Out in the Cold – new report on Shell’s plans in the Arctic

Shell’s Annual General Meeting tomorrow is unlikely to go calmly. The company’s problems range from anger over excessive executive pay to spills in the Niger delta. At this time, Platform, Greenpeace and FairPensions are putting to scrutiny offshore Arctic exploration as a key direction in the company’s strategy.

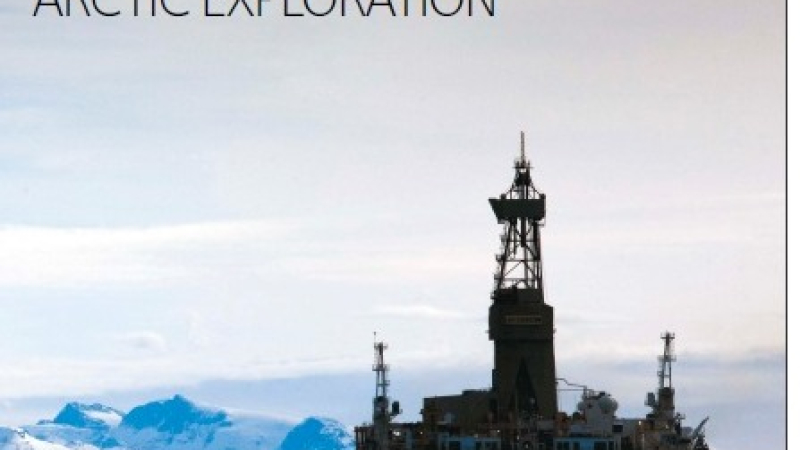

The new report 'Out in the Cold' – Investor Risk in Shell’s Arctic Exploration’ details Shell’s existing and planned oil exploration and production projects in the offshore Arctic, with a focus on risks for the company’s investors. Download the report in pdf format here. The report is accompanied by an investor briefing, available here.

Shell’s extraction volumes have been going down for the past 10 years, except a 5% rise in 2010. It is no surprise, then, that among other international oil companies it is hoping to book new reserves by pushing into frontier zones such as the Arctic. Rapid reductions in ice cover (due to climate change driven by the combustion of fossil fuels) make the exploitation of newly discovered offshore resources possible at least theoretically. The Anglo-Dutch oil group is planning to drill five wells in the Chukchi and Beaufort Seas this summer, and is the first major international oil company the Arctic offshore a key exploration focus, spending at least 1/7 of its overall exploration budget in Alaska in 2011.

The threats posed by the drive into Arctic waters to the fragile Polar ecosystems and the communities that depend upon them have already made many headlines. In seas that remain ice-covered for most of the year, a spill like BP’s Deepwater Horizon disaster would be catastrophic and near impossible to clean up. The financial implications are less clear. Shell has admitted to a UK parliamentary committee that it has not calculated how much a large spill would cost to clean up.

In reality, spills notwithstanding, questions remain about the medium- and long-term economic viability of offshore Arctic oil extraction. It is dependent on high oil prices and, crucially, tax breaks. Market analysts Bernstein Research have stated that in the Arctic, “development costs will be at the high side of the industry range” and “development times are likely to disappoint”.

The report highlights Shell’s failure to address key technical and management concerns in going into this risky territory:

Shell’s spill response plans are inadequate – it has not yet tested its well capping system (key equipment in case of a well blowout) in Arctic conditions – and has stated to the parliamentary committee that it has no plans to do so.

Shell is developing an extensive partnership with Russian majority state-owned company Gazprom, with an extremely poor safety and transparency track record. Shell is yet to answer to how it plans to limit its exposure to Gazprom’s malpractice.

In Russia Shell is also dealing with a history of cost overruns and government duress, which continues to be a concern particularly after Vladimir Putin’s return to the presidential seat.

The detailing of these and other risks to Shell’s shareholders forms the heart of the report. On this basis we shall be engaging with institutional investors over the coming year, working to highlight the threats and find a different way forward.