Project – On record

This profile is no longer actively maintained, with the information now possibly out of dateBankTrack

Charles Roche Mineral Policy Institute

Project – On record

This profile is no longer actively maintained, with the information now possibly out of dateBankTrack

Charles Roche Mineral Policy Institute

What must happen

Similar to other mines in Papua New Guinea the Woodlark project is expected to deliver poor social outcomes for local communities and a legacy of terrestrial and marine destruction.

- It should not be funded by any responsible financial organisations

- The project should be redesigned and reassessed with proper consultation on Woodlark, throughout the Milne Bay Province and with external stakeholders.

- The disposal of mine waste into the ocean should be rejected by PNG and the host countries of mining and/or finance companies.

| Sectors | Mining |

| Location |

|

| Website | https://www.facebook.com/groups/alotauenvironment.nominingpollution/ |

|

|

This project has been identified as an Equator Project |

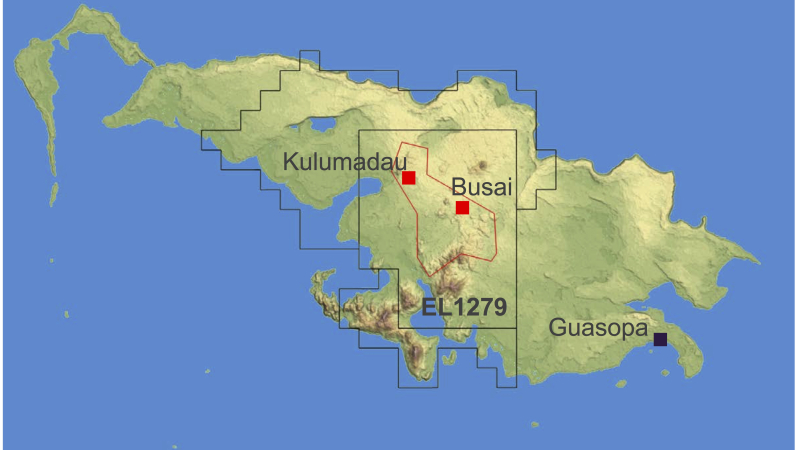

The Woodlark Island Goldmine Project mine is a proposed and approved open cut mine in the centre of Woodlark Island. The island is isolated and has a mainly subsistence population of 6000 people. The project will be operated by Woodlark Mining Limited (WML), a company owned by Kula Gold Limited, and was granted a Mining Lease in July 2014. This lease and two adjacent exploration leases cover half the land area of Woodlark Island. The PNG Government acquired a 5% interest in the project with the option to undertake a further acquisition of up to 25%. Proceeds from this interest are expected to be distributed between local landowners and the Milne Bay Provincial Government. During the exploration phase, the mine supported a workforce of approximately 350 people. During operation it is expected to be between 300 and 500. It is estimated that 60% of the workforce will be PNG locals. Various levels of PNG government and local communities have expressed concern about the opportunities to maximise local employment. Sources of conflict are yet to be fully realised but the principal concerns are described below. These concerns are amplified by delays in the EIR process, poor consultation practices, a lack of transparency and participation and the inexperience and small size of the company when compared to the size of the project.

Social and human rights impacts

Potential health impacts: Mental

problems including stress, depression and suicide, Health problems

related to alcoholism, prostitution, Occupational disease and accidents,

Infectious diseases, Deaths.

Visible social impacts: Displacement, Land dispossession.

Potential social impacts: Increase

in violence and crime, Loss of traditional

knowledge/practices/cultures, Specific impacts on women, Loss of

landscape/sense of place, Loss of livelihood.

Stakeholder engagement was conducted for an Environmental Impact

Statement (EIS) which was published in January 2013. Policies underlying

stakeholder engagement were stated as generic principles which include

respect and recognition of cultures and values, transparency and

consultation and seeking to create lasting, but temporally unspecific,

relationships built on trust and mutual respect. To this end, WML

considers that local communities have been consulted and ‘informed' of

planned mining and mine-related activities. A number of global

environment Non-Governmental Organisations (NGO's) and religious

organisations are listed within the EIS as being potential stakeholders,

but the EIS gives no indication that any NGO groups have been involved.

The Mineral Policy Institute requested involvement before the EIS was

released for public consultation in July 2013. This was ignored and

numerous subsequent requests for the EIS were rejected by Kula Gold

directors.

Impacts upon local communities were considered to be

‘direct', ‘indirect' or ‘minimal'. This assessment appears based solely

upon geographical proximity to the mine itself. The only village

considered to be directly impacted by the mine was Kulumandau. In this

case, direct impact consists of relocating nearly 10% of the population

of Woodlark Island. WML have indicated that it will facilitate

communication with the local communities by ‘credible' and ‘trusted'

representatives, but it is unclear how these representatives were

selected and how the qualities of credibility and trustworthiness were

measured and whether they were assessed by WML, the local communities or

both. Key potential points of conflict involve the lack of specific

plans for relocation and compensation of these affected villagers.

Relocation will mean that land has to be retitled and returned to

traditional owners. These concerns are magnified because of

uncertainties about the time-frame of the project and exploration

activity associated with adjacent leases.

The proposed marine

mine waste disposal has further potential for conflict involving both

local communities and those bordering the Solomon Sea. There are

specific concerns about the impact on the marine environment and fishing

activities in particular. Marine mine waste disposal has proven to be

very controversial in PNG and was the subject of a series of court cases

involving the Ramu Nickel mine and Basumuk Bay refinery.

Environmental and climate impacts

Potential: Air pollution, Biodiversity loss (wildlife, agro-diversity), Floods (river, coastal, mudflow), Loss of landscape/aesthetic degradation, Noise pollution, Soil contamination, Waste overflow, Deforestation and loss of vegetation cover, Surface water pollution / Decreasing water (physico-chemical, biological) quality, Groundwater pollution or depletion, Reduced ecological / hydrological connectivity, Mine tailing spills, Soil erosion, Large-scale disturbance of hydro and geological systems

This project is not yet fully funded, and is a no go for banks. It is closely tracked by BankTrack.

Kula Gold has appointed an unknown financial advisor to identify funding options and is seeking $200 million in project finance. Other options include funding via debt, equity, a corprate transaction or a joint venture.

To date shareholders have provided strong support for capital raising, with includes Equator Principle banks and their associated/subsidiary/nominee shareholding companies.

Kula Gold (second entry - do not use)

AustraliaApplicable norms and standards

Woodlark Island

2015

2015-04-23 00:00:00 | Woodlark Island

Proponents Kula Gold released their 2014 Annual Report on the 30th March 2015. In it the Chairman, David Frecker, acknowleges that finding the finance to construct the mine will be a challenge at current gold prices.

2014

2014-12-10 00:00:00 | Woodlark Island

In December 2014, another request by the Mineral Policy Institute (MPI) for a copy of the Environmental Impact Statement was made directly to CEO Stuart Pether, once again MPI was denied access. Note: Since mid 2013 Kuld Gold has persistently denied MPI access to the EIS indicating a very low commitment to transparency.