the climate-critical Amazon forest, which in the last 12 months experienced raging fires and rapidly increasing rates of deforestation.

The letter comes as reports emerge that BNDES plans to sell shares it holds in both companies in either December 2019 or early 2020.

It highlights various allegations of JBS and Marfrig’s links to worrying deforestation. It also points out that an unknown, but likely significant, portion of their Amazon cattle purchases are not audited – raising questions of how investors can do their due diligence into the company without this information, and ensure their financing is not exposed to deforestation.

“Over the last 12 months, an area of forest equivalent to over six times the size of London was destroyed, a 30% increase over the previous year,” signatories write. “This alarming rise in the destruction of the Amazon has intensified under the Bolsonaro Government, undermining global commitments and efforts to address the current climate crisis.”

They also point to claims from the Federal Prosecutors Office in Brazil, which stated that “no company that currently purchases from the Amazon can say that their supply chain is deforestation free.”

The letter calls on investors and financial service providers to withhold additional share purchases in JBS and Marfrig until they can accurately assess each company’s legal compliance and Environmental, Social and Governance (ESG) risks.

With groups such as Amazon Watch, BankTrack, Global Witness and Greenpeace Brazil already signed up to the letter, more are expected to add their names in the coming days. You can see the full letter with signatories here.

The signatories not only include organisations who work on forest protection internationally and within Brazil, but also those who look to fight the huge human cost of deforestation, including attacks against Land and Environment Defenders and indigenous communities – who are disproportionately impacted by forest destruction and land grabs linked to deforestation and the cattle sector.

Significantly, the call follows a recent statement from 244 investors in September asking companies exposed to deforestation to act urgently to save the Amazon. And it follows a Global Witness investigation revealing how more than 300 banks and investors backed six of the world’s most harmful agribusinesses to the tune of $44bn.

Both JBS and Marfrig denied the allegations linking them to deforestation, claiming they have systems in place that screen out purchasing cattle from ranches where deforestation has occurred and which are verified by independent audits – fuller responses by the companies to these allegations can be seen in the open letter linked here.

Shona Hawkes, Senior Global Policy Adviser, Global Witness said:

“Just three short months ago, investors really put themselves out there by showing a new commitment to use their power for the common good – using their collective voice to call for an end to the rapidly escalating destruction of the Brazilian Amazon.

“This new potential sale of shares in JBS and Marfrig – companies accused of multiple links to Amazon deforestation – will be the first real test of that investor commitment.

“Either banks and financiers act to stop money flowing into the destruction of a forest vital for halting climate breakdown, or they don’t. Whether they choose to facilitate the purchase of these shares, or cash in on them themselves, the role of our financial institutions here is key.”

The spokesperson from Global Witness also pointed out that allegations of irregular practices involving investments in JBS by BNDES had not gone unnoticed by official bodies, exposing potential investors in JBS’s shares to these risks. In October 2019, a Parliamentary Inquiry of Brazil’s Chamber of Deputies released a report on illicit practices of BNDES’s past financing of various companies, including allegations of irregularities in its financial dealings with JBS between 2005 and 2014.

In a statement made in 2017 on JBS’s financial relationship with BNDES, the company denied “that there was any favouritism in the operations made by BNDES’s subsidiary, BNDESPar, and that these were carried out according to the rules of capital markets in Brazil.”

Hawkes also pointed to the role governments, particularly in the UK, France and US, play in regulating their financial systems to ensure that rapid investment in environmentally damaging projects is ended.

“Mandatory due diligence is crucial here,” she said, “it must be put in place for all financiers, banks, investors and companies that might end up intentionally or otherwise fuelling environmental destruction and human rights abuses.”